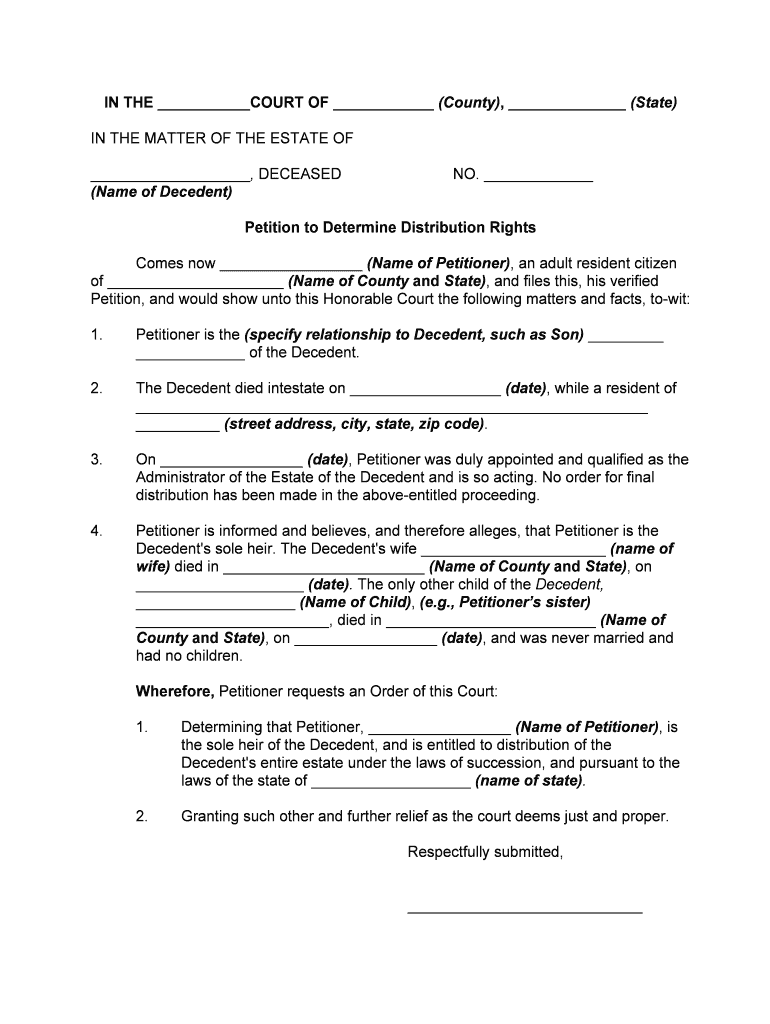

Distribution Assets Form

What is the division of assets form?

The division of assets form is a legal document used to outline how assets will be distributed among parties, typically in the context of divorce, inheritance, or partnership dissolution. This form is crucial for ensuring that all parties agree on the allocation of property, finances, and other assets. It serves as a formal record that can help prevent disputes and misunderstandings in the future. By clearly documenting the distribution plan, individuals can protect their rights and ensure compliance with relevant legal requirements.

Key elements of the division of assets form

A comprehensive division of assets form includes several key elements that are essential for its effectiveness and legal validity. These elements typically encompass:

- Identification of parties: Names and contact information of all individuals involved in the asset distribution.

- Description of assets: A detailed list of all assets subject to division, including real estate, bank accounts, investments, and personal property.

- Valuation of assets: An assessment of the current market value of each asset to ensure fair distribution.

- Distribution plan: Clear instructions on how each asset will be divided among the parties, including any terms or conditions.

- Signatures: Signatures of all parties involved, indicating their agreement to the terms outlined in the form.

Steps to complete the division of assets form

Completing the division of assets form involves several important steps to ensure accuracy and compliance with legal standards. The process typically includes:

- Gather necessary information: Collect all relevant financial documents, including bank statements, property deeds, and investment records.

- List all assets: Create a comprehensive inventory of all assets that need to be divided.

- Determine asset values: Assign a fair market value to each asset, possibly consulting with a professional appraiser if needed.

- Draft the form: Fill out the division of assets form, ensuring all required information is included and accurately represented.

- Review and revise: Have all parties review the form to confirm agreement and make any necessary adjustments.

- Sign the form: Ensure that all parties sign the document in the presence of a notary if required.

Legal use of the division of assets form

The division of assets form is legally binding when completed correctly and signed by all involved parties. It is essential to adhere to state-specific laws governing asset distribution to ensure the form's enforceability. In many cases, the form may need to be submitted to a court or other legal authority, particularly in divorce or probate proceedings. Understanding the legal implications of the form helps protect the rights of all parties and facilitates a smoother resolution of asset distribution matters.

Required documents for the division of assets form

To effectively complete the division of assets form, certain documents are typically required. These documents may include:

- Financial statements: Bank statements, investment account statements, and retirement account summaries.

- Property documents: Deeds, titles, and any existing liens or mortgages on real estate.

- Valuation reports: Appraisals or assessments for significant assets, such as real estate or business interests.

- Legal agreements: Any existing prenuptial agreements or partnership agreements that may impact asset distribution.

Examples of using the division of assets form

The division of assets form can be utilized in various scenarios, including:

- Divorce proceedings: To outline how marital property will be divided between spouses.

- Estate planning: To specify how assets will be distributed among heirs after an individual's death.

- Business dissolution: To detail the division of assets when a partnership or business is dissolved.

Quick guide on how to complete distribution assets

Handle Distribution Assets smoothly on any gadget

Digital document administration has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, as you can locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents rapidly without interruptions. Manage Distribution Assets on any device with airSlate SignNow Android or iOS applications and simplify any document-related workflow today.

How to edit and eSign Distribution Assets effortlessly

- Obtain Distribution Assets and click on Get Form to initiate.

- Utilize the instruments we offer to complete your document.

- Emphasize critical parts of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you’d like to send your form, whether by email, SMS, invitation link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Distribution Assets and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a division of assets form?

A division of assets form is a legal document used to outline the distribution of assets between parties, often in cases of divorce or separation. This form helps to ensure clarity and fairness during asset division, ensuring that all parties agree on the asset allocation. Using airSlate SignNow, you can easily create and eSign a division of assets form without hassle.

-

How do I create a division of assets form using airSlate SignNow?

Creating a division of assets form with airSlate SignNow is simple and straightforward. You can start by selecting a template or building your own form using our intuitive interface. The platform allows you to customize the document to fit your specific needs before sending it for eSignature.

-

Is there a cost associated with using the division of assets form on airSlate SignNow?

Yes, while airSlate SignNow offers reasonable pricing plans, the costs depend on the features you choose. Our plans are designed to be cost-effective for businesses of all sizes, ensuring you can access the tools needed to manage your division of assets form efficiently. Consider the value of time saved and improved organization when evaluating the investment.

-

What features does airSlate SignNow provide for division of assets forms?

AirSlate SignNow offers various features tailored for division of assets forms, such as customizable templates, secure eSigning, and real-time tracking of document status. Additionally, you can collaborate with other parties and attach necessary documents for comprehensive asset transparency. These features simplify the asset division process, making it more efficient.

-

Can I integrate airSlate SignNow with other tools for managing division of assets forms?

Yes, airSlate SignNow provides various integrations that allow you to connect with popular productivity and document management tools. This means you can streamline your workflow and manage division of assets forms directly alongside your other software applications. Integrations enhance the overall efficiency and functionality of your document processes.

-

How secure is the division of assets form when using airSlate SignNow?

Security is a top priority at airSlate SignNow, especially when handling sensitive documents like a division of assets form. The platform utilizes advanced encryption and complies with legal data protection regulations, ensuring your documents remain safe and confidential. You can trust that your information is well-protected.

-

What are the benefits of using airSlate SignNow for a division of assets form?

Using airSlate SignNow for a division of assets form offers numerous benefits, including ease of use, increased efficiency, and enhanced security. The platform simplifies the entire signing process, allowing users to focus on their core tasks without the hassle of traditional paperwork. This not only saves time but also helps in avoiding costly errors.

Get more for Distribution Assets

- Nevada programs form

- Control number de p093 pkg form

- Mod iv users manual njgov form

- Space above for recording information only

- Tax assessment parcel identification number form

- Chapter 1337 power of attorney ohio laws and rules form

- Delaware power of attorney formsdurable healthcare

- Control number de p109 pkg form

Find out other Distribution Assets

- eSign Louisiana Notice of Rent Increase Mobile

- eSign Washington Notice of Rent Increase Computer

- How To eSign Florida Notice to Quit

- How To eSign Hawaii Notice to Quit

- eSign Montana Pet Addendum to Lease Agreement Online

- How To eSign Florida Tenant Removal

- How To eSign Hawaii Tenant Removal

- eSign Hawaii Tenant Removal Simple

- eSign Arkansas Vacation Rental Short Term Lease Agreement Easy

- Can I eSign North Carolina Vacation Rental Short Term Lease Agreement

- eSign Michigan Escrow Agreement Now

- eSign Hawaii Sales Receipt Template Online

- eSign Utah Sales Receipt Template Free

- eSign Alabama Sales Invoice Template Online

- eSign Vermont Escrow Agreement Easy

- How Can I eSign Wisconsin Escrow Agreement

- How To eSign Nebraska Sales Invoice Template

- eSign Nebraska Sales Invoice Template Simple

- eSign New York Sales Invoice Template Now

- eSign Pennsylvania Sales Invoice Template Computer