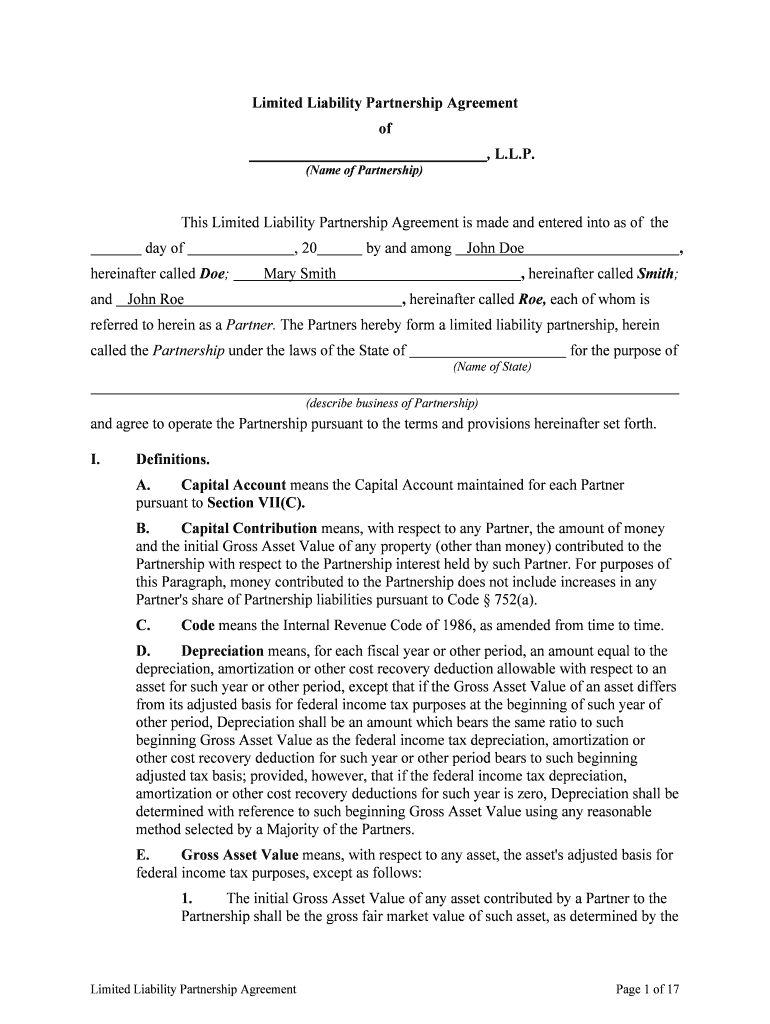

Llp Form

What is the LLP?

A Limited Liability Partnership (LLP) is a business structure that combines elements of partnerships and corporations. In an LLP, partners enjoy limited liability protection, meaning they are not personally responsible for the debts and liabilities of the partnership. This structure is particularly beneficial for professional services firms, such as law or accounting practices, where partners want to protect their personal assets while maintaining operational flexibility.

Key elements of the LLP

Several key elements define an LLP, including:

- Limited liability: Partners are shielded from personal liability for the partnership's debts, protecting their individual assets.

- Flexibility: LLPs allow for flexible management structures, enabling partners to define their roles and responsibilities.

- Taxation: LLPs typically benefit from pass-through taxation, meaning profits and losses are reported on partners' individual tax returns, avoiding double taxation.

- Formal agreement: An LLP requires a written partnership agreement that outlines the terms of the partnership, including profit sharing and decision-making processes.

How to obtain the LLP

To establish an LLP, business owners must follow several steps, which may vary by state. Generally, the process includes:

- Choosing a name: The name must comply with state regulations and include "Limited Liability Partnership" or an abbreviation.

- Filing paperwork: Submit the necessary formation documents, often called a Certificate of Limited Liability Partnership, to the appropriate state agency.

- Creating a partnership agreement: Draft a comprehensive agreement that outlines the roles, responsibilities, and financial arrangements among partners.

- Obtaining necessary licenses: Depending on the business type, partners may need to secure specific licenses or permits.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for LLPs regarding taxation and reporting. LLPs are generally treated as pass-through entities, meaning the income is reported on the partners' individual tax returns. Each partner must report their share of the LLP's income, deductions, and credits. Additionally, LLPs must file Form 1065, U.S. Return of Partnership Income, to report the partnership's financial activity.

State-specific rules for the LLP

Each state has its own regulations governing the formation and operation of LLPs. This includes specific filing requirements, fees, and ongoing compliance obligations. Some states may also have unique rules regarding the types of businesses that can operate as LLPs. It is essential for business owners to consult their state's Secretary of State website or a legal professional to understand the specific requirements applicable to their LLP.

Examples of using the LLP

LLPs are commonly used in various professional fields, including:

- Law firms: Many law practices operate as LLPs to protect partners from liability related to the actions of other partners.

- Accounting firms: Accountants often choose the LLP structure to limit personal liability while benefiting from flexible management.

- Consulting firms: LLPs provide a suitable structure for consulting businesses, allowing partners to collaborate while safeguarding their assets.

Quick guide on how to complete llp

Complete Llp effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It presents an ideal environmentally-friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage Llp on any device with airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

How to modify and eSign Llp effortlessly

- Locate Llp and then click Get Form to begin.

- Utilize the tools provided to complete your document.

- Highlight signNow sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal standing as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to send your form—via email, SMS, or an invitation link—or download it to your computer.

Eliminate the issues of lost or misplaced files, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Llp and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the primary difference between LLP and LLC?

The difference between LLP and LLC primarily lies in the liability protection they offer. An LLP or Limited Liability Partnership provides limited liability to its partners, while an LLC or Limited Liability Company protects its owners from personal liability for business debts. Both structures offer unique benefits, depending on the business's needs.

-

How do I choose between an LLC and an LLP?

Choosing between an LLC and LLP depends on various factors like the number of owners and the desired management structure. The difference between LLP and LLC is crucial: if you want to protect personal assets from business liabilities, an LLC might be best. However, if your business involves multiple partners who want to actively manage the business, an LLP could be more suitable.

-

What are the cost implications of forming an LLC vs an LLP?

The costs associated with forming an LLC or LLP can vary widely by state and by the complexity of your business. Generally, the difference between LLP and LLC also extends to formation and maintenance fees, which may be higher for LLPs due to the need for extensive partnership agreements. It's important to evaluate both options in terms of initial setup costs and ongoing compliance requirements.

-

Can I convert my LLP to an LLC or vice versa?

Yes, you can convert between an LLP and an LLC, but the process requires following state regulations and procedures. The difference between LLP and LLC structures necessitates careful planning because it involves legal and tax implications. Consulting with a legal expert can help streamline this process.

-

What are the tax implications of an LLC compared to an LLP?

The tax implications differ signNowly between an LLC and an LLP. An LLC offers pass-through taxation, potentially leading to lower overall taxes, while an LLP also allows for pass-through taxation but partners can be self-employed. Understanding the difference between LLP and LLC from a tax perspective is essential in making an informed decision.

-

What features should I look for in an eSignature solution for my LLC or LLP?

When choosing an eSignature solution for your LLC or LLP, look for features that enhance document security, compliance, and user-friendliness. The difference between LLP and LLC often influences business operations, and using a reliable eSignature platform like airSlate SignNow can streamline document management for either business type.

-

Does airSlate SignNow support integrations with accounting software for LLCs and LLPs?

Yes, airSlate SignNow offers integrations with various accounting software, making it easier for both LLCs and LLPs to manage their financial documentation efficiently. The difference between LLP and LLC roles within your business can shape how you utilize these integrations. Integrating your eSignature solution can enhance workflow and productivity.

Get more for Llp

- Applicants signature below form

- Stated deadline as landlord i may form

- Tenant has reviewed this document and agrees that in consideration of the use and possession of form

- Describes how your home should be left and what our procedures are for returning your security form

- Additions to the property above the cost of shall be made only with the prior form

- Request is made under the terms of my lease agreement andor form

- Of rent payments by the lessee under the lease agreement between form

- Or the behavior of persons on your leased premises form

Find out other Llp

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile