Il Llc Form

What is the IL LLC?

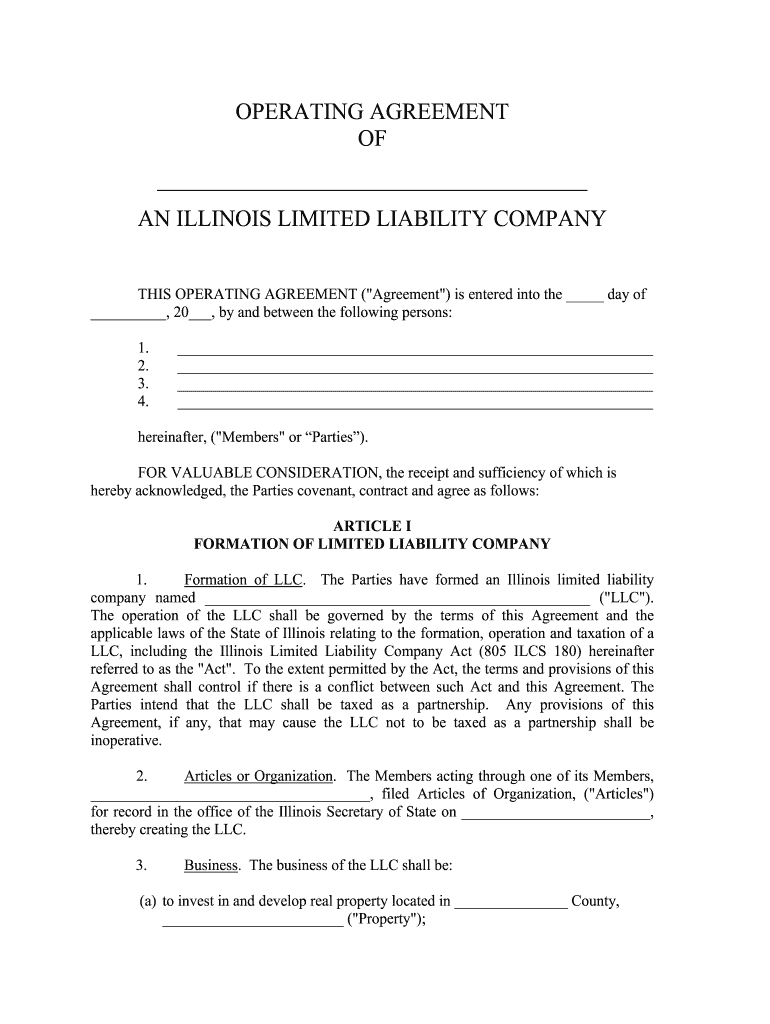

The Illinois Limited Liability Company (IL LLC) is a business structure that combines the benefits of both a corporation and a partnership. It provides personal liability protection for its owners, known as members, while allowing for flexible management and tax options. An IL LLC is recognized as a separate legal entity, meaning it can own property, enter contracts, and conduct business in its own name. This structure is particularly appealing to small business owners and entrepreneurs in Illinois, as it offers a straightforward way to protect personal assets from business liabilities.

Steps to Complete the IL LLC

Filing for an Illinois LLC involves several key steps. First, you need to choose a unique name for your LLC that complies with Illinois naming requirements. Next, you must designate a registered agent who will receive legal documents on behalf of the LLC. After that, you will file the Articles of Organization with the Illinois Secretary of State, which includes basic information about your LLC. Once your application is approved, you should create an operating agreement that outlines the management structure and operating procedures of your LLC. Finally, ensure you obtain any necessary business licenses and permits to operate legally in your area.

Legal Use of the IL LLC

Using an IL LLC legally involves adhering to state regulations and maintaining compliance with applicable laws. This includes filing annual reports, paying necessary fees, and keeping accurate records of business activities. The IL LLC must also comply with federal regulations, including tax obligations. By following these legal requirements, members can ensure that their LLC remains in good standing and continues to benefit from the liability protections it offers.

Required Documents

To form an IL LLC, several documents are necessary. The primary document is the Articles of Organization, which must be filed with the Illinois Secretary of State. This document includes essential information such as the LLC's name, address, and the name of the registered agent. Additionally, an operating agreement is recommended, although not mandatory, to outline the management structure and member responsibilities. Depending on the nature of the business, other documents may include business licenses and permits specific to the industry.

Eligibility Criteria

To establish an IL LLC, you must meet certain eligibility criteria. The members can be individuals or other business entities, and there is no limit to the number of members. However, all members must be at least eighteen years old. The chosen name for the LLC must be distinguishable from existing entities registered in Illinois and must include “Limited Liability Company” or its abbreviations. Additionally, the LLC must have a registered agent with a physical address in Illinois to receive legal documents.

IRS Guidelines

When operating an IL LLC, it is essential to understand the IRS guidelines regarding taxation. By default, single-member LLCs are treated as sole proprietorships, while multi-member LLCs are treated as partnerships for tax purposes. This means that the income and expenses of the LLC pass through to the members' personal tax returns. However, LLCs can also elect to be taxed as a corporation if desired. Understanding these guidelines helps ensure compliance with federal tax laws and optimizes tax benefits for the members.

Form Submission Methods

To submit the required documents for forming an IL LLC, you have several options. The Articles of Organization can be filed online through the Illinois Secretary of State's website, which is typically the fastest method. Alternatively, you can submit the form by mail or in person at the Secretary of State's office. Each method has its processing times and fees, so it is advisable to choose the option that best suits your needs and timeline.

Quick guide on how to complete il llc

Complete Il Llc effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to swiftly create, edit, and eSign your documents without unnecessary delays. Manage Il Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign Il Llc with ease

- Find Il Llc and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or conceal sensitive information using the special tools that airSlate SignNow offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information, then click the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form navigation, and mistakes that necessitate reprinting new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Il Llc and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the first step to have an Illinois LLC get started?

To have an Illinois LLC get started, you need to choose a unique name for your business and file the Articles of Organization with the Illinois Secretary of State. This process is crucial for legitimizing your company and allows you to operate legally in Illinois. Once these documents are filed, you can use airSlate SignNow to securely sign and send important business documents.

-

How much does it cost to form an Illinois LLC?

The cost to form an Illinois LLC includes several fees such as the filing fee for the Articles of Organization, which is currently $150. Additionally, you may have other costs depending on legal advice or additional documents needed. With airSlate SignNow, you can manage these processes efficiently, ensuring all your expenses are organized.

-

What are the benefits of creating an Illinois LLC?

Creating an Illinois LLC provides personal liability protection, which means your personal assets are shielded from business debts and lawsuits. It also offers tax flexibility, allowing you to choose how you want to be taxed. Using airSlate SignNow can further streamline the process, allowing you to focus on growing your business.

-

Can I use airSlate SignNow for managing LLC documents?

Yes, you can use airSlate SignNow for managing all your LLC documents, including the Articles of Organization and operating agreements. This platform allows you to easily eSign and track these documents electronically, making the process faster and more efficient. Thus, managing your Illinois LLC gets simpler with our solution.

-

What features does airSlate SignNow offer for LLCs?

airSlate SignNow offers features including customizable templates, secure eSignature options, and document tracking. This makes it an ideal solution for Illinois LLCs looking to streamline their document handling. Whether sending contracts or important filings, having these features enhances your operational efficiency.

-

How do I maintain my Illinois LLC after formation?

To maintain your Illinois LLC after formation, you must file annual reports and ensure compliance with state regulations. Failure to meet these requirements can lead to penalties or dissolution of your LLC. You can manage your filings and keep track of due dates efficiently with airSlate SignNow.

-

Is airSlate SignNow suitable for LLCs of all sizes?

Absolutely, airSlate SignNow is designed to accommodate LLCs of all sizes, from sole proprietorships to larger businesses. Its flexibility allows it to grow with your business needs. As your Illinois LLC gets more clients and documents, airSlate SignNow scales seamlessly to meet your document management requirements.

Get more for Il Llc

- Control number ky name 3 form

- Codepnc form

- Codeonc form

- In re change of name for form

- Kentucky fixed rate note installment payments secured commercial property form

- Chiron corp form 10 q received 08092002 160020

- The foregoing instrument was acknowledged before me this date by name of person form

- Control number ky p003 pkg form

Find out other Il Llc

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile