Seap Washington State 2014-2026

What is the SEAP in Washington State?

The Self Employment Assistance Program (SEAP) in Washington State is designed to support individuals who are self-employed or looking to start their own business. This program provides financial assistance to eligible participants while they develop their business plans and establish their enterprises. The SEAP is particularly beneficial for those who may be transitioning from unemployment to self-employment, as it allows them to receive benefits while focusing on their new ventures.

Eligibility Criteria for the SEAP

To qualify for the SEAP, applicants must meet specific eligibility requirements set by the Washington State Employment Security Department. Generally, individuals must:

- Be receiving unemployment benefits or have recently exhausted them.

- Demonstrate a viable business idea and a plan for self-employment.

- Commit to participating in the program's required training and workshops.

Meeting these criteria is essential for ensuring that participants can effectively benefit from the program while contributing to the state's economy.

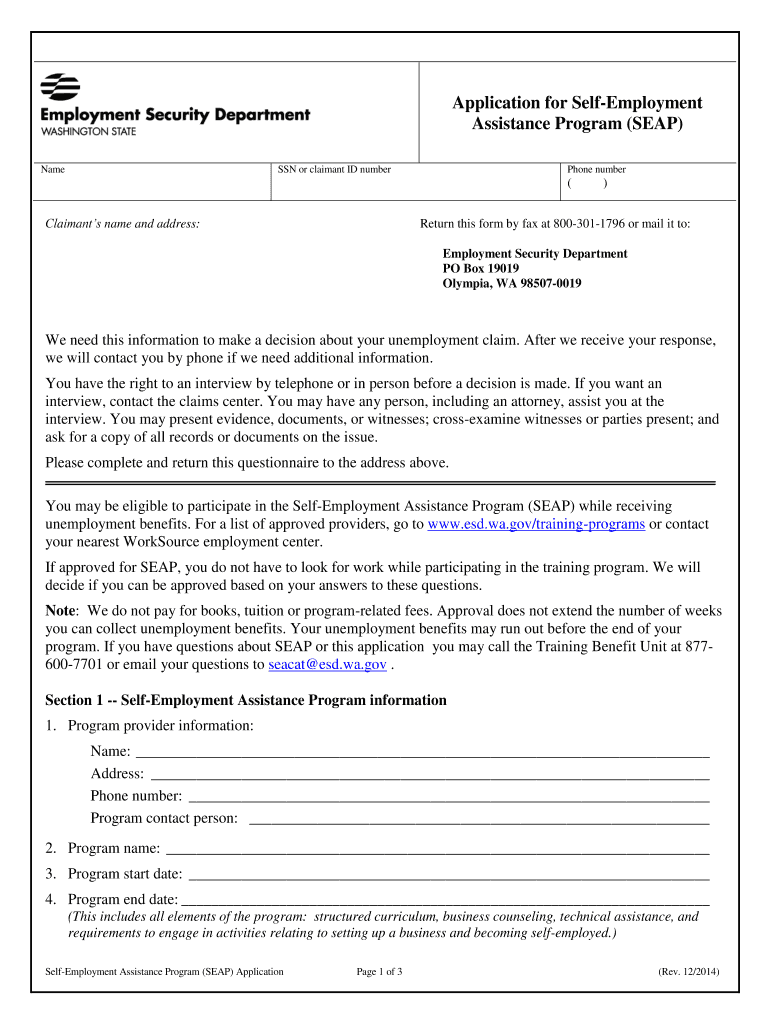

Steps to Complete the SEAP Application

Filling out the SEAP application form involves several key steps to ensure a smooth and successful submission:

- Gather necessary documents, such as proof of unemployment benefits and a detailed business plan.

- Access the SEAP application form through the Washington State Employment Security Department's website.

- Complete the form accurately, ensuring all required fields are filled with correct information.

- Review the application for any errors or omissions before submission.

- Submit the application online or by mail, depending on your preference.

Following these steps will help streamline the application process and increase the chances of approval.

Required Documents for the SEAP Application

Applicants must provide specific documentation to support their SEAP application. Commonly required documents include:

- Proof of unemployment benefits, such as a benefit statement.

- A comprehensive business plan outlining the proposed business structure and goals.

- Identification documents, such as a driver's license or Social Security card.

Having these documents ready will facilitate a more efficient application process and help demonstrate eligibility for the program.

Legal Use of the SEAP in Washington State

The SEAP is governed by various state laws and regulations to ensure that it operates within legal parameters. Participants must adhere to the guidelines set forth by the Washington State Employment Security Department, including:

- Maintaining accurate records of business activities and income.

- Participating in required training sessions and workshops.

- Reporting any changes in business status or personal circumstances that may affect eligibility.

Understanding these legal obligations is crucial for participants to remain compliant and avoid any potential penalties.

Form Submission Methods for the SEAP Application

Applicants have multiple options for submitting their SEAP application form. These methods include:

- Online submission through the Washington State Employment Security Department's website, which is typically the fastest option.

- Mailing the completed form to the appropriate department address, ensuring it is postmarked by the application deadline.

- In-person submission at designated local offices, providing an opportunity for direct assistance if needed.

Choosing the right submission method can enhance the efficiency of the application process and ensure timely consideration.

Quick guide on how to complete washington self employment assistance program form

Simplify Your Human Resources Operations with Seap Washington State Template

Every HR professional understands the importance of maintaining employees’ information organized and systematic. With airSlate SignNow, you gain access to a vast collection of state-specific employment forms that signNowly enhance the management, administration, and storage of all job-related documents in a single location. airSlate SignNow enables you to oversee Seap Washington State administration from beginning to end, with comprehensive editing and eSignature tools available whenever you need them. Improve your accuracy, document security, and eliminate minor manual errors in just a few clicks.

How to Modify and eSign Seap Washington State:

- Locate the relevant state and search for the form you require.

- Access the form page and then click Get Form to start working with it.

- Allow Seap Washington State to upload in our editor and adhere to the prompts that highlight mandatory fields.

- Enter your information or include additional fillable fields to the form.

- Utilize our tools and features to adapt your form as necessary: annotate, redact sensitive information, and create an eSignature.

- Review your document for errors before moving forward with its submission.

- Click on Done to save changes and download your form.

- Alternatively, dispatch your documents directly to your recipients and gather signatures and information.

- Safely store completed documents in your airSlate SignNow account and access them whenever you need.

Employing a versatile eSignature solution is essential when managing Seap Washington State. Make even the most complicated workflow as seamless as possible with airSlate SignNow. Start your free trial today to discover what you can achieve with your department.

Create this form in 5 minutes or less

FAQs

-

What form can I fill out as a self-employed individual to make my CPA’s job easier?

A QuickBooks Trial Balance and Detailed General Ledger - printed and in Excel format. Work with your CPA to create an appropriate chart of accounts for your business. And use a good bookkeeper to keep your books. If your books look good, the CPA will ask some question to gain comfort and then accept your numbers with little further investigation.Please do not bring a boxful of crumpled receipts. You will pay more for your CPA to uncrumple them and categorize them. If you are a really small business, a legal pad sheet categorizing your receipts. If your receipts are a mess, or your books a mess, your CPA needs to ask a lot more questions and spend a lot more time gaining comfort with your books. Bad books from a shady client means a lot of grief for the CPA and a lot more fees.

-

What are some tips to fill out the kvpy self appraisal form?

You should not lie in the self-appraisal form. Professors generally do not ask anything from the self appraisal form. But if they find out some extraordinary stuffs in your form, they may ask you about those topics. And if you do not know those topics properly, you will have higher chance of NOT getting selected for the fellowship. So, DO NOT write anything that you are not sure about.If I remember properly, in the form they ask, “What is your favorite subject?” and I mentioned Biology there. Head of the interview panel saw that and asked me about my favorite field of biology. When I told genetics, two professors started asking question from genetics and did not ask anything from any other fields at all (except exactly 2 chemistry questions as I mentioned chemistry as my 2nd favorite subject). But they did not check other answers in self-appraisal form (at least in my presence).Do mention about science camps if you have attended any. Again, do not lie.All the best for interview round. :)

-

What form do I need to fill out when I’m a self-employee but the business belongs to my sister and mine (IRS question)?

Thanks Bruce. Edited answer below:Ok. It's time you do some reading…and if your business made decent money, get a tax accountant.Self employed / sole proprietor: 1040Self employed / LLC: must file Corp business filing and issue K1 then 1040Self employed / LLC w S Corp option: (you should have been on your own payroll) must file Corp business filing and issue K1, then 1040Self employed / C Corp: (you should have been on your own payroll) must file Corp business filing and issue 1099 DIV, then 1040.Corporate business filing and tax is due March 15. You can extend the filing, but any tax is due the March 15. If you don't pay on or before March 15, fees and interest are applied.Personal filing and tax is due April 15. You can extend the filing, but any tax is due on April 15. If you don't pay on or before April 15, fees and interest are applied.Same for your sister.Don't forget to file/pay the company's sales and use taxes, if applicable (State).You will also have to do corporate and personal filings with your state.

Create this form in 5 minutes!

How to create an eSignature for the washington self employment assistance program form

How to generate an eSignature for your Washington Self Employment Assistance Program Form online

How to make an electronic signature for your Washington Self Employment Assistance Program Form in Chrome

How to generate an electronic signature for putting it on the Washington Self Employment Assistance Program Form in Gmail

How to generate an eSignature for the Washington Self Employment Assistance Program Form straight from your smart phone

How to create an electronic signature for the Washington Self Employment Assistance Program Form on iOS

How to create an electronic signature for the Washington Self Employment Assistance Program Form on Android

People also ask

-

What is the WA SEAP application and how can it benefit my business?

The WA SEAP application is a digital tool designed to streamline your document signing and management process. By integrating airSlate SignNow's features, it allows businesses to efficiently send, sign, and manage documents online, ultimately saving time and reducing operational costs.

-

How much does the WA SEAP application cost?

Pricing for the WA SEAP application varies based on the chosen plan and features. airSlate SignNow offers flexible subscription options that cater to businesses of all sizes, ensuring you only pay for what you need while getting access to essential eSignature functionalities.

-

What features does the WA SEAP application offer?

The WA SEAP application includes features like customizable templates, real-time tracking of document status, and secure storage options. These functionalities enhance efficiency in document processing, making it easier for users to manage their signing workflows.

-

Is the WA SEAP application easy to use?

Yes, the WA SEAP application is built with user-friendliness in mind. The intuitive interface allows users to navigate effortlessly, send documents for signing, and track their status without needing extensive technical knowledge.

-

Can the WA SEAP application integrate with other software?

Absolutely! The WA SEAP application seamlessly integrates with various popular software solutions, including CRM and document management systems. This ensures a smooth workflow by connecting existing tools with airSlate SignNow's capabilities for enhanced productivity.

-

What security measures are in place for the WA SEAP application?

The WA SEAP application prioritizes document security by employing advanced encryption protocols and compliance with legal standards. This ensures that your sensitive information remains protected during the entire signing process.

-

How can the WA SEAP application help in reducing turnaround time?

Utilizing the WA SEAP application signNowly reduces turnaround time by enabling quick document access and instant eSigning capabilities. This streamlines the signing process and allows businesses to finalize agreements much more rapidly, increasing overall efficiency.

Get more for Seap Washington State

Find out other Seap Washington State

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors