Ca Husband Wife Form

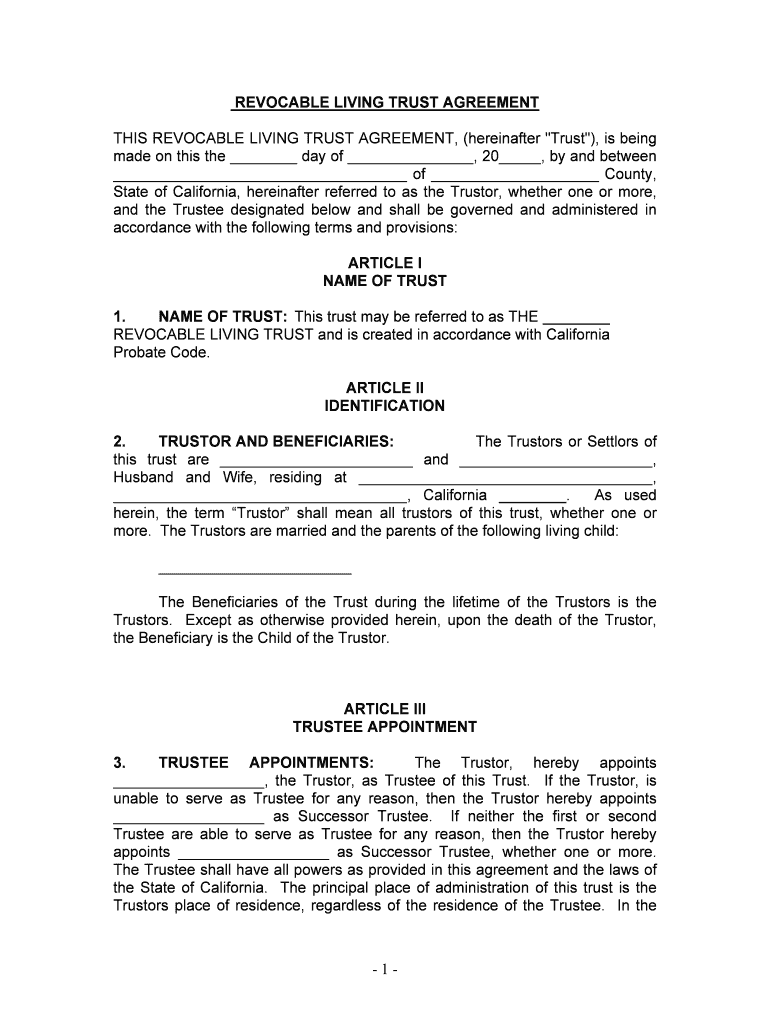

What is the California Living Trust for Husband and Wife?

A California living trust for husband and wife is a legal arrangement that allows couples to manage their assets during their lifetime and specify how those assets will be distributed after death. This type of trust is particularly beneficial for married couples as it can simplify the estate planning process, help avoid probate, and provide privacy regarding asset distribution. By establishing a living trust, both partners can retain control over their assets while ensuring that their wishes are honored, even if one spouse becomes incapacitated.

Key Elements of the California Living Trust for Husband and Wife

Several key elements define a California living trust for husband and wife:

- Grantors: Both spouses are typically the grantors, meaning they create the trust and transfer their assets into it.

- Trustee: The couple can serve as co-trustees, allowing them to manage the trust assets together. They may also designate a successor trustee to take over after their death.

- Beneficiaries: The couple can name themselves as beneficiaries during their lifetime, with provisions for other beneficiaries, such as children or charities, after their passing.

- Revocability: Most living trusts are revocable, meaning the couple can modify or dissolve the trust at any time while they are alive and competent.

Steps to Complete the California Living Trust for Husband and Wife

Completing a California living trust involves several important steps:

- Gather Information: Collect all necessary information about assets, including real estate, bank accounts, investments, and personal property.

- Choose a Trustee: Decide whether to act as co-trustees or appoint a successor trustee.

- Draft the Trust Document: Create the trust document outlining the terms, including asset distribution and management instructions. It is advisable to consult an attorney for this step to ensure compliance with California laws.

- Transfer Assets: Formally transfer ownership of the selected assets into the trust by changing titles and updating account information.

- Sign and Notarize: Both spouses must sign the trust document in the presence of a notary public to make it legally binding.

Legal Use of the California Living Trust for Husband and Wife

The legal use of a California living trust for husband and wife is recognized under California law, providing a framework for asset management and distribution. This trust can be used to:

- Designate how assets are to be managed during the couple's lifetime.

- Specify distribution of assets upon the death of one or both spouses.

- Avoid probate, which can be a lengthy and costly process.

- Maintain privacy, as trusts do not become public records like wills do.

Required Documents for the California Living Trust for Husband and Wife

To establish a California living trust, certain documents are typically required:

- Identification: Valid identification for both spouses, such as driver's licenses or passports.

- Asset Documentation: Deeds, titles, and account statements for all assets intended to be transferred into the trust.

- Trust Document: A drafted trust agreement that outlines the terms and conditions of the trust.

Examples of Using the California Living Trust for Husband and Wife

There are various scenarios where a California living trust for husband and wife can be beneficial:

- A couple wants to ensure their children inherit their home without going through probate.

- One spouse becomes incapacitated, and the other needs to manage their joint assets seamlessly.

- A couple wishes to provide for a special needs child while protecting their assets from being counted against government benefits.

Quick guide on how to complete ca husband wife

Effortlessly Prepare Ca Husband Wife on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, as you can easily locate the correct template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly and without complications. Manage Ca Husband Wife on any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused workflow today.

How to Edit and Electronically Sign Ca Husband Wife with Ease

- Find Ca Husband Wife and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and electronically sign Ca Husband Wife to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a living trust for husband and wife?

A living trust for husband and wife is a legal document that allows couples to manage their assets during their lifetime and after death. It offers a way to avoid probate and ensures that property is passed down according to the couple's wishes, providing peace of mind and control over their estate.

-

How does a living trust for husband and wife work?

A living trust for husband and wife works by transferring ownership of assets into the trust, which is managed by the couple as trustees. This arrangement allows them to maintain control over their property, while also specifying how their assets should be distributed upon their passing, simplifying the inheritance process.

-

What are the benefits of a living trust for husband and wife?

The benefits of a living trust for husband and wife include the avoidance of probate, privacy of estate matters, and the ability to manage assets if one spouse becomes incapacitated. It helps couples ensure their estate is handled efficiently and according to their specific wishes.

-

How much does creating a living trust for husband and wife cost?

Creating a living trust for husband and wife can vary in cost depending on various factors such as the complexity of the estate and legal fees. Generally, professionals may charge between $1,000 to $3,000 for the creation of a comprehensive trust, which can save money in the long run by avoiding probate costs.

-

Is a living trust for husband and wife revocable?

Yes, a living trust for husband and wife is typically revocable, meaning that either spouse can modify or dissolve the trust at any time during their lifetime. This flexibility is beneficial as it allows the couple to adapt their estate planning as their circumstances or wishes evolve.

-

Can a living trust for husband and wife include children as beneficiaries?

Absolutely, a living trust for husband and wife can include their children as beneficiaries. This ensures that the couple can clearly define how their assets should be distributed among their children, helping to prevent any potential disputes after their passing.

-

What types of assets can be included in a living trust for husband and wife?

A living trust for husband and wife can include a wide range of assets such as real estate, bank accounts, investments, and personal property. By including these assets in the trust, couples can better manage and control their estate according to their preferences.

Get more for Ca Husband Wife

- Motion for change of place of trial e forms alabama

- Sample form 49 order of probation alabama

- Sample form 10 e forms alabama administrative office

- Circuit court of county term ad 20 e forms alabama

- How to find georgia court recordscourtreferencecom form

- Rules of criminal procedure appendix of forms alabama

- Order striking matters as surplusage form

- Motion for more definite statementpdf forms

Find out other Ca Husband Wife

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed