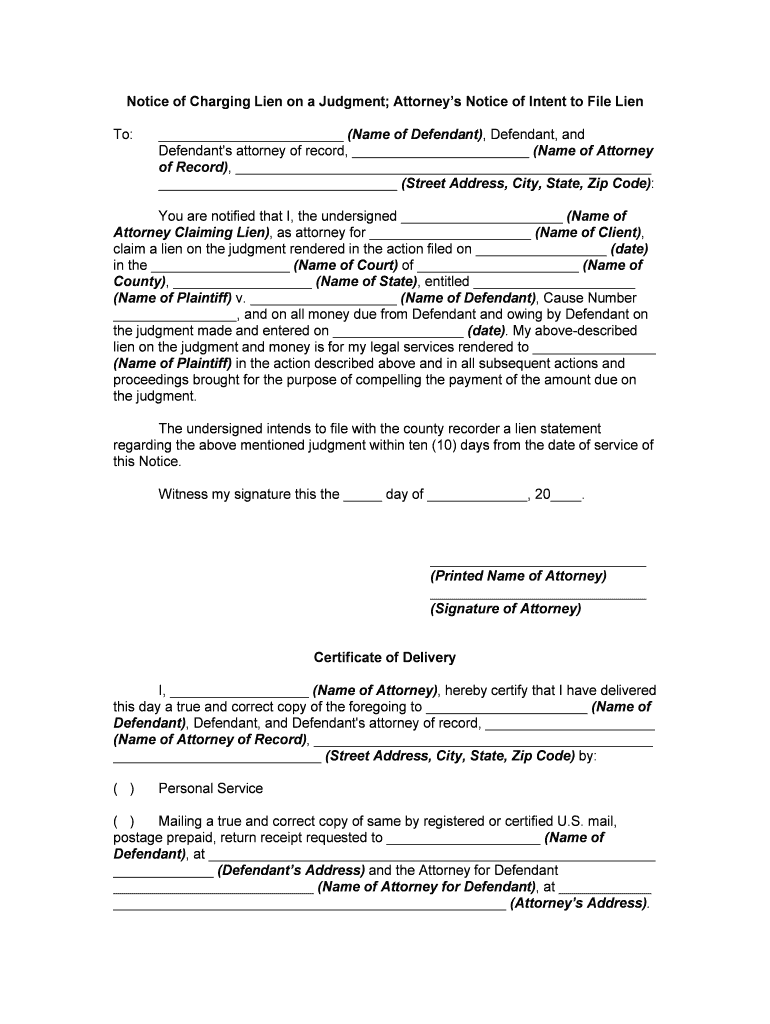

Lien Form

What is the lien?

A lien is a legal claim or right against a property that allows a creditor to obtain access to the property if the debtor fails to fulfill their obligations. This can involve unpaid debts or obligations related to financial agreements. In the United States, liens can be placed on various types of property, including real estate, vehicles, and personal assets. The lien serves as a public notice that the property is encumbered, which can affect the owner's ability to sell or refinance the property.

How to use the lien

Using a lien involves several steps, starting with the determination of the type of lien needed based on the specific situation. For example, a charging lien may be appropriate for attorneys seeking payment for services rendered. Once the type is identified, the lien form must be completed accurately, ensuring all required information is included. After completion, the lien should be filed with the appropriate governmental authority, such as a county clerk's office, to make it legally enforceable.

Steps to complete the lien

Completing a lien requires careful attention to detail. Here are the essential steps:

- Identify the type of lien you need.

- Gather necessary information, including the debtor's details and the amount owed.

- Complete the lien form accurately, ensuring all sections are filled out.

- Sign the form where required, ensuring compliance with any state-specific regulations.

- File the completed lien with the appropriate authority, such as the county recorder or clerk.

Legal use of the lien

The legal use of a lien is governed by state laws, which outline the requirements for creating and enforcing liens. It is essential to understand these regulations to ensure that the lien is valid and enforceable. For instance, some states may require specific language in the lien document or mandate that the lien be filed within a certain timeframe after the debt arises. Understanding these legal parameters helps protect the rights of the creditor and ensures compliance with applicable laws.

Key elements of the lien

Several key elements must be present for a lien to be valid:

- The existence of a debt or obligation.

- A legal right to place a lien on the property.

- Proper documentation, including a completed lien form.

- Filing the lien with the appropriate authority.

- Notification to the property owner, if required by law.

Required documents

When filing a lien, specific documents are typically required to support the claim. These may include:

- The completed lien form.

- Proof of the debt, such as invoices or contracts.

- Any correspondence related to the debt.

- Identification of the property subject to the lien.

Filing deadlines / Important dates

Filing deadlines for liens can vary significantly by state and type of lien. It is crucial to be aware of these timelines to ensure that the lien remains enforceable. For example, some states may require liens to be filed within a certain number of days after the debt is incurred. Missing these deadlines can result in the loss of the right to enforce the lien. Therefore, keeping track of important dates is essential for anyone involved in lien processes.

Quick guide on how to complete lien

Effortlessly prepare Lien on any device

Managing documents online has gained signNow popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the correct form and securely store it digitally. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents rapidly without delays. Handle Lien on any device using airSlate SignNow's Android or iOS applications and improve any document-focused process today.

How to edit and eSign Lien effortlessly

- Obtain Lien and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your preference. Modify and eSign Lien and ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lien and how can airSlate SignNow help manage it?

A lien is a legal right or interest that a lender has in the debtor's property, until the debt obligation is satisfied. airSlate SignNow offers an efficient solution for managing lien documents by allowing businesses to create, send, and eSign lien agreements securely and quickly. This helps streamline the process, ensuring that all parties involved can access essential documents easily.

-

How does the pricing for airSlate SignNow compare for businesses dealing with lien documents?

airSlate SignNow offers flexible pricing plans tailored to the needs of businesses involving lien documentation. With competitive rates, you can choose the plan that fits your budget while benefiting from seamless eSigning capabilities that enhance the lien management process. The cost-effectiveness of our solution helps businesses save time and resources.

-

What features does airSlate SignNow provide for lien document management?

airSlate SignNow includes robust features such as customizable templates, real-time tracking, and seamless integration options for lien document management. These tools ensure that businesses can efficiently create and manage liens while maintaining compliance and security. The user-friendly interface simplifies the process, enhancing productivity.

-

Can airSlate SignNow integrate with other software for handling liens?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, such as CRM and ERP systems, to facilitate lien management. This integration allows businesses to synchronize data and streamline workflows, ensuring all processes related to liens are organized and efficient. By connecting your favorite tools, you can further enhance your lien document handling.

-

What are the benefits of using airSlate SignNow for lien agreements?

Using airSlate SignNow for lien agreements signNowly reduces turnaround time and enhances the security of your documents. The ability to eSign and track lien documents electronically helps ensure all parties are on the same page, while also minimizing the risk of human error. Additionally, the platform's convenience improves overall customer satisfaction.

-

Is airSlate SignNow secure enough for sensitive lien documents?

Absolutely, airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards for sensitive lien documents. Our platform ensures that all eSigned lien agreements are protected against unauthorized access, providing peace of mind for businesses handling confidential information. Security features help you manage lien-related risks effectively.

-

How can I get started with airSlate SignNow for managing lien documents?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features and see how the platform can streamline your lien document management. After registering, you'll have access to tools that will facilitate the creation, sending, and signing of lien documents effortlessly.

Get more for Lien

Find out other Lien

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement