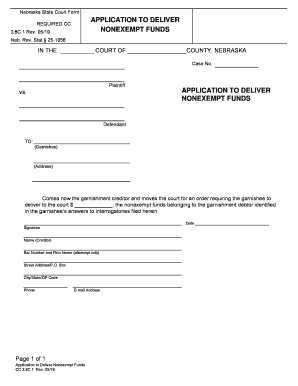

NONEXEMPT FUNDS Form

What is the NONEXEMPT FUNDS

The term "nonexempt funds" refers to financial assets that are subject to taxation and regulatory oversight. These funds typically include income generated from investments, wages, and other sources that do not qualify for tax exemptions. Understanding nonexempt funds is essential for individuals and businesses to ensure compliance with tax obligations and to manage their financial reporting accurately.

Steps to complete the NONEXEMPT FUNDS

Completing the nonexempt funds form involves several important steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements and investment records. Next, accurately fill out the form by entering your financial information as required. It is crucial to double-check all entries for correctness before submission. Finally, ensure that you eSign the document using a trusted platform like signNow, which provides a secure and legally binding signature process.

Legal use of the NONEXEMPT FUNDS

The legal use of nonexempt funds is governed by various tax laws and regulations. These funds must be reported accurately on tax returns to avoid penalties. It is vital to maintain records of all transactions involving nonexempt funds for auditing purposes. Compliance with IRS guidelines and state-specific regulations is essential to ensure that the use of these funds is legitimate and lawful.

Key elements of the NONEXEMPT FUNDS

Key elements of nonexempt funds include the source of income, the amount earned, and the applicable tax rates. It is important to differentiate between exempt and nonexempt funds, as this classification affects tax liabilities. Additionally, understanding the implications of nonexempt funds on overall financial health is crucial for effective financial planning.

Examples of using the NONEXEMPT FUNDS

Examples of nonexempt funds include wages from employment, rental income, and dividends from investments. For instance, if an individual receives a salary from their job, that income is classified as nonexempt and must be reported on their tax return. Similarly, profits from selling stocks or real estate are also considered nonexempt funds, requiring accurate reporting to tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for nonexempt funds vary depending on the type of income and the taxpayer's status. Generally, individual taxpayers must file their federal income tax returns by April fifteenth of each year. It is important to stay informed about state-specific deadlines as well, as these can differ significantly. Missing these deadlines can result in penalties and interest on unpaid taxes.

Required Documents

To accurately complete the nonexempt funds form, several documents are typically required. These may include W-2 forms from employers, 1099 forms for freelance or contract work, and records of any investment income. Keeping thorough documentation ensures that all sources of nonexempt funds are reported correctly, which is essential for compliance with tax regulations.

Quick guide on how to complete nonexempt funds

Prepare NONEXEMPT FUNDS effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed materials, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage NONEXEMPT FUNDS on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign NONEXEMPT FUNDS effortlessly

- Locate NONEXEMPT FUNDS and click on Get Form to begin.

- Leverage the tools we provide to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information using features that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and electronically sign NONEXEMPT FUNDS and ensure clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are NONEXEMPT FUNDS in relation to airSlate SignNow?

NONEXEMPT FUNDS refer to funds that are not exempt from certain regulations. With airSlate SignNow, businesses can manage documents related to NONEXEMPT FUNDS effectively, ensuring compliance with relevant financial regulations while streamlining the signing process.

-

How does airSlate SignNow help with the management of NONEXEMPT FUNDS?

airSlate SignNow simplifies the management of NONEXEMPT FUNDS by providing a secure platform for eSigning critical documents. By using our solution, you can effortlessly track signatures and approvals, ensuring that all financial transactions involving these funds are handled efficiently.

-

Are there any additional costs for processing NONEXEMPT FUNDS with airSlate SignNow?

There are no hidden fees for processing NONEXEMPT FUNDS with airSlate SignNow. Our transparent pricing structure allows you to choose a plan that best fits your needs without worrying about unexpected costs associated with handling these funds.

-

What features does airSlate SignNow offer that benefit NONEXEMPT FUNDS transactions?

Key features for handling NONEXEMPT FUNDS transactions include customizable templates, audit trails, and secure cloud storage. These tools allow businesses to ensure compliance and maintain an organized record of all document exchanges related to these funds.

-

Can airSlate SignNow integrate with software used for NONEXEMPT FUNDS?

Yes, airSlate SignNow integrates seamlessly with various financial management tools and platforms that track NONEXEMPT FUNDS. This allows for a smoother workflow, as users can easily send, sign, and store documents without disrupting their existing processes.

-

What benefits does airSlate SignNow provide for small businesses handling NONEXEMPT FUNDS?

For small businesses managing NONEXEMPT FUNDS, airSlate SignNow offers a cost-effective solution that enhances productivity. The platform's ease of use reduces the time spent on paperwork, allowing businesses to focus more on their core operations and compliance.

-

Is airSlate SignNow compliant with regulations regarding NONEXEMPT FUNDS?

Yes, airSlate SignNow adheres to industry standards and regulations concerning NONEXEMPT FUNDS. Our secure platform is designed to ensure that all documents are handled in compliance with legal requirements, providing peace of mind for businesses.

Get more for NONEXEMPT FUNDS

- Form 740 kentucky department of revenue taxhow

- 740 kentucky individual income tax return form 42a740 revenue ky

- 740 1500010001 k i t r 2015 full year residents only for revenue ky form

- Ty2016 individual income tax forms department of revenue revenue ky

- Declination of influenza vaccination my employer o form

- Last will and testament questionnaire wpafb af form

- Incite indiana 403472498 form

- Saint project for confirmation form

Find out other NONEXEMPT FUNDS

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation