OPTIONAL FILER REFERENCE DATA Form

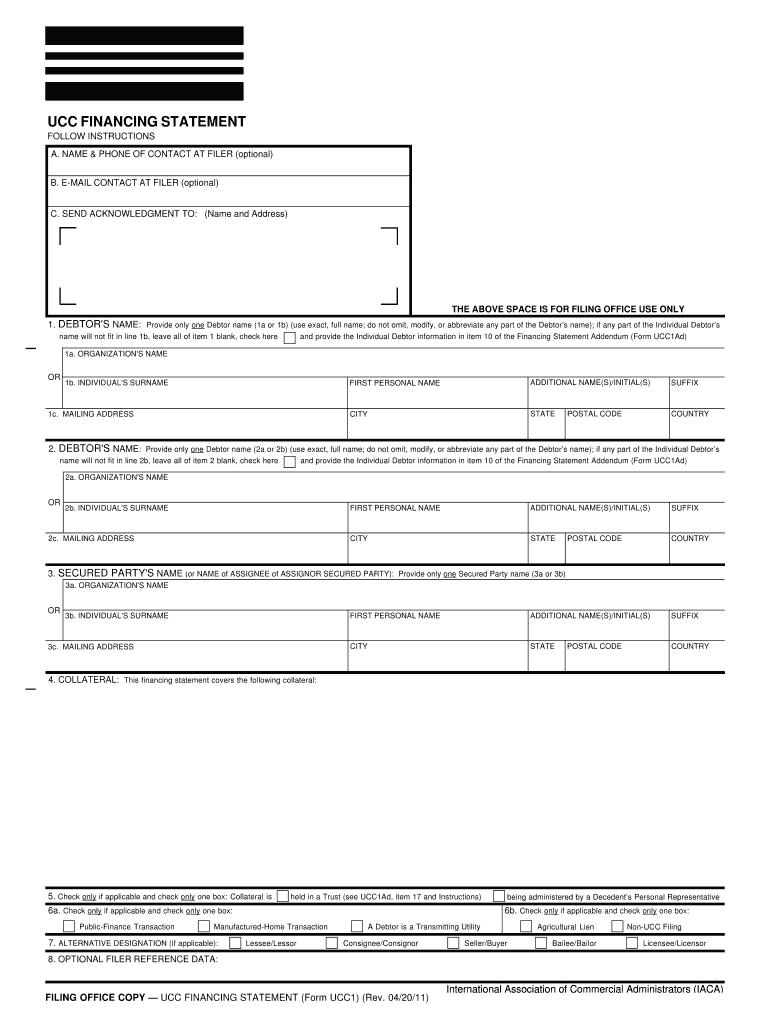

What is the Optional Filer Reference Data?

The Optional Filer Reference Data is a specific form used primarily for tax purposes in the United States. This form allows individuals or entities to provide additional information that may assist in the processing of their tax returns. While it is not mandatory, submitting this data can help clarify any discrepancies and ensure accurate tax assessments. It is particularly useful for taxpayers who have unique circumstances that may not be fully captured by standard tax forms.

Steps to Complete the Optional Filer Reference Data

Completing the Optional Filer Reference Data involves several straightforward steps. First, gather all necessary personal and financial information, including your Social Security number, income details, and any relevant deductions. Next, accurately fill out the form, ensuring that all sections are completed to avoid processing delays. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified guidelines, whether electronically or via mail.

Legal Use of the Optional Filer Reference Data

The Optional Filer Reference Data is legally recognized when completed correctly and submitted in accordance with IRS guidelines. It is essential to ensure that the information provided is truthful and accurate, as discrepancies can lead to penalties or audits. Utilizing this form in compliance with tax regulations can enhance the legitimacy of your filing and provide additional context for your tax situation, particularly if you have complex financial circumstances.

Filing Deadlines / Important Dates

Timely submission of the Optional Filer Reference Data is crucial to avoid penalties. Generally, this form should be submitted alongside your annual tax return, which is typically due on April fifteenth. However, if you are filing for an extension, ensure that you also extend the deadline for submitting this form. Keeping track of these important dates helps maintain compliance with tax regulations and avoids unnecessary complications.

Examples of Using the Optional Filer Reference Data

There are various scenarios in which the Optional Filer Reference Data can be beneficial. For instance, a self-employed individual may use this form to report additional income sources that are not captured on standard tax forms. Similarly, retirees may include information about pension distributions or other retirement income. By providing this supplementary data, taxpayers can ensure that their unique financial situations are accurately represented, potentially leading to more favorable tax outcomes.

Who Issues the Form?

The Optional Filer Reference Data is issued by the Internal Revenue Service (IRS), which is the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to complete the form and the specific circumstances under which it should be used. It is important to refer to the IRS website or official publications for the most current information regarding this form and its requirements.

Quick guide on how to complete optional filer reference data

Effortlessly prepare OPTIONAL FILER REFERENCE DATA on any device

Digital document management has gained popularity among organizations and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed papers, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly, without delays. Manage OPTIONAL FILER REFERENCE DATA on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented workflow today.

How to modify and electronically sign OPTIONAL FILER REFERENCE DATA effortlessly

- Find OPTIONAL FILER REFERENCE DATA and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just a few seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to send your form: via email, SMS, or an invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign OPTIONAL FILER REFERENCE DATA to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is OPTIONAL FILER REFERENCE DATA in airSlate SignNow?

OPTIONAL FILER REFERENCE DATA in airSlate SignNow enables users to add specific reference information to their documents. This feature allows for better tracking and management of documents by including unique identifiers. It is especially useful for organizations needing enhanced document organization and audit capabilities.

-

How does OPTIONAL FILER REFERENCE DATA improve document management?

By utilizing OPTIONAL FILER REFERENCE DATA, businesses can streamline their document management processes. This additional layer of information helps clarify the purpose and tracking of each document, making it easier to retrieve and manage them efficiently. Overall, it supports stronger document organization within the airSlate SignNow platform.

-

Is there an additional cost for using OPTIONAL FILER REFERENCE DATA?

No, there is no additional cost associated with utilizing OPTIONAL FILER REFERENCE DATA in airSlate SignNow. This feature is included in the standard pricing plan, making it an accessible tool for all users. Organizations can leverage this capability without worrying about extra fees.

-

Can I integrate OPTIONAL FILER REFERENCE DATA with other applications?

Yes, OPTIONAL FILER REFERENCE DATA can be easily integrated with other applications through airSlate SignNow's API. This means you can enhance your workflows by connecting your existing systems with the reference data tool. This flexibility allows for seamless data exchange and improved operational efficiency.

-

What are the benefits of using OPTIONAL FILER REFERENCE DATA for my team?

Using OPTIONAL FILER REFERENCE DATA can signNowly enhance your team's productivity. It enables your members to quickly locate and access necessary documents thanks to the reference data associated with each file. This translates to quicker turnaround times and improved collaboration within your organization.

-

Is OPTIONAL FILER REFERENCE DATA user-friendly for new users?

Absolutely! OPTIONAL FILER REFERENCE DATA is designed to be user-friendly, making it easy for new users to effectively implement and utilize it. The clean interface and straightforward features within airSlate SignNow ensure that all users, regardless of tech-savviness, can navigate and benefit from this functionality.

-

How can OPTIONAL FILER REFERENCE DATA be utilized in compliance management?

OPTIONAL FILER REFERENCE DATA plays a crucial role in compliance management by ensuring that all necessary information accompanies documents. Companies can effectively track and document compliance requirements by incorporating reference data. This level of documentation can help reduce legal risks and support regulatory adherence.

Get more for OPTIONAL FILER REFERENCE DATA

Find out other OPTIONAL FILER REFERENCE DATA

- Sign Arizona Web Hosting Agreement Easy

- How Can I Sign Arizona Web Hosting Agreement

- Help Me With Sign Alaska Web Hosting Agreement

- Sign Alaska Web Hosting Agreement Easy

- Sign Arkansas Web Hosting Agreement Simple

- Sign Indiana Web Hosting Agreement Online

- Sign Indiana Web Hosting Agreement Easy

- How To Sign Louisiana Web Hosting Agreement

- Sign Maryland Web Hosting Agreement Now

- Sign Maryland Web Hosting Agreement Free

- Sign Maryland Web Hosting Agreement Fast

- Help Me With Sign New York Web Hosting Agreement

- Sign Connecticut Joint Venture Agreement Template Free

- Sign South Dakota Web Hosting Agreement Free

- Sign Wisconsin Web Hosting Agreement Later

- Sign Wisconsin Web Hosting Agreement Easy

- Sign Illinois Deposit Receipt Template Myself

- Sign Illinois Deposit Receipt Template Free

- Sign Missouri Joint Venture Agreement Template Free

- Sign Tennessee Joint Venture Agreement Template Free