Illinois Lien Form

What is the Illinois Lien

The Illinois lien is a legal claim against a property that serves as security for a debt or obligation. This type of lien can arise from various circumstances, including unpaid taxes, contractor services, or other financial obligations. It allows creditors to secure their interests in a property until the debt is satisfied. In Illinois, liens can be placed on real estate, personal property, or both, depending on the nature of the obligation.

How to use the Illinois Lien

Utilizing the Illinois lien involves understanding its purpose and the process for filing it. To use this lien, a creditor must first determine the amount owed and ensure that they have the legal right to file a lien against the debtor's property. Once the necessary documentation is prepared, the lien must be filed with the appropriate county office. This process formally notifies the public of the creditor's claim and establishes their legal rights over the property.

Steps to complete the Illinois Lien

Completing the Illinois lien involves several key steps:

- Gather necessary information about the debtor and the property.

- Prepare the lien form, ensuring all required details are included.

- File the completed form with the appropriate county recorder's office.

- Pay any associated filing fees.

- Notify the debtor of the lien filing, as required by law.

Legal use of the Illinois Lien

The legal use of the Illinois lien is governed by state laws that outline the rights and responsibilities of both creditors and debtors. Creditors must follow specific procedures to ensure that their liens are valid and enforceable. This includes adhering to filing deadlines, providing proper notice to debtors, and maintaining accurate records. Failure to comply with these legal requirements can result in the lien being deemed invalid.

Key elements of the Illinois Lien

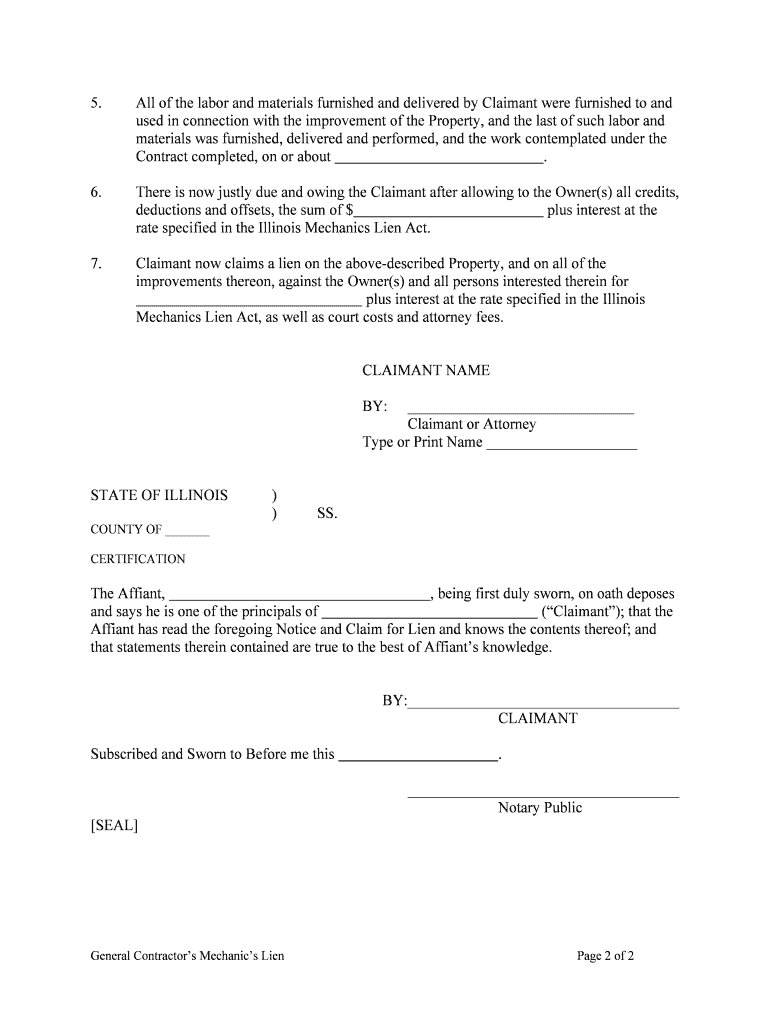

Several key elements define the Illinois lien, including:

- The name and address of the lien claimant.

- The name and address of the property owner.

- A description of the property subject to the lien.

- The amount of the debt or obligation secured by the lien.

- The date the lien was filed.

Filing Deadlines / Important Dates

Filing deadlines for the Illinois lien can vary based on the type of lien being filed. Generally, it is crucial for creditors to file their liens within specific time frames to maintain their rights. For example, mechanics liens must typically be filed within four months of the last date of service or delivery. Understanding these deadlines is essential for ensuring the enforceability of the lien.

Quick guide on how to complete illinois lien

Easily Prepare Illinois Lien on Any Device

Digital document management has become favored by businesses and individuals alike. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, as you can easily locate the right form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly and without delays. Manage Illinois Lien on any device using airSlate SignNow's Android or iOS applications and enhance your document-focused workflow today.

How to Modify and eSign Illinois Lien With Ease

- Obtain Illinois Lien and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive details using tools offered specifically for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click the Done button to finalize your modifications.

- Decide how you want to share your form—via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate the printing of additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Illinois Lien and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Illinois lien?

An Illinois lien is a legal claim against a property or asset that is typically used to secure the repayment of a debt. It ensures that the creditor has a right to the property until the obligation is fulfilled. Understanding Illinois liens is crucial for businesses dealing with property transactions.

-

How can airSlate SignNow help with processing Illinois liens?

AirSlate SignNow simplifies the process of managing Illinois liens by allowing users to easily create, send, and eSign necessary documents. This streamlines documentation workflows, saving time and reducing errors. Our platform ensures that all lien documents are securely handled and can be tracked throughout the signing process.

-

Are there specific features in SignNow for Illinois lien management?

Yes, airSlate SignNow offers specific features tailored for Illinois lien management, including customizable document templates and automated workflows. Users can set reminders for lien renewals and track signatures in real-time, ensuring all documents related to Illinois liens are processed efficiently.

-

What are the pricing options for airSlate SignNow related to Illinois lien services?

AirSlate SignNow provides flexible pricing options that cater to businesses of all sizes. Our plans include eSigning capabilities essential for managing Illinois liens at an affordable cost. You can choose a plan that suits your organizational needs while ensuring seamless lien processing.

-

Can airSlate SignNow integrate with other tools for managing Illinois liens?

Yes, airSlate SignNow integrates with various platforms and software, enhancing the management of Illinois liens. These integrations facilitate the flow of information between your systems and support better document management practices, making it easier to track and organize lien-related tasks.

-

What benefits does eSigning provide for Illinois lien documents?

eSigning offers numerous benefits for Illinois lien documents, including increased efficiency and reduced processing time. With airSlate SignNow, you can legally sign lien documents online, eliminating the need for physical signatures. This not only speeds up transactions but also increases compliance with legal requirements.

-

Is airSlate SignNow compliant with Illinois lien regulations?

Absolutely, airSlate SignNow is designed to comply with all relevant Illinois lien regulations. We keep our platform updated to align with legal requirements, helping businesses ensure that their lien documents meet state laws effectively. You can sign with confidence knowing your eSignatures are legally valid.

Get more for Illinois Lien

Find out other Illinois Lien

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors