TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications 2023-2026

Understanding the TC-65 Form for Utah Partnerships

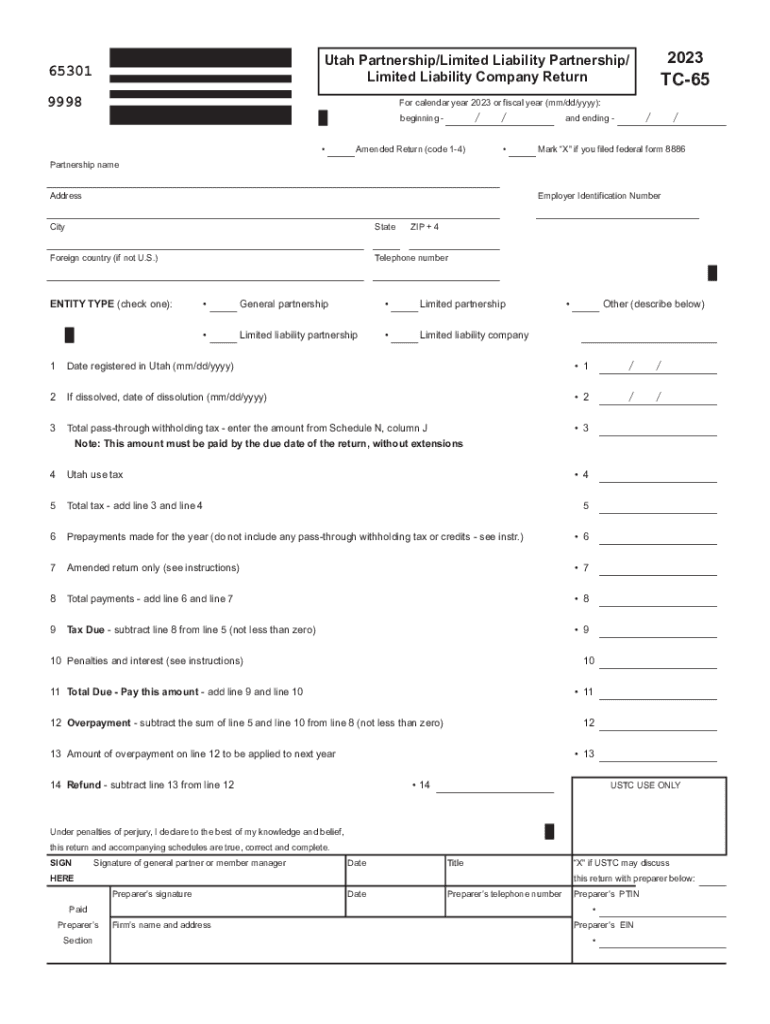

The TC-65 form is essential for partnerships operating in Utah. This form is used to report income, deductions, and credits for partnerships, limited liability companies (LLCs), and limited liability partnerships (LLPs). It ensures that partnerships comply with state tax regulations and provides a clear overview of the partnership's financial activities for the tax year. The TC-65 form must be filed annually, and it includes detailed sections that capture the partnership's financial performance and distributions to partners.

Steps to Complete the TC-65 Form

Completing the TC-65 form involves several key steps to ensure accuracy and compliance. First, gather all necessary financial records, including income statements, expense reports, and partner contributions. Next, fill in the basic information about the partnership, such as the name, address, and federal employer identification number (EIN). Then, report the partnership's income and deductions in the appropriate sections. Be sure to allocate income and deductions to each partner according to the partnership agreement. Finally, review the completed form for accuracy before submitting it to the state.

Required Documents for the TC-65 Form

When preparing to file the TC-65 form, specific documents are required to support the information reported. Essential documents include:

- Partnership agreement outlining the distribution of profits and losses

- Financial statements, including profit and loss statements

- Records of partner contributions and distributions

- Any applicable schedules for credits or deductions

Having these documents ready will facilitate the completion of the TC-65 form and help ensure compliance with state tax laws.

Filing Deadlines for the TC-65 Form

It is crucial to be aware of the filing deadlines for the TC-65 form to avoid penalties. The TC-65 form is typically due on the 15th day of the fourth month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the form is due by April 15. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Timely filing is essential to maintain good standing with the state and avoid late fees.

Legal Use of the TC-65 Form

The TC-65 form serves a legal purpose in the state of Utah, as it is required for tax compliance for partnerships. Filing this form accurately is essential to avoid legal repercussions, including audits or penalties from the Utah State Tax Commission. Additionally, the information provided on the TC-65 form can be used in legal contexts, such as disputes among partners or in the event of a partnership dissolution. Therefore, maintaining accurate records and ensuring proper completion of the form is vital for legal protection.

Examples of Using the TC-65 Form

Understanding how to use the TC-65 form can be clarified through examples. For instance, if a partnership generates $100,000 in revenue and incurs $40,000 in expenses, the TC-65 form would report these figures, showing a net income of $60,000. This net income would then be allocated to each partner based on their ownership percentage. Another example involves a partnership that claims deductions for business expenses such as rent and utilities, which must be accurately reported on the TC-65 form to reduce taxable income. These examples illustrate the practical application of the TC-65 form in real-world scenarios.

Quick guide on how to complete tc 65 forms utah partnershipllpllc return forms ampamp publications

Effortlessly Prepare TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications on Any Device

The management of online documents has become increasingly popular among organizations and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed papers, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Manage TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to Modify and Electronically Sign TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications with Ease

- Obtain TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information using tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications to ensure exceptional communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tc 65 forms utah partnershipllpllc return forms ampamp publications

Create this form in 5 minutes!

How to create an eSignature for the tc 65 forms utah partnershipllpllc return forms ampamp publications

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2012 Utah Limited and how can it benefit my business?

The 2012 Utah Limited refers to specific legal structures that businesses can use for operational efficiency. By utilizing the 2012 Utah Limited, companies can enjoy liability protection, tax benefits, and enhanced credibility. airSlate SignNow can streamline document signing processes related to these entities, making compliance effortless.

-

How much does airSlate SignNow cost for handling 2012 Utah Limited documents?

airSlate SignNow offers competitive pricing plans to accommodate businesses dealing with 2012 Utah Limited documents. Our packages are designed to be cost-effective, ensuring that you receive a robust eSigning solution without breaking the bank. You can select a plan that suits your needs, whether you are a small startup or a larger enterprise.

-

What features does airSlate SignNow offer for 2012 Utah Limited eSigning?

airSlate SignNow provides a range of features tailored for businesses dealing with 2012 Utah Limited documents. These include secure eSignatures, customizable templates, and real-time tracking of document status. Our user-friendly platform is designed to simplify the signing process for all parties involved.

-

Can I integrate airSlate SignNow with other tools for my 2012 Utah Limited business?

Yes, airSlate SignNow seamlessly integrates with a variety of business applications, enhancing your workflow around 2012 Utah Limited documents. You can connect it with tools like CRM systems, accounting software, and cloud storage solutions. This integration allows for streamlined operations and improved efficiency.

-

Is airSlate SignNow secure for signing 2012 Utah Limited documents?

Absolutely! airSlate SignNow employs robust security measures to protect your 2012 Utah Limited documents. With features like multi-factor authentication and encrypted data storage, you can be confident that your sensitive information is secure. We comply with industry standards to ensure the highest level of protection.

-

How does airSlate SignNow simplify the signing process for 2012 Utah Limited documents?

airSlate SignNow simplifies the signing process for 2012 Utah Limited documents by providing an intuitive user interface. Users can quickly upload, fill out, and send documents for eSignature without complex procedures. This efficiency saves time and reduces errors, enabling businesses to focus more on their core activities.

-

What are the benefits of using airSlate SignNow for my 2012 Utah Limited operations?

Using airSlate SignNow for your 2012 Utah Limited operations offers numerous benefits, including faster turnaround times and reduced paper usage. The platform also enhances compliance with legal requirements, ensuring that your business remains in good standing. Ultimately, it provides a cost-effective solution for all your document signing needs.

Get more for TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications

- Redd partnership voluntary redd database progress report ksrevenue form

- Kreda annual report form

- Printablerestraining ordero form for ky 2011

- Louisiana state 2012 it 540 form online 2016

- Tax form it 540 louisiana department of revenue louisianagov

- Ma st 4 fillable 2000 form

- State tax form 3abc assessors use only mass

- Form 355 7004 application for extension of time to file massgov

Find out other TC 65 Forms, Utah PartnershipLLPLLC Return Forms & Publications

- Sign Tennessee Courts Residential Lease Agreement Online

- How Do I eSign Arkansas Charity LLC Operating Agreement

- eSign Colorado Charity LLC Operating Agreement Fast

- eSign Connecticut Charity Living Will Later

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy