Llc Limited Liability Companies Form

Understanding LLCs and Their Members

Limited Liability Companies (LLCs) are a popular business structure in the United States, combining the flexibility of a partnership with the liability protection of a corporation. LLC members are the owners of the company, and they can be individuals, corporations, or other LLCs. Each member's liability is typically limited to their investment in the company, protecting personal assets from business debts and lawsuits.

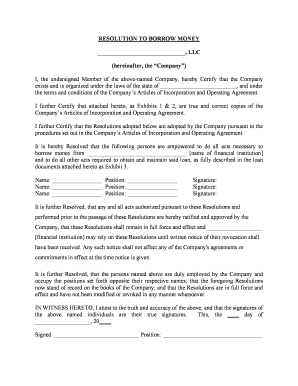

Key Elements of an LLC Resolution

An LLC resolution is a formal document that records decisions made by the members of the LLC. It is essential for documenting important actions such as the appointment of officers, approval of new members, or significant financial decisions. Key elements of an LLC resolution include:

- Date of the meeting or decision

- Names of the members present

- Details of the decision made

- Signatures of the members for verification

Steps to Complete an LLC Resolution

Completing an LLC resolution involves several straightforward steps. First, gather all members for a meeting to discuss the proposed resolution. Next, draft the resolution, ensuring it includes all necessary details such as the decision being made and the date. After drafting, present the resolution for discussion and vote among members. Once approved, ensure all members sign the document to formalize the decision.

Legal Use of LLC Resolutions

LLC resolutions hold legal significance as they provide evidence of the decisions made by the members. They are often required by banks and other financial institutions when opening accounts or applying for loans. Additionally, maintaining proper records of LLC resolutions can help protect the limited liability status of the company by demonstrating that it operates as a separate legal entity.

Examples of LLC Resolutions

Examples of common LLC resolutions include:

- Approval of a new member joining the LLC

- Authorization to borrow money or enter into contracts

- Appointment of officers or managers

- Approval of major expenditures or investments

State-Specific Rules for LLC Resolutions

Each state in the U.S. may have specific rules regarding the formation and operation of LLCs, including requirements for resolutions. It is essential for LLC members to familiarize themselves with their state's laws to ensure compliance. Some states may require resolutions to be filed with the Secretary of State or may have specific language that must be included in the resolutions.

Quick guide on how to complete llc limited liability companies

Complete Llc Limited Liability Companies effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documentation, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without delays. Manage Llc Limited Liability Companies on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

The easiest way to modify and eSign Llc Limited Liability Companies with ease

- Find Llc Limited Liability Companies and click Get Form to initiate the process.

- Utilize the tools available to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Llc Limited Liability Companies and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the benefits of using airSlate SignNow for resolution LLC members?

airSlate SignNow provides resolution LLC members with a streamlined process for sending and signing documents electronically. This not only saves time but also enhances productivity by reducing paperwork. The solution is user-friendly, making it accessible for all LLC members, regardless of technical expertise.

-

How does airSlate SignNow ensure the security of documents for resolution LLC members?

airSlate SignNow prioritizes the security of documents for resolution LLC members by implementing robust encryption protocols. This ensures that all signed documents are secure and compliant with legal requirements. Furthermore, users can access audit trails and logs to monitor document activity.

-

What integrations does airSlate SignNow offer for resolution LLC members?

For resolution LLC members, airSlate SignNow integrates with popular tools such as Google Drive, Dropbox, and Microsoft Office. This allows members to seamlessly manage their documents across platforms. The integration enhances collaboration and efficiency within the LLC.

-

Is there a free trial available for resolution LLC members?

Yes, airSlate SignNow offers a free trial for resolution LLC members to explore its features. This enables members to evaluate the platform's effectiveness before committing to a subscription. The trial period offers full access to all functionalities, helping LLC members make informed decisions.

-

What pricing plans are available for resolution LLC members?

airSlate SignNow offers flexible pricing plans tailored for resolution LLC members to suit different business needs. Plans are competitively priced and provide value with essential features. Members can choose a plan that aligns with their document management needs and budget.

-

Can resolution LLC members customize templates in airSlate SignNow?

Absolutely! Resolution LLC members can create and customize templates in airSlate SignNow to streamline their document processes. This feature allows members to save time on repetitive tasks and ensures consistency across all documents. Customized templates enhance workflow efficiency.

-

How can resolution LLC members track document status in airSlate SignNow?

Resolution LLC members can easily track the status of their documents in airSlate SignNow through a user-friendly dashboard. The platform provides real-time updates on who has signed and who needs to take action. This transparency helps members stay organized and on top of their document management.

Get more for Llc Limited Liability Companies

- An independent contractor for all purposes arising under this agreement and the use of the form

- Fillable online claim for compensation missouri department form

- Insert lessee or lessor as appropriate is responsible for making any and all form

- Its receipt of such invoice or statement which shall be presumed to have been received on or before the fifteenth 15th day of form

- 3 state the full name and current residence address of each person form

- 2 above who was present andor claims to have been present at the form

- Pre 14a 1 a09 00018ppre14ahtm form pre 14a table of

- Contact us missouri department of labor mogov form

Find out other Llc Limited Liability Companies

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure