Illinois Estate Form

What is the Illinois Estate?

The Illinois estate refers to the legal process involved in managing and distributing the assets of a deceased individual in the state of Illinois. This process typically requires the appointment of an executor or administrator, who is responsible for settling debts, paying taxes, and distributing the remaining assets according to the deceased's will or, in the absence of a will, according to state law. Understanding the Illinois estate process is crucial for beneficiaries and heirs, as it outlines their rights and responsibilities during this time.

Steps to complete the Illinois Estate

Completing the Illinois estate process involves several key steps:

- Gather necessary documents: Collect the deceased's will, financial statements, and any relevant legal documents.

- File the will with the probate court: Submit the will and a petition for probate to the appropriate court in Illinois.

- Notify interested parties: Inform beneficiaries, heirs, and creditors about the probate proceedings.

- Inventory and appraise assets: List all assets and have them appraised to determine their value.

- Settle debts and taxes: Pay any outstanding debts and taxes owed by the estate.

- Distribute remaining assets: After debts are settled, distribute the remaining assets according to the will or state law.

Required Documents

When dealing with the Illinois estate process, several documents are essential:

- The deceased's will, if available

- Death certificate

- Petition for probate

- Inventory of assets

- Records of debts and liabilities

- Tax returns for the deceased

Legal use of the Illinois Estate

The legal use of the Illinois estate process ensures that the deceased's wishes are honored and that their assets are distributed fairly. This process is governed by state laws, which dictate how estates are managed and how disputes are resolved. Legal representation is often advisable to navigate the complexities of probate law and to ensure compliance with all legal requirements.

Eligibility Criteria

Eligibility to initiate the Illinois estate process typically includes being a named executor in the will, an heir, or a beneficiary. Additionally, individuals must be at least eighteen years old and of sound mind to serve as executors. If there is no will, Illinois law will determine the rightful heirs based on intestacy laws, which outline how assets are distributed when someone dies without a will.

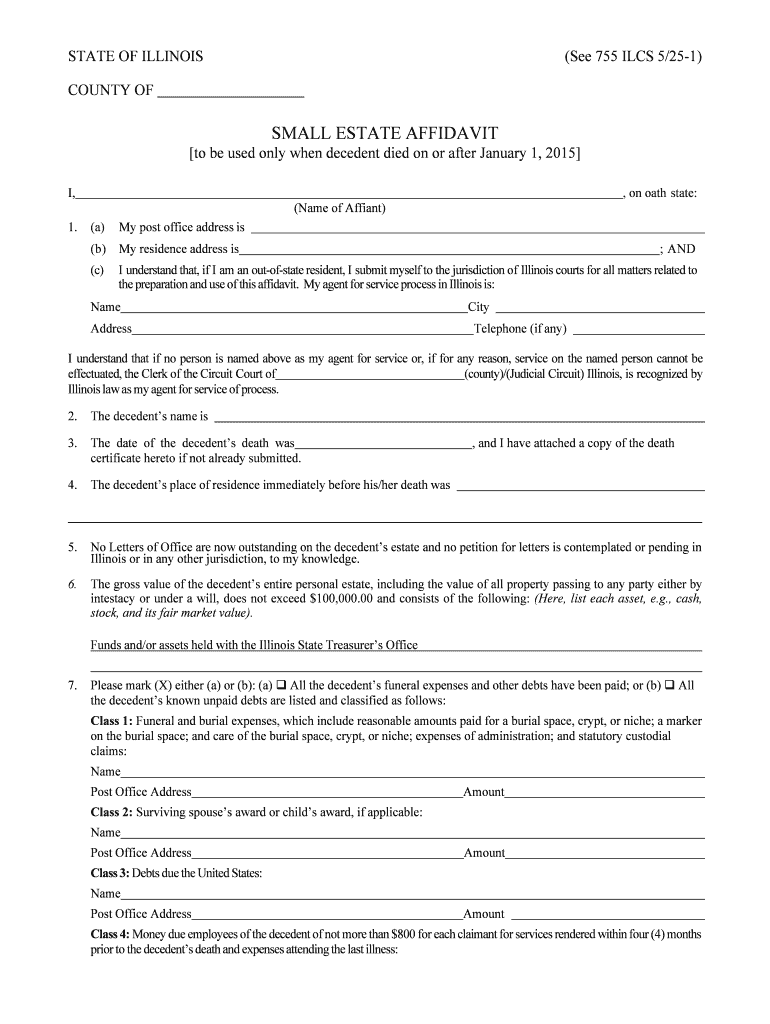

Who Issues the Form

The small estate affidavit form in Illinois is typically issued by the probate court or can be obtained from legal resources or attorneys specializing in estate planning. This form is essential for individuals seeking to claim assets from a deceased person's estate without going through the full probate process, provided the estate meets certain criteria regarding its value.

Quick guide on how to complete illinois estate

Finalize Illinois Estate effortlessly on any device

Digital document organization has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can access the necessary form and securely archive it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly and without delays. Manage Illinois Estate on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest method to modify and electronically sign Illinois Estate without hassle

- Acquire Illinois Estate and then click Get Form to initiate the process.

- Utilize the features we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate generating new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Illinois Estate and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a small estate affidavit pdf?

A small estate affidavit pdf is a legal document that allows heirs to claim the assets of a deceased person's estate without going through the lengthy probate process. This form simplifies the transfer of small estates and is essential for expediting the inheritance process.

-

How do I create a small estate affidavit pdf using airSlate SignNow?

To create a small estate affidavit pdf with airSlate SignNow, simply upload your existing document or use our templates to craft an affidavit. The platform is user-friendly, allowing you to edit, sign, and send documents seamlessly, ensuring you have a valid and enforceable legal document.

-

Is there a cost associated with creating a small estate affidavit pdf?

airSlate SignNow offers competitive pricing plans that allow users to create and manage small estate affidavit pdfs efficiently. Our subscription plans are designed to be cost-effective, providing you with the tools required for eSigning and document management at an affordable price.

-

What features does airSlate SignNow offer for small estate affidavits?

AirSlate SignNow provides a range of features for small estate affidavits, including customizable templates, secure eSigning, and document sharing capabilities. Additionally, users benefit from cloud storage and easy access from any device, ensuring your small estate affidavit pdf is always at your fingertips.

-

Can I store my small estate affidavit pdf securely?

Yes, airSlate SignNow ensures the security of your small estate affidavit pdf by offering secure cloud storage with encryption. This guarantees that your sensitive documents are protected from unauthorized access, allowing you peace of mind while managing legal paperwork.

-

Does airSlate SignNow integrate with other applications for managing affidavits?

Indeed, airSlate SignNow offers robust integrations with various applications, facilitating a seamless workflow for managing small estate affidavit pdfs. You can connect with platforms like Google Drive, Dropbox, and other productivity tools to streamline your document management process.

-

What are the benefits of using airSlate SignNow for small estate affidavits?

Using airSlate SignNow for small estate affidavits provides multiple benefits, including saving time, reducing paperwork, and eliminating the hassle of in-person signatures. Our platform empowers you to handle your documentation efficiently, enhancing your overall productivity and simplifying legal processes.

Get more for Illinois Estate

Find out other Illinois Estate

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word