Form it 209 Claim for Noncustodial Parent New York State Earned Income Credit Tax Year 2024

What is the Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

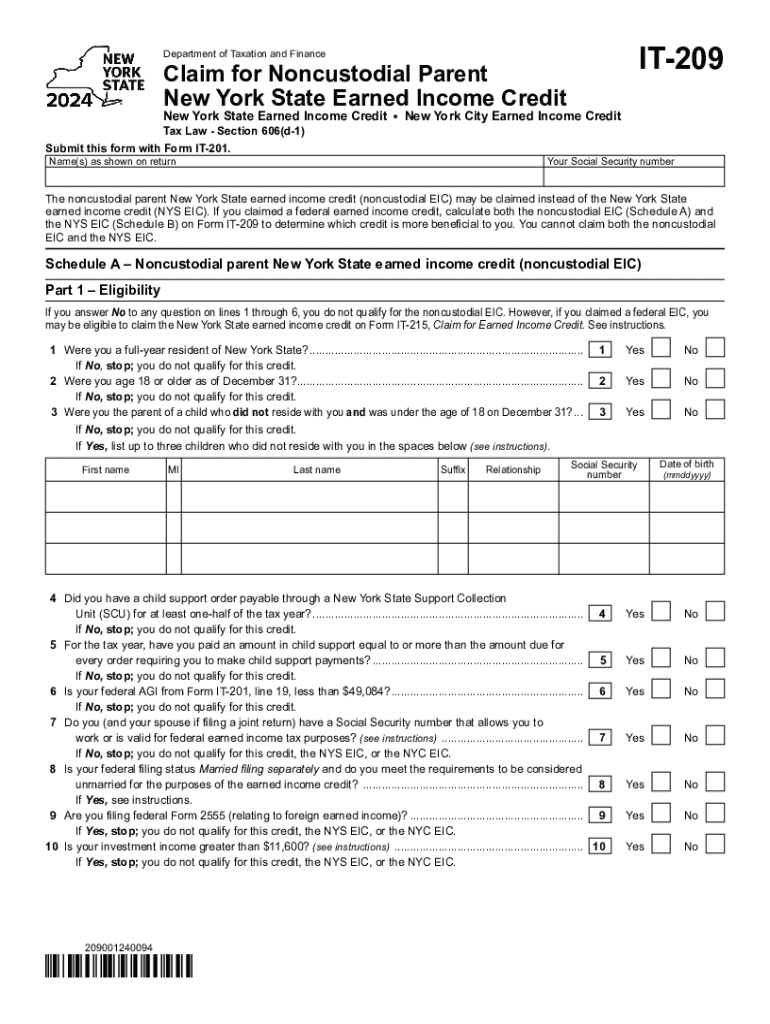

The Form IT 209 is a tax form used by noncustodial parents in New York State to claim the Earned Income Credit (EIC) for the tax year. This credit is designed to reduce the tax burden on eligible taxpayers who have qualifying children. Noncustodial parents can utilize this form to receive a financial benefit, as it allows them to claim a portion of the credit that would otherwise be unavailable to them due to their custodial status. The form is essential for ensuring that noncustodial parents can access the financial support intended for families with children.

How to use the Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

To effectively use the Form IT 209, noncustodial parents must first determine their eligibility based on income and family size. The form requires the taxpayer to provide personal information, including their Social Security number and details about their child or children. After filling out the necessary sections, the form must be submitted along with the primary tax return. It is crucial to ensure that all information is accurate and complete to avoid delays in processing the claim.

Steps to complete the Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

Completing the Form IT 209 involves several key steps:

- Gather necessary documents, including income statements and proof of child residency.

- Fill out the personal information section, ensuring accuracy in names and Social Security numbers.

- Provide details about the qualifying child or children, including their names and dates of birth.

- Calculate the Earned Income Credit based on the provided income and family size.

- Review the completed form for any errors or omissions.

- Submit the form along with your New York State tax return, either electronically or by mail.

Eligibility Criteria

To qualify for the Earned Income Credit using the Form IT 209, noncustodial parents must meet specific eligibility criteria. These include having a valid Social Security number, meeting income limits set by the state, and having a qualifying child who meets age and residency requirements. Additionally, the child must have lived with the noncustodial parent for more than half of the tax year. Understanding these criteria is vital for successful claims.

Required Documents

When completing the Form IT 209, noncustodial parents need to prepare several documents to support their claim. Essential documents include:

- Proof of income, such as W-2 forms or 1099 forms.

- Documentation of the child's residency, which may include school records or medical documents.

- Identification documents, such as a driver's license or state ID.

Having these documents ready can streamline the completion process and ensure compliance with state requirements.

Form Submission Methods

The Form IT 209 can be submitted in various ways, depending on the taxpayer's preference. Options include:

- Online submission through approved e-filing services, which can expedite processing.

- Mailing the completed form along with the tax return to the appropriate address specified by the New York State Department of Taxation and Finance.

- In-person submission at designated tax offices, though this option may be limited due to location and availability.

Choosing the right submission method can impact the speed and efficiency of the claim process.

Create this form in 5 minutes or less

Find and fill out the correct form it 209 claim for noncustodial parent new york state earned income credit tax year 770657631

Create this form in 5 minutes!

How to create an eSignature for the form it 209 claim for noncustodial parent new york state earned income credit tax year 770657631

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IT 209 form and why is it important?

The IT 209 form is a tax document used for reporting income and calculating tax liabilities. It is important for individuals and businesses to accurately complete this form to ensure compliance with tax regulations and avoid penalties.

-

How can airSlate SignNow help with the IT 209 form?

airSlate SignNow simplifies the process of completing and signing the IT 209 form by providing an easy-to-use platform for electronic signatures. This ensures that your documents are signed quickly and securely, streamlining your tax filing process.

-

Is there a cost associated with using airSlate SignNow for the IT 209 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to features that facilitate the signing and management of documents, including the IT 209 form, at a cost-effective rate.

-

What features does airSlate SignNow offer for managing the IT 209 form?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage for managing the IT 209 form. These features enhance efficiency and ensure that your documents are organized and easily accessible.

-

Can I integrate airSlate SignNow with other software for the IT 209 form?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the IT 209 form alongside your existing tools. This integration helps streamline workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for the IT 209 form?

Using airSlate SignNow for the IT 209 form offers numerous benefits, including faster turnaround times, reduced paperwork, and enhanced security. This solution empowers businesses to focus on their core activities while ensuring compliance with tax requirements.

-

Is airSlate SignNow secure for handling the IT 209 form?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure access controls, to protect your data when handling the IT 209 form. You can trust that your sensitive information is safe and secure.

Get more for Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

Find out other Form IT 209 Claim For Noncustodial Parent New York State Earned Income Credit Tax Year

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors