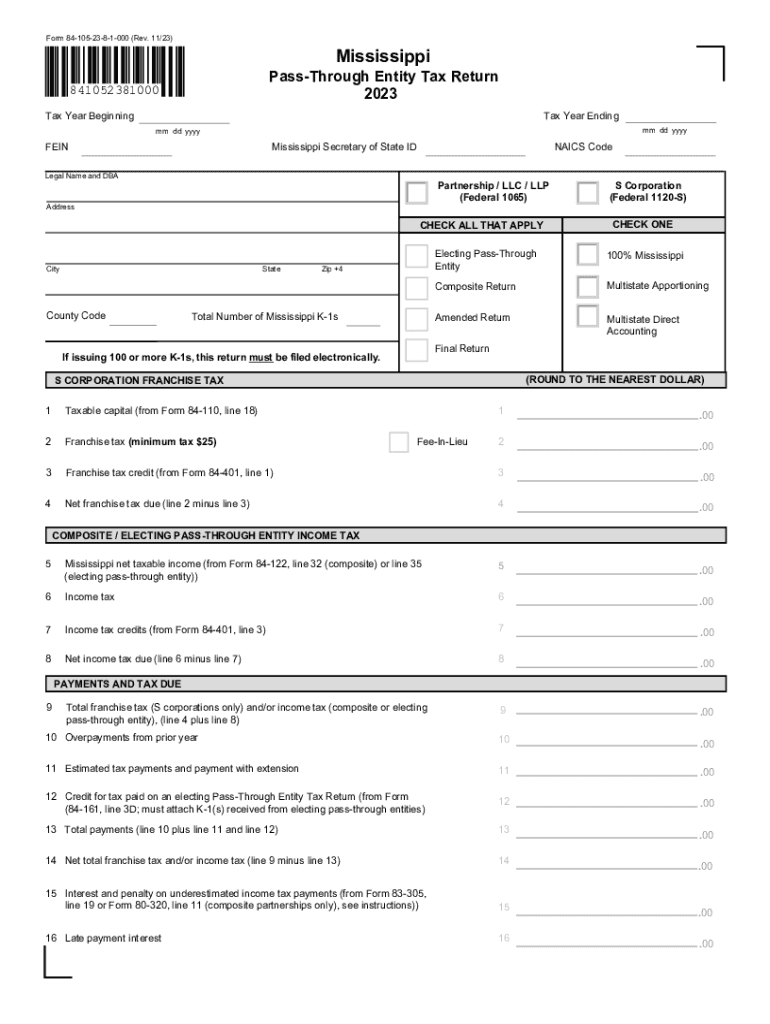

Form 84 105 Mississippi Department of Revenue MS GOV 2023

What is the Form 84-105 from the Mississippi Department of Revenue?

The Form 84-105 is a tax form issued by the Mississippi Department of Revenue. It is primarily used for specific tax-related purposes, often involving adjustments or claims for refunds. This form is essential for individuals and businesses who need to report changes to their tax information or seek refunds for overpaid taxes. Understanding the purpose of this form is crucial for ensuring compliance with Mississippi tax regulations.

How to Use the Form 84-105

Using the Form 84-105 involves several steps to ensure accurate completion and submission. First, gather all necessary documents that support your claim or adjustment. This may include previous tax returns, receipts, and any correspondence with the Department of Revenue. Next, fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. Proper use of the form can facilitate a smoother processing experience with the Mississippi Department of Revenue.

Steps to Complete the Form 84-105

Completing the Form 84-105 requires attention to detail. Begin by entering your personal information, including your name, address, and Social Security number or taxpayer identification number. Next, provide the specific details related to your tax situation, such as the tax year in question and the nature of the adjustment or claim. Be sure to include any required documentation that supports your request. Finally, sign and date the form before submitting it to the appropriate address as indicated in the instructions.

Legal Use of the Form 84-105

The Form 84-105 must be used in accordance with Mississippi tax laws. It is designed for legitimate claims and adjustments, ensuring that taxpayers can rectify any discrepancies in their tax filings. Misuse of the form can lead to penalties or legal repercussions. Therefore, it is essential to understand the legal implications of submitting this form and to use it solely for its intended purpose.

Filing Deadlines and Important Dates

Filing deadlines for the Form 84-105 vary depending on the specific tax situation. Typically, taxpayers must submit the form by the due date of the original tax return for the year in question. It is important to stay informed about any changes to deadlines or additional requirements established by the Mississippi Department of Revenue. Missing a deadline can result in delays in processing or denial of claims.

Required Documents for the Form 84-105

When submitting the Form 84-105, certain documents may be required to support your claim or adjustment. Commonly required documents include copies of previous tax returns, proof of payments made, and any relevant correspondence with the Mississippi Department of Revenue. Ensuring that all necessary documentation is included can help facilitate a smoother review process and increase the likelihood of approval.

Examples of Using the Form 84-105

There are various scenarios in which the Form 84-105 may be utilized. For instance, a taxpayer may use this form to claim a refund for overpaid taxes or to adjust a previously filed return due to an error. Additionally, businesses may need to submit this form when correcting tax-related information that affects their tax liability. Understanding these examples can help taxpayers determine when and how to use the form effectively.

Quick guide on how to complete form 84 105 mississippi department of revenue ms gov

Effortlessly prepare Form 84 105 Mississippi Department Of Revenue MS GOV on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing access to the appropriate form and secure online storage. airSlate SignNow equips you with all the necessary resources to create, edit, and electronically sign your documents quickly and efficiently. Manage Form 84 105 Mississippi Department Of Revenue MS GOV on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based workflow today.

The easiest way to edit and electronically sign Form 84 105 Mississippi Department Of Revenue MS GOV without stress

- Find Form 84 105 Mississippi Department Of Revenue MS GOV and click Get Form to begin.

- Utilize the tools provided to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Choose your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download to your computer.

No more worrying about lost or misfiled documents, tedious form hunts, or the need to reprint copies due to errors. airSlate SignNow addresses your document management requirements in just a few clicks from your chosen device. Edit and electronically sign Form 84 105 Mississippi Department Of Revenue MS GOV to ensure clear communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 84 105 mississippi department of revenue ms gov

Create this form in 5 minutes!

How to create an eSignature for the form 84 105 mississippi department of revenue ms gov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of airSlate SignNow related to ms 84 105 instructions 2023?

airSlate SignNow offers multiple features that facilitate the efficient management of ms 84 105 instructions 2023. These include customizable templates, easy document sharing, and advanced eSignature capabilities. Users can also track document status in real-time, ensuring a smooth signing process.

-

How can I get started with airSlate SignNow for ms 84 105 instructions 2023?

Getting started with airSlate SignNow for ms 84 105 instructions 2023 is simple. You can sign up for a free trial on our website, where you’ll find guidance on how to use the platform effectively. Once you’re set up, you can upload your documents and start eSigning in no time.

-

What pricing options does airSlate SignNow offer for ms 84 105 instructions 2023?

airSlate SignNow provides flexible pricing plans suitable for various business needs regarding ms 84 105 instructions 2023. Our plans include options for individuals, small teams, and larger enterprises, ensuring that each customer can find a cost-effective solution tailored to their requirements.

-

Can airSlate SignNow integrate with other software for managing ms 84 105 instructions 2023?

Yes, airSlate SignNow supports integration with various software solutions, enhancing your experience with ms 84 105 instructions 2023. You can connect it with popular applications such as Google Drive, Dropbox, and CRM platforms, allowing for seamless document management across your tools.

-

What are the benefits of using airSlate SignNow for ms 84 105 instructions 2023?

By utilizing airSlate SignNow for ms 84 105 instructions 2023, businesses can streamline their document workflows and enhance collaboration. The platform allows for faster turnaround times on signatures, reduces paperwork, and increases overall productivity, making it a valuable tool for any organization.

-

Is there customer support available for airSlate SignNow users handling ms 84 105 instructions 2023?

Absolutely! airSlate SignNow offers dedicated customer support for users managing ms 84 105 instructions 2023. Our support team is available through various channels, including live chat and email, ensuring you receive assistance whenever needed.

-

Are there any security measures in place for airSlate SignNow and ms 84 105 instructions 2023?

Yes, airSlate SignNow implements robust security measures to protect your documents and information for ms 84 105 instructions 2023. We utilize industry-standard encryption, multi-factor authentication, and secure cloud storage to ensure that your data remains safe and confidential.

Get more for Form 84 105 Mississippi Department Of Revenue MS GOV

Find out other Form 84 105 Mississippi Department Of Revenue MS GOV

- How Can I Electronic signature New York Real Estate Warranty Deed

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will