Charitable Trust Template Form

What is the Charitable Trust Template

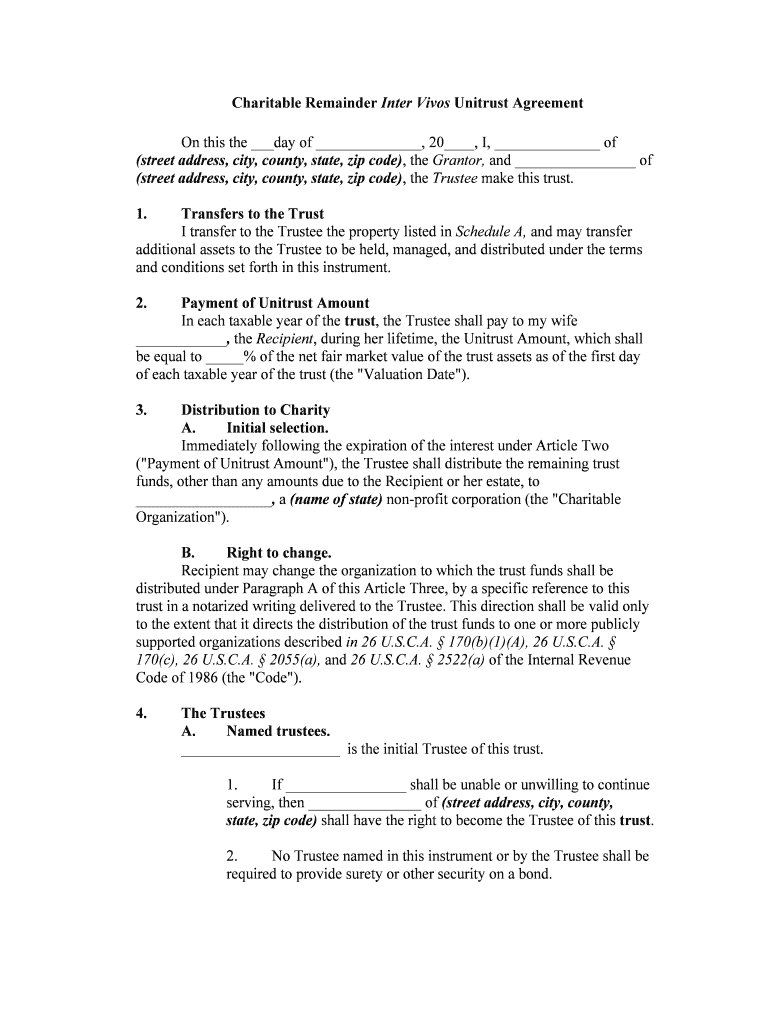

The charitable trust template is a legal document used to establish a charitable trust, allowing individuals or organizations to donate assets for charitable purposes while benefiting from potential tax advantages. This template outlines the specific terms and conditions of the trust, including the beneficiaries, the appointed trustee, and the management of the trust assets. It serves as a foundational document that ensures compliance with applicable laws and regulations governing charitable trusts in the United States.

Key Elements of the Charitable Trust Template

A well-structured charitable trust template includes several critical components:

- Trust Name: The official name of the charitable trust.

- Grantor Information: Details about the individual or entity establishing the trust.

- Trustee Designation: Identification of the trustee responsible for managing the trust assets.

- Beneficiary Designation: Specification of the charitable organizations or causes that will benefit from the trust.

- Asset Management Guidelines: Instructions for how the trust assets should be managed and distributed.

- Termination Clause: Conditions under which the trust may be dissolved.

Steps to Complete the Charitable Trust Template

Completing the charitable trust template involves several important steps:

- Gather Necessary Information: Collect all relevant details about the grantor, trustee, and beneficiaries.

- Fill Out the Template: Carefully input the gathered information into the template, ensuring accuracy.

- Review Legal Requirements: Verify that the template complies with state-specific regulations regarding charitable trusts.

- Obtain Signatures: Ensure that all required parties, including the grantor and trustee, sign the document.

- File the Document: Submit the completed template to the appropriate state authority, if required.

Legal Use of the Charitable Trust Template

The charitable trust template must adhere to specific legal standards to be considered valid. This includes compliance with both federal and state laws governing charitable organizations. The document should clearly outline the purpose of the trust, the designated beneficiaries, and the powers granted to the trustee. It is advisable to consult with a legal professional to ensure that the template meets all legal requirements and effectively protects the interests of all parties involved.

IRS Guidelines

The Internal Revenue Service (IRS) provides guidelines for charitable trusts, particularly regarding tax deductions and compliance. To qualify for tax-exempt status, the charitable trust must meet specific criteria, including the requirement that its assets are used exclusively for charitable purposes. The IRS also mandates that the trust must file annual returns, such as Form 990, to report its financial activities. Understanding these guidelines is crucial for maintaining compliance and maximizing the potential tax benefits associated with charitable giving.

Eligibility Criteria

To establish a charitable trust, certain eligibility criteria must be met. Typically, the grantor must be an individual or entity with the legal capacity to create a trust. Additionally, the trust must have a clearly defined charitable purpose, which aligns with IRS regulations. The beneficiaries must be recognized charitable organizations or causes that qualify under Section 501(c)(3) of the Internal Revenue Code. Ensuring that these criteria are met is essential for the trust to function effectively and maintain its tax-exempt status.

Quick guide on how to complete charitable trust template

Complete Charitable Trust Template seamlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as a superb eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents promptly without delays. Handle Charitable Trust Template on any platform using airSlate SignNow's Android or iOS applications and simplify your document-related processes today.

How to modify and eSign Charitable Trust Template with ease

- Find Charitable Trust Template and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically provides for this function.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to submit your form: via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements with just a few clicks from your preferred device. Modify and eSign Charitable Trust Template and ensure outstanding communication at any point in your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable unitrust form?

A charitable unitrust form is a legal document that allows individuals to create a charitable remainder unitrust. This trust enables donors to receive income from their assets while ultimately benefiting a charity. Using airSlate SignNow, you can easily create and manage your charitable unitrust form digitally, ensuring efficiency and compliance.

-

How do I create a charitable unitrust form using airSlate SignNow?

Creating a charitable unitrust form with airSlate SignNow is simple. You start by choosing a template or uploading your own document, then customize it as needed. Our platform streamlines the signing process, allowing you to send your form to all parties for eSignature, making it quick and hassle-free.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different user needs. Each plan includes features for creating, sending, and signing documents like the charitable unitrust form. You can explore our website for detailed pricing information and choose the plan that best fits your requirements.

-

What features are included in the airSlate SignNow platform for charitable unitrust forms?

Our platform includes several features specifically designed for your charitable unitrust form, such as customizable templates, workflow automation, and real-time tracking. You can also utilize bulk sending options and integration with other applications to streamline your charitable giving process.

-

Can I integrate airSlate SignNow with other software for managing charitable unitrust forms?

Yes, airSlate SignNow offers seamless integrations with various software applications. This allows you to manage your charitable unitrust form alongside tools you already use, such as CRM systems and marketing platforms. Our integrations enhance your workflow and improve productivity.

-

What are the benefits of using airSlate SignNow for a charitable unitrust form?

Using airSlate SignNow for your charitable unitrust form provides several benefits including increased efficiency, legal compliance, and enhanced security. The platform allows you to manage all your documents in one place, simplifying the signing process. This results in faster transactions and a more streamlined charitable giving experience.

-

Is airSlate SignNow secure for handling charitable unitrust forms?

Absolutely! airSlate SignNow employs top-grade security measures to protect your charitable unitrust forms and personal data. Our platform is compliant with industry standards, ensuring that all your documents are secure during the signing process and beyond.

Get more for Charitable Trust Template

- Motion 3106 form

- How to file a claim in small claims court form

- Special civil 9104 form

- Wage execution form

- Supporting statement for sba form 1149 reginfogov

- How to use this online this form can be filled out on your

- Please start by downloading a blank complaint form from www

- Request for admission of facts justanswer form

Find out other Charitable Trust Template

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement