Trust Benefit Form

Understanding the Trust Benefit

The trust benefit refers to the advantages provided by an irrevocable trust, which is a legal arrangement that cannot be altered or revoked once established. This type of trust allows for the transfer of assets, ensuring that they are managed according to the trustor's wishes. Beneficiaries receive benefits from the trust, which can include income generated from the trust assets or direct distributions. The trust benefit is particularly valuable for estate planning, asset protection, and tax management, as it helps to minimize estate taxes and protect assets from creditors.

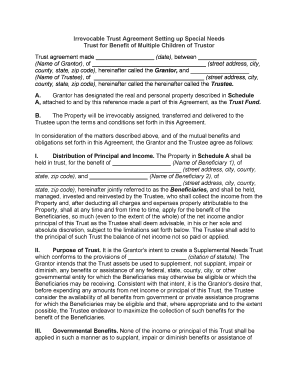

Steps to Complete the Irrevocable Trust Agreement

Completing an irrevocable trust agreement involves several important steps to ensure its validity and effectiveness. First, identify the trustor, beneficiaries, and trustee. Next, outline the assets to be included in the trust. It is essential to specify the terms and conditions under which the trust operates, including distribution guidelines and management responsibilities. After drafting the agreement, both the trustor and trustee must sign it in the presence of a notary public to ensure legal compliance. Finally, funding the trust by transferring assets into it is crucial to activate the trust benefits.

Key Elements of an Irrevocable Trust Agreement

An irrevocable trust agreement must contain several key elements to be legally binding and effective. These include:

- Trustor Information: Details about the person creating the trust.

- Trustee Designation: The individual or entity responsible for managing the trust.

- Beneficiary Designation: Names of individuals or organizations that will benefit from the trust.

- Asset Description: A detailed list of assets included in the trust.

- Distribution Terms: Guidelines on how and when beneficiaries will receive benefits.

- Governing Law: The state laws that will govern the trust.

Legal Use of the Trust Benefit

The legal use of the trust benefit is governed by state laws and regulations. An irrevocable trust must comply with the Uniform Trust Code, which outlines the rights and responsibilities of trustees and beneficiaries. This legal framework ensures that the trust operates as intended and protects the interests of all parties involved. Additionally, it is important to adhere to any specific state requirements regarding the creation and management of trusts, as these can vary significantly across the United States.

Examples of Using the Trust Benefit

There are various scenarios in which an irrevocable trust can be beneficial. For instance, families often use these trusts to protect assets from estate taxes, ensuring that more wealth is passed on to heirs. Another example is using an irrevocable trust to provide for a special needs beneficiary without jeopardizing their eligibility for government assistance. Additionally, business owners may establish irrevocable trusts to secure business assets and ensure a smooth transition of ownership upon their passing.

Required Documents for Establishing an Irrevocable Trust

To establish an irrevocable trust, several documents are typically required. These include:

- Trust Agreement: The formal document outlining the terms of the trust.

- Asset Deeds: Documentation proving ownership of the assets being transferred into the trust.

- Identification: Valid identification for all parties involved, including the trustor, trustee, and beneficiaries.

- Tax Identification Number: An Employer Identification Number (EIN) may be needed for the trust.

Quick guide on how to complete trust benefit

Effortlessly Prepare Trust Benefit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly, without delays. Manage Trust Benefit on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign Trust Benefit effortlessly

- Obtain Trust Benefit and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Highlight pertinent sections of your documents or hide sensitive data with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your method of sending the form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign Trust Benefit and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust agreement sample?

An irrevocable trust agreement sample is a legal document that outlines the terms of a trust that cannot be modified or revoked once established. This type of agreement is used to manage assets and can provide tax benefits, ensuring that assets are protected for beneficiaries. By reviewing a sample, individuals can better understand how to create their own irrevocable trust agreement.

-

How can I create an irrevocable trust agreement using airSlate SignNow?

Creating an irrevocable trust agreement with airSlate SignNow is straightforward. You can start by selecting a customizable template or uploading your own document. The platform allows you to easily fill out, sign, and send the irrevocable trust agreement sample securely, making the process efficient and convenient.

-

Is there a cost associated with using airSlate SignNow for eSigning irrevocable trust agreements?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes. Each plan provides features to eSign irrevocable trust agreement samples among other legal documents, ensuring that your needs are met without breaking the bank. You can review the pricing options on our website to find the best fit for your requirements.

-

What features does airSlate SignNow offer for managing trust agreements?

airSlate SignNow provides a suite of features tailored for managing legal documents like irrevocable trust agreements. Users can benefit from customizable templates, secure eSigning, document tracking, and integrations with popular cloud storage services, streamlining the entire process from creation to signature.

-

Can I integrate airSlate SignNow with other software for my trust agreement processes?

Absolutely, airSlate SignNow offers seamless integrations with various widely-used applications such as Google Drive, Dropbox, and CRM tools, enhancing your workflow when dealing with irrevocable trust agreement samples. This integration capability helps maintain efficiency and keeps all your documents organized in one place.

-

What are the benefits of using airSlate SignNow for trust agreements?

Using airSlate SignNow for trust agreements offers numerous benefits, including improved accuracy, speed, and security. With our platform, you can ensure that your irrevocable trust agreement sample is signed promptly and received securely, which minimizes the risk of errors or lost documents. This efficiency can save time and hassle for all parties involved.

-

Is airSlate SignNow legally compliant for eSigning trust agreements?

Yes, airSlate SignNow is fully compliant with eSignature laws such as the ESIGN Act and UETA, ensuring that your irrevocable trust agreement sample is legally binding. This compliance provides peace of mind that your electronically signed documents hold the same legal weight as traditional paper documents.

Get more for Trust Benefit

- Congratulations on passing the cpa exam form

- Corrections to derogatory credit report form

- Proposal for sole distributorship form

- Termination of lease landlord to tenant form

- Demand reimbursement of accrued vacation after termination form

- 1st ltr req for hearing not filed form

- Chapter 16 writing letters and memoswrite for business form

- Name vs form

Find out other Trust Benefit

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document

- How To Electronic signature Arkansas Banking Document

- How Do I Electronic signature California Banking Form

- How Do I eSignature Michigan Courts Document

- Can I eSignature Missouri Courts Document

- How Can I Electronic signature Delaware Banking PDF

- Can I Electronic signature Hawaii Banking Document

- Can I eSignature North Carolina Courts Presentation

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF