Gift Deed Form

What is the Gift Deed

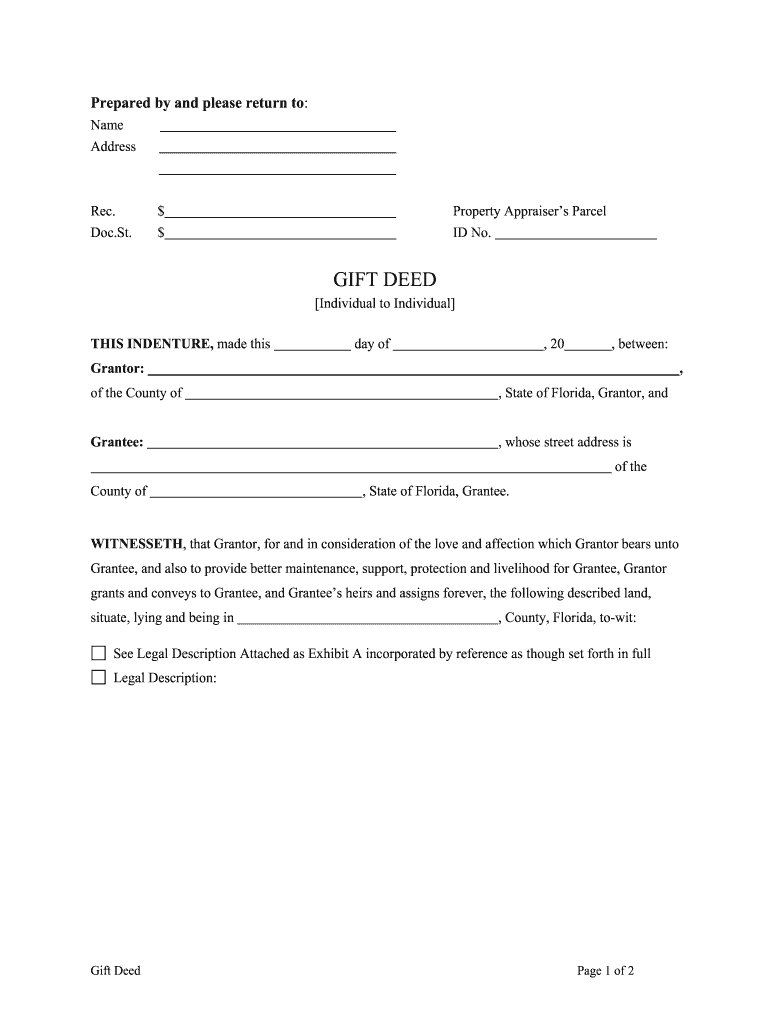

A gift deed is a legal document that facilitates the transfer of property ownership from one individual to another without any exchange of money. This document outlines the terms of the gift, ensuring that the transfer is recognized legally. It is essential for the donor (the person giving the gift) to clearly state their intention to gift the property, and for the recipient (the person receiving the gift) to accept it. The gift deed is particularly important in estate planning and can help avoid potential disputes in the future.

How to Use the Gift Deed

Using a gift deed involves several steps to ensure that the transfer of property is executed smoothly and legally. First, both parties should agree on the terms of the gift, including the property's details and any conditions attached to the transfer. Next, the gift deed must be drafted, ideally with the assistance of a legal professional to ensure compliance with state laws. Once the document is prepared, it should be signed by both the donor and the recipient in the presence of a notary public to validate the transaction. Finally, the signed gift deed should be recorded with the appropriate local government office to provide public notice of the transfer.

Key Elements of the Gift Deed

A well-structured gift deed should include several key elements to ensure its validity. These elements typically consist of:

- Donor's Information: Full name and address of the person giving the gift.

- Recipient's Information: Full name and address of the person receiving the gift.

- Description of the Property: Detailed description of the property being gifted, including its legal description.

- Intent to Gift: A clear statement indicating that the donor intends to give the property as a gift.

- Signatures: Signatures of both the donor and the recipient, along with a notary public's acknowledgment.

Steps to Complete the Gift Deed

Completing a gift deed involves several important steps to ensure that the document is legally binding. The process typically includes:

- Gather necessary information about the property and both parties.

- Draft the gift deed, including all required elements.

- Review the document for accuracy and completeness.

- Sign the deed in the presence of a notary public.

- File the signed gift deed with the appropriate local government office.

Legal Use of the Gift Deed

The legal use of a gift deed is crucial for ensuring that the property transfer is recognized by law. A properly executed gift deed can serve as proof of ownership for the recipient and can protect against claims from other parties. It is important to comply with state-specific regulations regarding gift deeds, as these can vary significantly. Additionally, the deed may need to be accompanied by other documents, such as a property tax statement or title deed, depending on local requirements.

IRS Guidelines

The Internal Revenue Service (IRS) has specific guidelines regarding gift deeds, particularly concerning tax implications. Generally, gifts exceeding a certain value may be subject to gift tax. It is essential for both the donor and recipient to understand these guidelines to avoid potential tax liabilities. Donors may need to file a gift tax return if the value of the gift exceeds the annual exclusion limit. Consulting a tax professional can provide clarity on how to navigate these regulations effectively.

Quick guide on how to complete gift deed 481370384

Effortlessly Prepare Gift Deed on Any Device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage Gift Deed on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to Modify and Electronically Sign Gift Deed with Ease

- Locate Gift Deed and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of your documents or hide sensitive data using tools specifically designed for this purpose by airSlate SignNow.

- Create your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to confirm your updates.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Gift Deed and ensure outstanding communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a gift deed format?

A gift deed format is a legal document used to transfer ownership of property or assets as a gift without any exchange of money. It outlines the details of the gift and ensures that the transfer is legally recognized. Using the right gift deed format is crucial to avoid potential disputes in the future.

-

How can airSlate SignNow help with creating a gift deed format?

airSlate SignNow offers an intuitive platform that allows users to create, edit, and finalize a gift deed format quickly and efficiently. With customizable templates and easy document sharing, you can ensure that your gift deed meets legal requirements while being user-friendly. This streamlines the process and saves you valuable time.

-

Is there a cost associated with using airSlate SignNow for the gift deed format?

Yes, airSlate SignNow offers various pricing plans to suit your needs. You can choose from affordable options that provide access to features specifically designed for crafting documents like the gift deed format. This cost-effective solution ensures you get the required functionality without breaking the bank.

-

What features does airSlate SignNow offer for managing a gift deed format?

airSlate SignNow includes features such as eSignature capabilities, document tracking, and customizable templates for a gift deed format. These features make it easy to manage your documents from start to finish, ensuring compliance and security throughout the signing process. Additionally, you can collaborate with multiple parties seamlessly.

-

Can I integrate airSlate SignNow with other tools when using the gift deed format?

Absolutely! airSlate SignNow integrates with various popular tools and software, allowing you to work efficiently while creating a gift deed format. This interoperability means you can connect with your favorite CRM, workflow management systems, or cloud storage services to streamline your business processes.

-

What are the benefits of using airSlate SignNow for a gift deed format?

Using airSlate SignNow for your gift deed format offers numerous benefits, including increased efficiency, enhanced security, and legal compliance. The platform simplifies the document management process, providing an easy way to send and sign documents. Additionally, it reduces paper waste and keeps your transactions environmentally friendly.

-

Is the gift deed format legally binding?

Yes, a gift deed format created using airSlate SignNow is legally binding, provided it complies with local laws and regulations. The platform ensures that documents created and signed are enforceable in a court of law. Always ensure that your gift deed format meets all necessary legal requirements for validity.

Get more for Gift Deed

- You are notified that default has occurred in the conditions of the following described mortgage form

- Affidavit as to federal tax liens minnesota uniform

- 2 m uniform conveyancing blanks

- Affidavit regarding military service form

- Affidavit of mailing notice of sale to persons form

- Deed tax due form

- Assignment of sheriffs certificate by business form

- Certification of redemption by sheriff minnesota form

Find out other Gift Deed

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement