64 8 2022-2026

What is the 64 8 form?

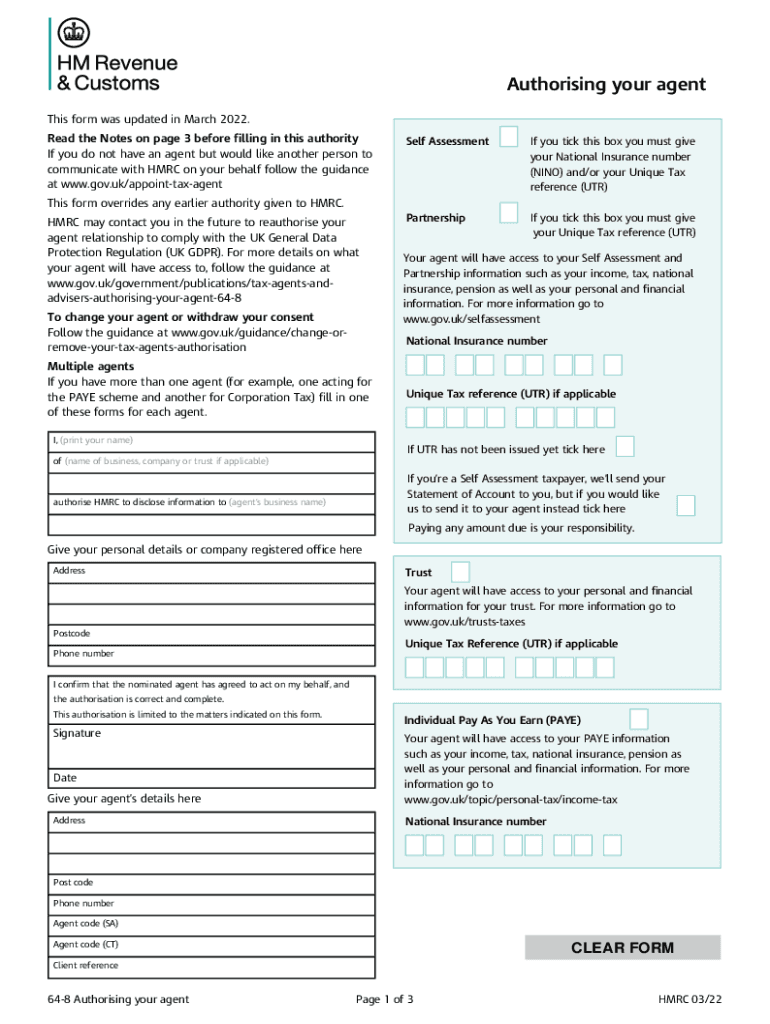

The 64 8 form, also known as the HMRC form 64 8, is a document used in the United Kingdom to authorize an agent to act on behalf of a taxpayer in dealings with HM Revenue and Customs (HMRC). This form is essential for individuals or businesses that wish to grant permission for an accountant or tax advisor to manage their tax affairs. By completing the 64 8 form, taxpayers can ensure that their agents receive necessary information and can communicate directly with HMRC regarding tax matters.

How to use the 64 8 form

Using the 64 8 form involves a straightforward process. First, the taxpayer must fill out the form with their personal details, including name, address, and National Insurance number. Next, the taxpayer needs to provide the details of the agent they wish to authorize, including their name and contact information. Once completed, the form should be signed by the taxpayer to validate the authorization. This signed form can then be submitted to HMRC, allowing the agent to represent the taxpayer in tax-related matters.

Steps to complete the 64 8

Completing the 64 8 form requires several key steps:

- Gather necessary information, including your personal details and those of your agent.

- Fill in the form accurately, ensuring all required fields are completed.

- Review the information for any errors or omissions.

- Sign the form to confirm your authorization of the agent.

- Submit the completed form to HMRC, either online or via postal mail.

Legal use of the 64 8

The 64 8 form is legally binding once it is signed and submitted to HMRC. This authorization allows the appointed agent to access specific tax information and communicate with HMRC on behalf of the taxpayer. It is important to ensure that the form is filled out correctly and submitted in accordance with HMRC guidelines to maintain its legal validity. Misuse of the form or providing false information may lead to penalties or legal repercussions.

Key elements of the 64 8

Several key elements are crucial when completing the 64 8 form:

- Taxpayer Information: Full name, address, and National Insurance number.

- Agent Information: Name and contact details of the authorized agent.

- Signature: The taxpayer's signature is required to validate the authorization.

- Date: The date of signing the form must be included.

Form Submission Methods (Online / Mail / In-Person)

The 64 8 form can be submitted to HMRC through various methods. Taxpayers may choose to submit the form online via the HMRC website, which is often the quickest option. Alternatively, the completed form can be mailed directly to HMRC at the appropriate address. In some cases, taxpayers may also deliver the form in person at a local HMRC office. It is essential to choose the method that best suits the taxpayer's needs and to ensure that the form is submitted correctly to avoid delays in processing.

Quick guide on how to complete 64 8

Complete 64 8 effortlessly on any gadget

Digital document management has gained popularity among enterprises and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage 64 8 on any gadget with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign 64 8 with ease

- Locate 64 8 and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device of your choice. Modify and eSign 64 8 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 64 8

Create this form in 5 minutes!

People also ask

-

What is the 64 8 form and why is it important for businesses?

The 64 8 form is a critical document for businesses in the UK, allowing them to authorize agents to act on their behalf regarding tax matters. This form simplifies communication with HMRC and ensures compliance. By utilizing airSlate SignNow, you can quickly sign and send the 64 8 form electronically, saving time and enhancing efficiency.

-

How does airSlate SignNow simplify the process of completing the 64 8 form?

airSlate SignNow streamlines the 64 8 form process by offering an intuitive interface for filling out and electronically signing documents. The platform allows multiple users to collaborate, ensuring that all necessary information is captured correctly. Additionally, the eSigning features eliminate the need for physical paperwork, making the entire process faster and more convenient.

-

Is there a cost associated with using airSlate SignNow to manage the 64 8 form?

While airSlate SignNow offers various pricing plans, the cost of managing the 64 8 form can be both budget-friendly and flexible. You can choose a plan that fits your business needs, and the savings in time and resources can outweigh the expense. Overall, the investment in an efficient eSigning solution like airSlate SignNow can lead to greater operational savings over time.

-

Can I integrate airSlate SignNow with existing software to manage the 64 8 form?

Yes, airSlate SignNow offers seamless integrations with multiple software platforms, making it easy to manage the 64 8 form alongside your existing tools. Whether you're using CRM, project management, or accounting software, you can enhance your workflow without disruption. This integration capability ensures that your team's processes remain efficient and connected.

-

What are the security features available when signing the 64 8 form with airSlate SignNow?

When signing the 64 8 form with airSlate SignNow, you benefit from advanced security features, including encryption, secure storage, and compliance with legal standards. The platform ensures that your sensitive business information remains protected throughout the signing process. You can have peace of mind knowing that your data is secure and your documents are legally binding.

-

How can using airSlate SignNow improve the turnaround time for the 64 8 form?

Using airSlate SignNow drastically improves the turnaround time for completing the 64 8 form by allowing instant document sharing and real-time eSigning. Unlike traditional methods which can take days, airSlate SignNow enables you to send and receive signed forms in minutes. This speed can signNowly enhance your business operations and responsiveness to HMRC requests.

-

What customer support options are available for those using airSlate SignNow for the 64 8 form?

airSlate SignNow provides excellent customer support options for users managing the 64 8 form, including live chat, email support, and a comprehensive knowledge base. Whether you have questions about using the platform or specific inquiries related to the 64 8 form, the support team is ready to assist you. Quick and responsive support ensures you can navigate any challenges efficiently.

Get more for 64 8

- Wipa initial intake information work incentive planning and vcu ntc

- Disabled parking permit application form bayside city council bayside vic gov

- Aflac cw06197ca form

- Of counsel agreement template form

- Credit repair forms pdf 100265263

- Declaration for providing gas connection with same address form

- Legal holding letter sample form

- Form tr 579 1 ct new york state authorization for electronic

Find out other 64 8

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free