Taxpayer is the Plaintiff, the Proper Defendant is the Municipality Form

What is the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

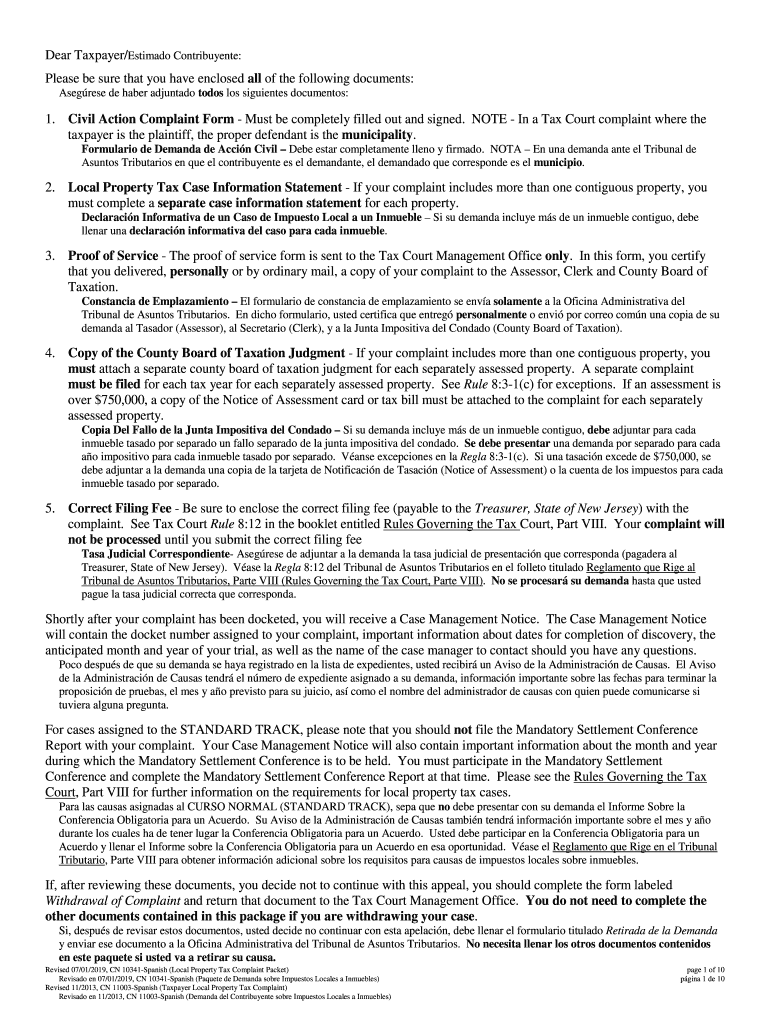

The form "Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality" is a legal document used in the context of disputes between taxpayers and municipal entities. This form establishes the taxpayer's role as the plaintiff, asserting their claims against the municipality, which serves as the proper defendant. It is essential for taxpayers to understand the implications of this designation, as it determines the legal framework within which their case will be evaluated.

Steps to complete the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

Completing the "Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality" form requires careful attention to detail. Here are the key steps involved:

- Gather necessary information, including personal identification details and specifics of the dispute.

- Clearly outline the claims against the municipality, providing supporting evidence where applicable.

- Ensure all required signatures are obtained, including your own and any witnesses if necessary.

- Review the form for accuracy and completeness before submission.

Legal use of the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

This form is legally binding when completed correctly and submitted in accordance with relevant laws. It serves as a formal notification to the municipality of the taxpayer's intent to pursue legal action. The legal use of this form is governed by state and federal regulations, which outline the procedures for filing disputes and the rights of the parties involved.

Key elements of the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

Several key elements must be included in the form to ensure its validity:

- The full name and address of the taxpayer.

- The name and address of the municipality being sued.

- A detailed description of the claims being made against the municipality.

- Signatures of all parties involved, affirming the accuracy of the information provided.

Examples of using the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

Common scenarios for using this form include disputes over property taxes, zoning issues, or municipal service failures. For instance, if a taxpayer believes they have been unfairly assessed property taxes, they may use this form to initiate a legal challenge against the municipality responsible for the tax assessment.

State-specific rules for the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

Each state may have unique regulations governing the use of this form. It is important for taxpayers to familiarize themselves with local laws, including filing deadlines and specific documentation requirements. Consulting with a legal professional can provide clarity on state-specific rules that may affect the filing process.

Quick guide on how to complete taxpayer is the plaintiff the proper defendant is the municipality

Effortlessly Prepare Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality on Any Device

Web-based document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your papers quickly and smoothly. Manage Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Edit and Electronically Sign Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality with Ease

- Obtain Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your form.

- Emphasize signNow sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from any device you select. Adjust and electronically sign Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean when the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality?

This phrase indicates a legal scenario where the taxpayer brings a case against a municipality. Understanding this context is crucial for correctly addressing legal documents. airSlate SignNow simplifies the process of eSigning these documents, ensuring all parties have access to the required files.

-

How does airSlate SignNow help in cases where the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality?

airSlate SignNow offers a streamlined platform for eSigning essential legal documents. This functionality becomes particularly important when navigating complex scenarios where the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality, enabling users to securely manage agreements efficiently.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow provides several pricing tiers to meet varied business needs. Each plan is designed to cater to users looking to manage documents in cases where the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality. For specific pricing details, visit our pricing page.

-

What features does airSlate SignNow offer for legal professionals?

airSlate SignNow includes powerful features such as document templates, team collaboration tools, and secure storage options. These features are particularly beneficial for legal professionals dealing with situations where the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality, ensuring everything is organized and accessible.

-

Is airSlate SignNow compliant with legal standards?

Yes, airSlate SignNow complies with major eSignature laws, ensuring that your documents are legally binding. This compliance is particularly signNow in contexts where the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality, as it helps maintain the integrity of the legal process.

-

What integrations does airSlate SignNow support?

airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and Microsoft Office. These integrations enhance workflow efficiency, especially in cases where the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality, allowing for a smooth document management experience.

-

Can airSlate SignNow assist in preparing documents for court?

Absolutely. airSlate SignNow is equipped to help you prepare and eSign legal documents needed for court cases. This is especially crucial when the Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality, as it ensures all documents are ready and compliant with procedural requirements.

Get more for Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

Find out other Taxpayer Is The Plaintiff, The Proper Defendant Is The Municipality

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document