Garnishment Employer Form

Understanding the Garnishment Employer

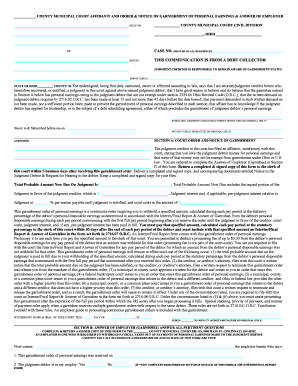

The garnishment employer is an entity that receives court orders to withhold a portion of an employee's earnings to satisfy a debt. This process is often initiated through legal proceedings, such as those outlined in Ohio civil procedure. Employers are required to comply with these orders and must ensure that the correct amount is withheld from the employee's paycheck. Understanding the role of the garnishment employer is crucial for both employers and employees, as it directly impacts financial stability and legal compliance.

Steps to Complete the Garnishment Employer

Completing the garnishment employer process involves several key steps. First, employers must receive the garnishment order, which specifies the amount to be withheld and the duration of the garnishment. Next, the employer should verify the employee's information to ensure accuracy. After confirming the details, the employer must implement the withholding from the employee's paycheck according to the specified guidelines. Finally, the employer is responsible for submitting the withheld amounts to the appropriate agency or creditor.

Legal Use of the Garnishment Employer

The legal use of the garnishment employer is governed by various laws and regulations, including those specific to Ohio civil procedure. Employers must adhere to these laws to avoid penalties and ensure that the garnishment process is executed correctly. This includes understanding the limits on the amount that can be garnished, as well as the rights of the employee. Employers should also be aware of any exemptions that may apply, such as those related to child support or bankruptcy.

Required Documents for Garnishment

To initiate the garnishment process, specific documents are required. These typically include the garnishment order issued by the court, which outlines the terms of the garnishment. Employers may also need to gather documentation related to the employee's earnings, such as pay stubs or wage statements. It is essential to keep accurate records of these documents to ensure compliance with legal requirements and to address any potential disputes that may arise.

Filing Deadlines and Important Dates

Filing deadlines and important dates are critical for the successful execution of the garnishment process. Employers must be aware of the timeframes for responding to garnishment orders and the deadlines for submitting withheld amounts. In Ohio, these deadlines are often specified in the garnishment order itself. Failure to adhere to these timelines can result in legal consequences for the employer, including potential penalties or additional liabilities.

State-Specific Rules for Garnishment

Each state, including Ohio, has specific rules governing the garnishment process. These rules dictate the maximum amount that can be garnished from an employee's wages, the procedures for notifying employees, and the timelines for compliance. Employers must familiarize themselves with these state-specific regulations to ensure they are acting within the law. Understanding these rules is essential to avoid legal complications and to protect the rights of employees.

Quick guide on how to complete garnishment employer

Complete Garnishment Employer effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers a superb eco-friendly substitute to conventional printed and signed documents, as you can acquire the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to generate, modify, and eSign your documents quickly without delays. Manage Garnishment Employer on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Garnishment Employer with ease

- Find Garnishment Employer and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of missing or lost documents, tedious searches for forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Garnishment Employer and maintain excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Ohio civil procedure and how does it relate to e-signing documents?

Ohio civil procedure encompasses the rules and processes governing civil legal cases in Ohio. Using airSlate SignNow, you can streamline the e-signing of documents while ensuring compliance with Ohio civil procedure, thus enhancing the efficiency of legal processes.

-

What features does airSlate SignNow offer for Ohio civil procedure?

airSlate SignNow provides features like customizable templates, automated workflows, and secure document storage, which are essential for managing legal documents under Ohio civil procedure. These features help you maintain compliance and ensure a smooth signing experience.

-

Is airSlate SignNow cost-effective for managing documents related to Ohio civil procedure?

Yes, airSlate SignNow is a cost-effective solution for managing documents related to Ohio civil procedure. Our pricing plans are designed to fit various budgets, ensuring that all businesses can access the tools they need for efficient e-signing and document management.

-

How does airSlate SignNow ensure compliance with Ohio civil procedure?

airSlate SignNow complies with Ohio civil procedure by employing advanced security protocols and providing users with features that align with state regulations. This ensures that your electronically signed documents hold legal weight and are recognized in Ohio courts.

-

Can I integrate airSlate SignNow with other tools I use for Ohio civil procedure?

Absolutely! airSlate SignNow offers seamless integrations with popular tools that are frequently used in Ohio civil procedure. This makes it easy to incorporate e-signatures into your existing workflows while enhancing productivity.

-

What benefits can I expect when using airSlate SignNow for Ohio civil procedure?

When using airSlate SignNow for Ohio civil procedure, you can expect increased efficiency, reduced turnaround times for document signing, and improved collaboration. These benefits ultimately lead to a smoother legal process and enhance your overall productivity.

-

How user-friendly is airSlate SignNow for those unfamiliar with Ohio civil procedure?

airSlate SignNow is designed to be intuitive and user-friendly, even for those unfamiliar with Ohio civil procedure. Our platform includes helpful resources and tutorials, making it easy for anyone to start sending and signing documents effortlessly.

Get more for Garnishment Employer

Find out other Garnishment Employer

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors