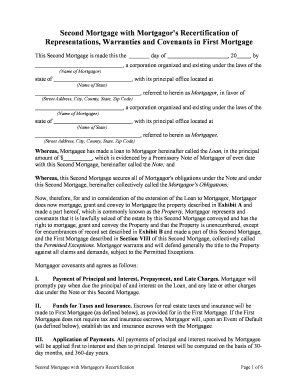

Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage Form

What is the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

The second mortgage with mortgagor's recertification of representations, warranties, and covenants in first mortgage is a legal document that allows homeowners to secure additional financing against their property. This type of mortgage is subordinate to the first mortgage, meaning that in the event of a foreclosure, the first mortgage lender has priority over the second mortgage lender. The recertification process involves the mortgagor reaffirming their representations, warranties, and covenants from the first mortgage, ensuring that all information remains accurate and compliant with lender requirements.

How to use the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

To use the second mortgage with mortgagor's recertification, homeowners must first assess their financial needs and determine the amount of additional funding required. Once the amount is established, the homeowner should gather necessary documentation, such as proof of income, credit history, and details about the first mortgage. This information will support the application process. After preparing the documentation, the homeowner can approach lenders who offer second mortgages and submit their application, including the recertification of representations, warranties, and covenants from the first mortgage.

Steps to complete the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

Completing the second mortgage with mortgagor's recertification involves several steps:

- Assess your financial situation and determine the amount needed.

- Gather required documentation, including income proof and existing mortgage details.

- Identify potential lenders and inquire about their second mortgage offerings.

- Submit your application, including the recertification of representations, warranties, and covenants.

- Review the loan terms and conditions provided by the lender.

- Sign the necessary documents electronically or in person.

- Receive the funds and ensure compliance with all terms set by the lender.

Key elements of the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

Several key elements define the second mortgage with mortgagor's recertification:

- Loan Amount: The amount of money borrowed against the property.

- Interest Rate: The rate at which interest will accrue on the borrowed amount.

- Repayment Terms: The schedule and duration for repaying the loan.

- Recertification Requirements: The need for the mortgagor to reaffirm the accuracy of their representations and warranties from the first mortgage.

- Subordination Clause: A statement confirming the priority of the first mortgage over the second mortgage.

Legal use of the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

The legal use of the second mortgage with mortgagor's recertification is crucial for ensuring that all parties involved understand their rights and obligations. This document must comply with federal and state regulations governing mortgage lending. Proper execution and adherence to legal standards, such as obtaining necessary signatures and maintaining accurate records, are essential for the enforceability of the mortgage. Additionally, lenders often require that the recertification process be documented to protect their interests and ensure compliance with underwriting standards.

Eligibility Criteria

Eligibility for obtaining a second mortgage with mortgagor's recertification typically includes the following criteria:

- Homeownership: The applicant must own the property against which the second mortgage is being taken.

- Equity: Sufficient equity in the home is required, usually at least twenty percent.

- Creditworthiness: A good credit score is essential to qualify for favorable terms.

- Income Verification: Proof of stable income to support repayment of both mortgages.

- Debt-to-Income Ratio: Lenders often assess this ratio to ensure the borrower can manage additional debt.

Quick guide on how to complete second mortgage with mortgagors recertification of representations warranties and covenants in first mortgage

Effortlessly Prepare Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and safely archive it online. airSlate SignNow equips you with all the resources necessary to generate, amend, and electronically sign your documents promptly, without any hold-ups. Handle Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage across any platform with the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to Edit and eSign Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage with Ease

- Obtain Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Emphasize key sections of the documents or conceal sensitive details using features specifically designed for that purpose by airSlate SignNow.

- Design your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to finalize your edits.

- Choose your preferred method for sharing your form, whether via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device you choose. Edit and eSign Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage?

A Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage is a financial instrument that allows homeowners to borrow against their property while ensuring that the terms of the first mortgage are upheld. This process involves a recertification that confirms the borrower’s compliance with the original mortgage agreements, safeguarding lenders against potential risks.

-

How does airSlate SignNow facilitate the execution of a Second Mortgage With Mortgagor's Recertification?

airSlate SignNow streamlines the process of executing a Second Mortgage With Mortgagor's Recertification by providing a user-friendly platform for sending and eSigning documents. This platform reduces paperwork, accelerates turnaround times, and ensures compliance, making it easier for both lenders and borrowers to complete transactions efficiently.

-

What are the benefits of using airSlate SignNow for Second Mortgages?

Using airSlate SignNow for Second Mortgages offers numerous benefits, including enhanced security, ease of access, and reduced costs associated with document management. The digital document solution empowers businesses to complete transactions quickly and confidently, ensuring that all parties are protected under the terms of the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage.

-

Is there a fee associated with processing a Second Mortgage With Mortgagor's Recertification on airSlate SignNow?

Yes, airSlate SignNow offers competitive pricing options for processing documents, including the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage. Pricing varies based on the plan selected, which allows businesses to choose a solution that fits their budget while enjoying the full range of features.

-

Can airSlate SignNow integrate with other financial software for Second Mortgages?

Absolutely! airSlate SignNow is designed to seamlessly integrate with a variety of financial software solutions, enabling users to manage their Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage transactions within their existing workflow. This integration helps streamline document handling and reduces the chances of errors.

-

How secure is the airSlate SignNow platform for handling sensitive mortgage documents?

The security of your documents is a top priority for airSlate SignNow. The platform utilizes advanced encryption protocols and adheres to industry standards to ensure that all information, including those related to the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage, is protected against unauthorized access and bsignNowes.

-

What features does airSlate SignNow offer for managing Second Mortgages?

airSlate SignNow offers a comprehensive set of features for managing Second Mortgages, such as customizable templates, bulk document sending, real-time tracking, and automated reminders. These features not only enhance user experience but also ensure that all parties can effectively manage the recertification process related to the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage.

Get more for Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

- Self help forms adoption colorado judicial branch

- Self help forms adoption legal colorado judicial branch

- Reported stenographically or by electronic recording means form

- Transcript request form pursuant to chief justice

- The petitioner must be 21 years of age or older unless a minor has permission by the court to file the form

- Child of petitioners and to render himher capable of inheriting their estate states the following facts form

- Petitioner 1 full name form

- 2019 colorado supreme court decisions colorado case form

Find out other Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure