Deed Tod Form

What is the Deed Tod

The Deed of Transfer on Death (TOD) is a legal document that allows property owners to designate beneficiaries who will receive their real estate upon their death, without the need for probate. This instrument is particularly useful for individuals looking to simplify the transfer of their assets and ensure that their property is passed directly to their chosen heirs. By using a TOD, property owners can maintain control over their assets during their lifetime, while also providing a clear path for the transfer of ownership after their passing.

Steps to complete the Deed Tod

Completing a Deed of Transfer on Death involves several important steps to ensure its validity and effectiveness. Here are the key steps:

- Gather necessary information: Collect details about the property, including the legal description and the names of the beneficiaries.

- Draft the deed: Use a standard form or template for the Deed Tod, ensuring it complies with state laws.

- Sign the deed: The property owner must sign the deed in the presence of a notary public to validate it.

- File the deed: Submit the completed deed with the appropriate county office where the property is located. This step is crucial for the deed to be effective.

Legal use of the Deed Tod

The legal use of a Deed of Transfer on Death is governed by state laws, which vary across the United States. Generally, the TOD allows property owners to transfer real estate without going through probate, making the process simpler and more efficient for beneficiaries. It is essential to ensure that the deed is executed correctly and filed with the appropriate authorities to avoid any legal complications. Additionally, property owners should be aware of any state-specific requirements that may affect the validity of the deed.

Key elements of the Deed Tod

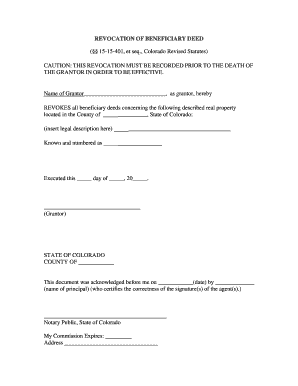

A valid Deed of Transfer on Death must include several key elements to ensure it is legally binding:

- Property description: A clear and accurate description of the property being transferred.

- Beneficiary information: The full names and addresses of the beneficiaries who will receive the property.

- Signature of the grantor: The property owner must sign the deed to indicate their intent.

- Notarization: The signature must be notarized to confirm the identity of the grantor and the authenticity of the document.

How to obtain the Deed Tod

Obtaining a Deed of Transfer on Death can be done through several avenues. Many states provide templates or forms online that can be downloaded and filled out. Additionally, legal professionals can assist in drafting a customized deed that meets specific needs and complies with state laws. It is advisable to consult with an attorney to ensure that all legal requirements are met and that the deed accurately reflects the property owner's wishes.

State-specific rules for the Deed Tod

Each state in the U.S. has its own regulations regarding the use of a Deed of Transfer on Death. Some states may have specific forms that must be used, while others may have particular requirements for notarization or filing. It is crucial for property owners to familiarize themselves with their state's laws to ensure the deed is valid and enforceable. Consulting state-specific resources or legal professionals can provide clarity on these regulations.

Quick guide on how to complete deed tod

Effortlessly Prepare Deed Tod on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Deed Tod on any device using the airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

How to Edit and eSign Deed Tod with Ease

- Locate Deed Tod and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal value as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, slow form searching, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Deed Tod and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What services does airSlate SignNow offer for transfer death documentation?

airSlate SignNow provides a seamless platform to electronically sign and manage documents related to transfer death issues. With our user-friendly interface, you can easily upload, sign, and send essential documents, ensuring a smooth transfer of assets and responsibilities after death.

-

How can airSlate SignNow simplify the transfer death process?

Using airSlate SignNow simplifies the transfer death process by allowing users to eSign and share crucial documents without the need for physical in-person meetings. This not only speeds up the process but also enhances convenience for all parties involved.

-

Is there a cost associated with using airSlate SignNow for transfer death forms?

Yes, there is a competitive pricing structure for airSlate SignNow, which offers various plans to fit different needs. Our cost-effective solution enables users to efficiently manage transfer death documentation while ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for efficient transfer death management?

airSlate SignNow includes features such as customizable templates for transfer death forms, advanced security options, and real-time tracking of document statuses. These tools are designed to make document management easier and ensure compliance during the transfer death process.

-

Can I integrate airSlate SignNow with other applications for transfer death management?

Absolutely! airSlate SignNow offers integration capabilities with various third-party applications, making it easier to manage all aspects of transfer death documentation. This allows you to streamline your workflows and keep your team aligned with real-time updates.

-

How secure is airSlate SignNow when dealing with sensitive transfer death documents?

Security is a top priority at airSlate SignNow. We implement industry-standard encryption protocols to protect sensitive transfer death documents, ensuring that your data remains confidential and secure throughout the signing process.

-

Can airSlate SignNow help speed up the transfer death process?

Yes, airSlate SignNow is designed to expedite the transfer death process by eliminating the need for paperwork and facilitating instant eSignatures. This efficiency can signNowly reduce the time required to complete important documentation, allowing for quicker resolution.

Get more for Deed Tod

- Customer follow up product sales form

- Records and our discussions form

- Agreement for consulting and training services sagent form

- Clients the end is near journal of accountancy form

- Professional resignation letter example the balance careers form

- Assignment of copyright to multiple works pursuant form

- Preamble agreement dated between form

- How to start a 501c3 nonprofit ministrylegalzoom legal info form

Find out other Deed Tod

- How To eSign West Virginia Termination Letter Template

- How To eSign Pennsylvania Independent Contractor Agreement Template

- eSignature Arkansas Affidavit of Heirship Secure

- How Can I eSign Alaska Emergency Contact Form

- Can I eSign Montana Employee Incident Report

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online