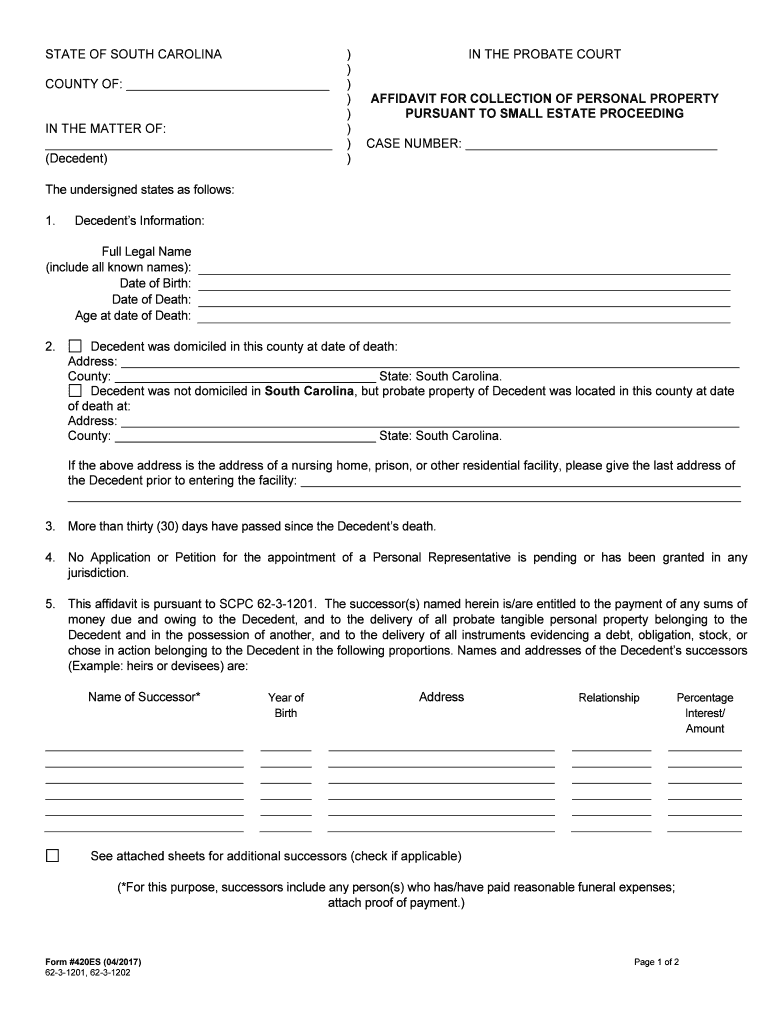

Estates Form

What is the Estates

The term "estates" refers to the legal concept of property ownership, encompassing both real estate and personal property. In the context of South Carolina, an estate can involve various types of assets, including land, homes, vehicles, and financial accounts. Understanding the nature of estates is crucial for individuals involved in estate planning, inheritance, or legal proceedings. Each estate is subject to specific laws and regulations that govern its management and distribution, particularly after the owner's passing.

How to use the Estates

Utilizing an estate effectively involves several steps, including proper documentation and adherence to legal requirements. Individuals may need to create an estate plan that outlines how their assets will be distributed upon their death. This often includes drafting wills, establishing trusts, and designating beneficiaries. In South Carolina, it is essential to ensure that all documents are legally binding and comply with state laws. Digital tools can simplify this process, allowing users to fill out and sign necessary forms electronically.

Steps to complete the Estates

Completing the estate process involves a series of methodical steps:

- Gather all relevant financial documents and asset information.

- Consult with a legal professional to understand specific state requirements.

- Create a will or trust, specifying how assets should be distributed.

- Ensure all documents are signed and witnessed according to South Carolina laws.

- File necessary forms with the appropriate court or agency.

Each step is vital to ensure that the estate is managed correctly and that the wishes of the deceased are honored.

Legal use of the Estates

The legal use of estates in South Carolina is governed by state laws that dictate how assets are managed and distributed. It is essential to comply with these regulations to avoid legal disputes and ensure that the estate is settled efficiently. This includes understanding the probate process, which is the legal procedure for validating a will and distributing assets. Utilizing electronic signatures and digital documentation can streamline this process, making it easier to meet legal requirements.

Required Documents

To manage an estate effectively, several documents are typically required:

- Last will and testament

- Trust documents, if applicable

- Death certificate

- Financial statements and asset inventories

- Tax returns for the deceased

Having these documents prepared and organized can facilitate a smoother estate administration process.

State-specific rules for the Estates

South Carolina has specific rules that govern estates, including the requirements for wills and the probate process. For instance, a will must be signed by the testator and witnessed by at least two individuals who are not beneficiaries. Additionally, South Carolina allows for simplified probate procedures for smaller estates, which can expedite the process. Understanding these state-specific rules is crucial for effective estate management.

Examples of using the Estates

Estates can be used in various scenarios, such as:

- Transferring property ownership to heirs after death.

- Establishing trusts to manage assets for minors or individuals with disabilities.

- Minimizing tax liabilities through strategic estate planning.

These examples illustrate how estates function in practical terms and highlight the importance of proper planning and documentation.

Quick guide on how to complete estates 481371163

Effortlessly prepare Estates on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without hindrance. Manage Estates on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

The easiest way to modify and electronically sign Estates with ease

- Locate Estates and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign tool, which takes only seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your method of sharing the form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from your preferred device. Edit and eSign Estates and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for estates?

airSlate SignNow offers various features that are essential for managing estates efficiently. Users can easily create, edit, and send estate documents, ensuring compliance and security. The platform also provides templates tailored for estate planning, making it user-friendly for both individuals and businesses.

-

How does airSlate SignNow support estate document management?

With airSlate SignNow, you can streamline estate document management through electronic signatures and secure cloud storage. This platform allows you to track the status of your estate documents in real-time, reducing the hassle associated with traditional paper methods. Additionally, you can collaborate with multiple parties involved in estate planning, enhancing communication.

-

What pricing options are available for estates with airSlate SignNow?

airSlate SignNow offers flexible pricing plans that cater to businesses managing estates of all sizes. From basic to advanced plans, you can choose one that fits your needs and budget. Each plan includes features that facilitate effective estate document processing, making it a cost-effective solution.

-

Can airSlate SignNow integrate with other systems for managing estates?

Yes, airSlate SignNow provides seamless integrations with various software commonly used in estate management. You can connect with tools like CRMs and document storage solutions to enhance your workflow. This interoperability allows for simplified estate document handling and increases efficiency.

-

How does using airSlate SignNow benefit estate administrators?

Using airSlate SignNow greatly benefits estate administrators by simplifying the signing and sharing process of estate documents. It provides a secure and efficient way to manage sensitive estate information while ensuring compliance with legal standards. The ease of access and tracking features help administrators stay organized and informed.

-

Is airSlate SignNow suitable for personal estate planning?

Absolutely! airSlate SignNow is designed to assist individuals in personal estate planning. The platform’s user-friendly interface allows users to create and sign estate documents from anywhere, simplifying the complicated process of estate management. This ease of use makes it ideal for anyone looking to manage their personal estates effectively.

-

How secure is airSlate SignNow for handling estate documents?

Security is a top priority for airSlate SignNow, especially when it comes to handling sensitive estate documents. The platform employs robust encryption and advanced authentication methods to protect your information. You can confidently manage your estates, knowing that your documents are safe and secure.

Get more for Estates

- See instructions on side two form

- Criteria for involuntary commitment in north carolina unc form

- Involuntary commitment unc school of government form

- Request and order for multidisciplinary evaluation sp 901mpdf form

- District court standards of judicial practice civil commitment form

- Report of foreclosure form

- State of north carolina final report and account of foreclosure form

- Name decedentwardpetitioners form

Find out other Estates

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors