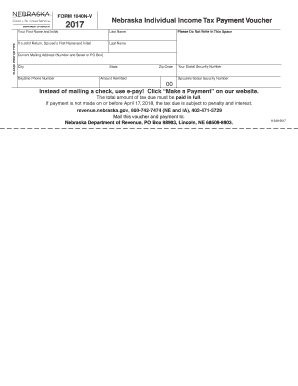

Form 1040N V Nebraska Individual Income Tax Payment

What is the Form 1040N V Nebraska Individual Income Tax Payment

The Form 1040N V is a payment voucher used for submitting individual income tax payments in Nebraska. This form is specifically designed for taxpayers who owe taxes and wish to remit their payments directly to the Nebraska Department of Revenue. It is important to note that the 1040N V is not a tax return but rather a means to facilitate payment of taxes owed based on the information reported on the Nebraska Individual Income Tax Return.

How to use the Form 1040N V Nebraska Individual Income Tax Payment

To use the Form 1040N V, taxpayers must first determine the amount of tax owed as indicated on their Nebraska Individual Income Tax Return. After calculating the total due, the taxpayer should complete the form by providing their name, address, and the payment amount. It is crucial to ensure that the information matches the details on the tax return to avoid processing delays. Once completed, the form can be submitted along with the payment to the appropriate address specified by the Nebraska Department of Revenue.

Steps to complete the Form 1040N V Nebraska Individual Income Tax Payment

Completing the Form 1040N V involves several steps:

- Obtain the Form 1040N V from the Nebraska Department of Revenue website or through other official sources.

- Fill in your personal information, including your name and address.

- Indicate the payment amount, which should match the tax owed on your return.

- Review the form for accuracy to ensure that all information is correct.

- Sign and date the form to validate the payment.

- Submit the form along with your payment to the designated address.

Legal use of the Form 1040N V Nebraska Individual Income Tax Payment

The Form 1040N V is legally binding when properly completed and submitted. It serves as an official record of payment to the Nebraska Department of Revenue. To ensure legal compliance, taxpayers must adhere to the guidelines set forth by the Nebraska Department of Revenue regarding payment methods and submission timelines. Failure to use the form correctly may result in penalties or delays in processing payments.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines associated with the Form 1040N V. Typically, the payment is due on the same date as the individual income tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. It is essential to check the Nebraska Department of Revenue’s official announcements for any changes to deadlines or specific instructions regarding late payments.

Required Documents

When submitting the Form 1040N V, taxpayers should have the following documents ready:

- A completed Nebraska Individual Income Tax Return.

- Any supporting documentation that verifies income and deductions claimed.

- Payment method details, such as a check or money order, if applicable.

Quick guide on how to complete form 1040n v 2017 nebraska individual income tax payment

Complete Form 1040N V Nebraska Individual Income Tax Payment effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct form and securely store it digitally. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle Form 1040N V Nebraska Individual Income Tax Payment on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Form 1040N V Nebraska Individual Income Tax Payment effortlessly

- Obtain Form 1040N V Nebraska Individual Income Tax Payment and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that aim.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 1040N V Nebraska Individual Income Tax Payment and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

-

How can I deduct on my Federal income taxes massage therapy for my chronic migraines? Is there some form to fill out to the IRS for permission?

As long as your doctor prescribed this, it is tax deductible under the category for medical expenses. There is no IRS form for permission.

-

How much will a doctor with a physical disability and annual net income of around Rs. 2.8 lakhs pay in income tax? Which ITR form is to be filled out?

For disability a deduction of ₹75,000/- is available u/s 80U.Rebate u/s87AFor AY 17–18, rebate was ₹5,000/- or income tax which ever is lower for person with income less than ₹5,00,000/-For AY 18–19, rebate is ₹2,500/- or income tax whichever is lower for person with income less than 3,50,000/-So, for an income of 2.8 lakhs, taxable income after deduction u/s 80U will remain ₹2,05,000/- which is below the slab rate and hence will not be taxable for any of the above said AY.For ITR,If doctor is practicing himself i.e. He has a professional income than ITR 4 should be filedIf doctor is getting any salary than ITR 1 should be filed.:)

Create this form in 5 minutes!

How to create an eSignature for the form 1040n v 2017 nebraska individual income tax payment

How to make an electronic signature for the Form 1040n V 2017 Nebraska Individual Income Tax Payment in the online mode

How to create an electronic signature for the Form 1040n V 2017 Nebraska Individual Income Tax Payment in Chrome

How to make an electronic signature for putting it on the Form 1040n V 2017 Nebraska Individual Income Tax Payment in Gmail

How to make an eSignature for the Form 1040n V 2017 Nebraska Individual Income Tax Payment from your smartphone

How to generate an eSignature for the Form 1040n V 2017 Nebraska Individual Income Tax Payment on iOS devices

How to make an eSignature for the Form 1040n V 2017 Nebraska Individual Income Tax Payment on Android

People also ask

-

What is Form 1040N V for Nebraska Individual Income Tax Payment?

Form 1040N V is a payment voucher used by residents of Nebraska to submit their individual income tax payments. This form helps taxpayers ensure their payments are properly recorded against their tax liabilities. Using airSlate SignNow, you can eSign and submit your Form 1040N V Nebraska Individual Income Tax Payment quickly and securely.

-

How can airSlate SignNow help with my Form 1040N V Nebraska Individual Income Tax Payment?

airSlate SignNow offers a streamlined process for eSigning your Form 1040N V Nebraska Individual Income Tax Payment. With our user-friendly platform, you can fill out, eSign, and send your tax payment documents efficiently, ensuring compliance and accuracy in your submissions.

-

Is airSlate SignNow cost-effective for filing Form 1040N V Nebraska Individual Income Tax Payment?

Yes, airSlate SignNow is a cost-effective solution for managing your Form 1040N V Nebraska Individual Income Tax Payment. Our pricing plans are designed to fit various budgets, providing access to essential features for eSigning and document management without breaking the bank.

-

What features does airSlate SignNow offer for handling tax payment forms?

airSlate SignNow provides robust features for handling tax payment forms, including templates for Form 1040N V Nebraska Individual Income Tax Payment, secure cloud storage, and easy eSigning capabilities. These features help simplify the tax filing process and ensure that your documents are always accessible and compliant.

-

Can I integrate airSlate SignNow with other tax software for Form 1040N V Nebraska Individual Income Tax Payment?

Absolutely! airSlate SignNow seamlessly integrates with various tax software applications, allowing you to manage your Form 1040N V Nebraska Individual Income Tax Payment alongside your other tax-related tasks. This integration enhances efficiency and ensures a smooth workflow for your tax filings.

-

What are the benefits of using airSlate SignNow for my Nebraska Individual Income Tax Payment?

Using airSlate SignNow for your Nebraska Individual Income Tax Payment offers numerous benefits, including time savings, enhanced security, and ease of use. You can eSign your Form 1040N V quickly and send it directly to the appropriate tax authorities, reducing the stress associated with tax season.

-

Is airSlate SignNow secure for submitting Form 1040N V Nebraska Individual Income Tax Payment?

Yes, airSlate SignNow prioritizes the security of your documents, including Form 1040N V Nebraska Individual Income Tax Payment. Our platform employs advanced encryption and secure storage protocols to protect your sensitive tax information, providing peace of mind when filing.

Get more for Form 1040N V Nebraska Individual Income Tax Payment

- 540 es form

- 100 es instructions form

- Ca form 589 year 2012

- Hsbc download name change foam form

- Hsbc online deposit slip form

- Hsbc deposit slip form

- Hsbc direct deposit form

- Ic 831 form 4466w wisconsin corporation or pass through entity application for quick refund of overpayment of estimated tax 794907800

Find out other Form 1040N V Nebraska Individual Income Tax Payment

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple