Instructions for Completing the 511 NR Income Tax Return 2023

Instructions for Completing the 511 NR Income Tax Return

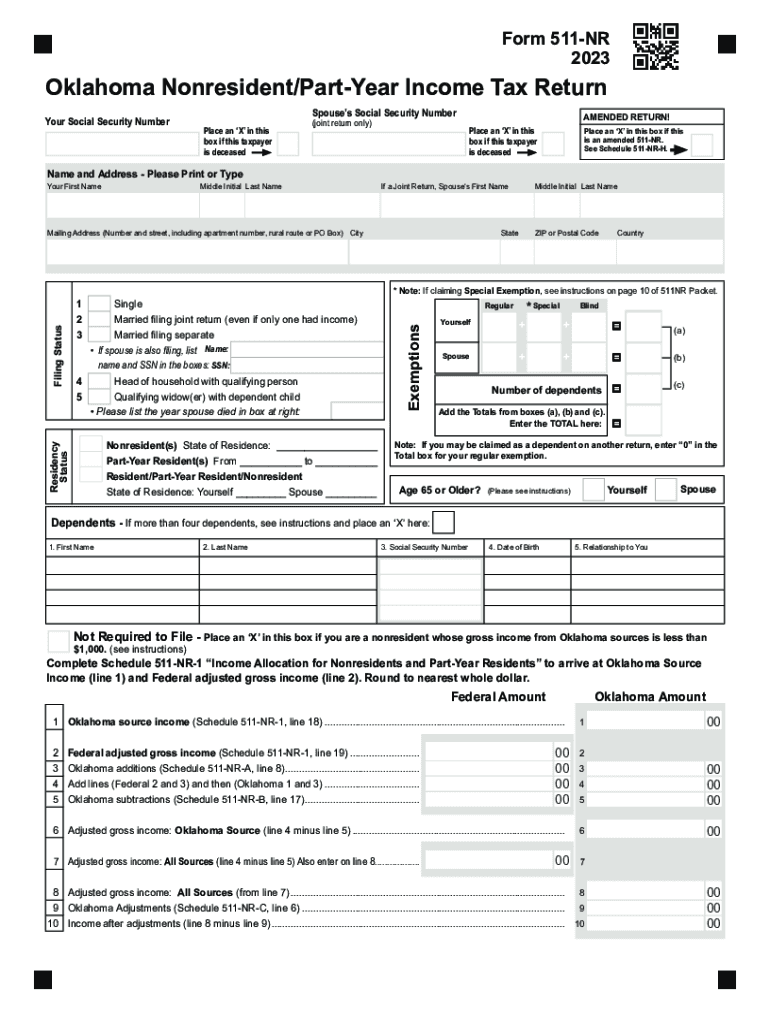

The 511 NR Income Tax Return is specifically designed for nonresidents who earn income in Oklahoma. To complete this form accurately, gather all necessary financial documents, including W-2s, 1099s, and any other income statements. It is essential to report all income earned while in Oklahoma, as well as any deductions or credits you may qualify for. Carefully follow the line-by-line instructions provided with the form to ensure compliance with state regulations.

Key Elements of the 511 NR Income Tax Return

The key elements of the 511 NR form include personal information, income details, and tax calculations. You will need to provide your name, address, and Social Security number. Additionally, report your total income, which may include wages, rental income, or business earnings. Deductions such as personal exemptions and standard deductions can also be claimed, which may reduce your taxable income. Understanding these elements is crucial for accurate filing.

Filing Deadlines / Important Dates

For the 2018 tax year, the filing deadline for the 511 NR Income Tax Return is typically April 15 of the following year. However, if you are unable to meet this deadline, you may request an extension. It is important to keep track of any changes in deadlines or specific dates that may affect your filing status. Late submissions can result in penalties, so staying informed is essential.

Required Documents for Filing

When preparing to file the 511 NR Income Tax Return, ensure you have all required documents on hand. This includes your W-2 forms, 1099 forms, and any other income documentation. Additionally, gather records of any deductions you plan to claim, such as receipts for business expenses or proof of contributions to retirement accounts. Having these documents ready will streamline the filing process and help avoid errors.

Form Submission Methods

The 511 NR Income Tax Return can be submitted through various methods. You may choose to file online using approved tax software or submit a paper form by mail. If you prefer in-person filing, check with local tax offices for availability. Each method has its own processing times, so consider your timeline when deciding how to submit your return.

Penalties for Non-Compliance

Failing to file the 511 NR Income Tax Return or submitting inaccurate information can result in penalties. These may include fines, interest on unpaid taxes, or even legal action in severe cases. It is crucial to ensure that your return is filed accurately and on time to avoid these consequences. Familiarize yourself with the specific penalties outlined by the Oklahoma Tax Commission to understand the risks associated with non-compliance.

Quick guide on how to complete instructions for completing the 511 nr income tax return

Easily Prepare Instructions For Completing The 511 NR Income Tax Return on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and electronically sign your documents swiftly without delays. Manage Instructions For Completing The 511 NR Income Tax Return on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Instructions For Completing The 511 NR Income Tax Return Effortlessly

- Locate Instructions For Completing The 511 NR Income Tax Return and click Get Form to begin.

- Utilize the available tools to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all details and click the Done button to finalize your changes.

- Select your preferred method of sending your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, the hassle of searching through forms, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and electronically sign Instructions For Completing The 511 NR Income Tax Return to ensure excellent communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for completing the 511 nr income tax return

Create this form in 5 minutes!

How to create an eSignature for the instructions for completing the 511 nr income tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of the 2018 Oklahoma tax return for businesses?

The 2018 Oklahoma tax return is crucial for businesses as it outlines their financial obligations and compliance with state laws. Properly filing this return can help avoid penalties and ensure eligibility for potential tax benefits. Staying updated with the 2018 Oklahoma tax regulations can also improve overall financial strategies.

-

How can airSlate SignNow simplify the process of signing the 2018 Oklahoma tax documents?

airSlate SignNow streamlines the signing process for 2018 Oklahoma tax documents by providing a secure, electronic signature solution. With our platform, you can easily send, sign, and manage tax forms from any device. This saves you time and enhances document security, making tax compliance hassle-free.

-

What pricing options does airSlate SignNow offer for businesses managing their 2018 Oklahoma tax documentation?

airSlate SignNow offers flexible pricing plans designed for businesses of all sizes managing their 2018 Oklahoma tax documentation. Our cost-effective solutions allow you to choose a plan that fits your budget and needs, ensuring you have access to essential eSigning features without overspending.

-

Can airSlate SignNow integrate with accounting software for handling 2018 Oklahoma tax tasks?

Yes, airSlate SignNow integrates seamlessly with various accounting software to enhance the management of your 2018 Oklahoma tax tasks. This integration allows for automatic synchronization of tax documents and streamlines the workflow between different platforms. Easily keep your financial documents organized and accessible.

-

What features does airSlate SignNow provide for ensuring compliance with 2018 Oklahoma tax requirements?

airSlate SignNow includes essential features for compliance with 2018 Oklahoma tax requirements, such as secure eSignatures, audit trails, and document storage. Our platform ensures that all signed documents are legally binding and easily retrievable for future reference. This helps users maintain audit-ready documentation at all times.

-

How does airSlate SignNow enhance the speed of processing 2018 Oklahoma tax documents?

airSlate SignNow signNowly enhances the speed of processing 2018 Oklahoma tax documents by allowing digital signatures to be added in seconds. No more waiting for physical mail or in-person signatures; our platform accelerates the entire process, enabling faster submissions and reviews. This efficiency is vital during tax season.

-

What benefits do businesses gain from using airSlate SignNow for their 2018 Oklahoma tax submissions?

Businesses using airSlate SignNow for their 2018 Oklahoma tax submissions gain numerous benefits, including increased efficiency, reduced costs, and improved security. Our user-friendly interface simplifies document management, while the secure eSigning process mitigates risks associated with traditional methods. It's a smart investment for any organization.

Get more for Instructions For Completing The 511 NR Income Tax Return

- Forms registrars office east georgia state college

- Financial guarantee form oral roberts university oru

- Cewd certificate student application student form

- I understand that this physical fitness program is form

- 2019 2020 satisfactory academic progress appeal form

- Doctor of occupational therapy school of health ampamp human form

- Gray less than 1 in us mark memorial day creative form

- Valdosta state university purchasing card pcard application form

Find out other Instructions For Completing The 511 NR Income Tax Return

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free

- How Can I Sign Connecticut Plumbing LLC Operating Agreement

- Sign Illinois Plumbing Business Plan Template Fast

- Sign Plumbing PPT Idaho Free

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself