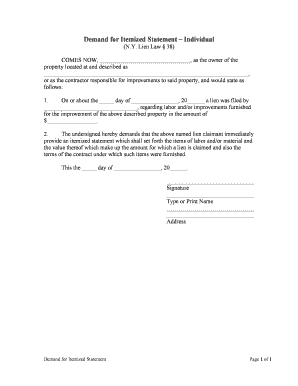

Itemized Statement Form

What is the itemized statement?

An itemized statement is a detailed record that outlines specific charges or transactions. It is often used in various contexts, such as tax filings or insurance claims, to provide transparency and clarity regarding expenses. For individuals in New York, this document can be essential for accurately reporting income or expenses to the tax department. It typically includes line items that describe each charge, the date incurred, and the total amount, facilitating easier verification and processing.

How to use the itemized statement

Using an itemized statement involves compiling all relevant expenses and ensuring that each entry is accurately documented. This statement can serve multiple purposes, including tax deductions, reimbursement requests, or legal documentation. To effectively use an itemized statement, keep the following steps in mind:

- Gather all receipts and invoices related to the expenses you wish to report.

- Organize your documents chronologically or by category to streamline the completion process.

- Ensure that each entry on the itemized statement includes a clear description, date, and amount.

- Review the completed statement for accuracy before submission to avoid delays or rejections.

Steps to complete the itemized statement

Completing an itemized statement requires attention to detail and organization. Follow these steps for a successful completion:

- Start with the correct form or template, ensuring it is suitable for your specific needs.

- List each expense item, providing a brief description and the date incurred.

- Include the total amount for each item, ensuring that calculations are accurate.

- Double-check all entries against your receipts and invoices for consistency.

- Finalize the document by signing it if required, and prepare it for submission.

Legal use of the itemized statement

The legal use of an itemized statement is crucial for compliance with various regulations, especially in tax-related matters. In New York, this document must adhere to specific guidelines to be considered valid. An itemized statement can be utilized in legal proceedings, insurance claims, or audits, provided it meets the necessary legal standards. It is important to ensure that the information is accurate and that the statement is submitted within the required timeframes to avoid penalties.

Key elements of the itemized statement

Understanding the key elements of an itemized statement can enhance its effectiveness. Essential components include:

- Description: A clear explanation of each expense.

- Date: The date when the expense was incurred.

- Amount: The total cost associated with each item.

- Supporting documents: Receipts or invoices that validate the expenses.

Filing deadlines / Important dates

Filing deadlines are critical when submitting an itemized statement, especially for tax purposes. In New York, taxpayers should be aware of the following important dates:

- Tax filing deadline: Typically April 15 for individual tax returns.

- Extension request deadline: Usually the same as the tax filing deadline.

- State-specific deadlines: Check for any additional deadlines set by the New York State Department of Taxation and Finance.

Quick guide on how to complete itemized statement

Effortlessly Prepare Itemized Statement on Any Device

The management of online documents has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed forms, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Itemized Statement on any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign Itemized Statement with Ease

- Obtain Itemized Statement and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive details using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you choose. Alter and eSign Itemized Statement to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are the key features of airSlate SignNow for NY mechanics?

airSlate SignNow offers NY mechanics a comprehensive set of features, including document eSigning, template creation, and automated workflows. These tools enable mechanics to streamline their contract processes and improve efficiency. The platform's intuitive interface allows users to manage documents easily, saving valuable time in their busy schedules.

-

How does airSlate SignNow benefit NY mechanics?

By using airSlate SignNow, NY mechanics can enhance their operational efficiency and reduce paperwork. With eSigning capabilities, they can quickly obtain client signatures without the hassle of printing or scanning documents. This not only expedites transactions but also fosters a more professional image with clients.

-

What pricing plans does airSlate SignNow offer for NY mechanics?

airSlate SignNow provides flexible pricing plans tailored to the needs of NY mechanics. Whether you're a solo mechanic or part of a larger shop, you can find a plan that fits your budget. Plans include scalable options, ensuring that as your business grows, your eSigning solution can grow with you.

-

Can airSlate SignNow be integrated with other tools NY mechanics use?

Yes, airSlate SignNow seamlessly integrates with various tools commonly used by NY mechanics, such as CRM software and accounting systems. This integration allows for a streamlined workflow, enabling mechanics to manage their documents, customer relationships, and financial transactions all in one place. Enhancing productivity has never been easier.

-

Is airSlate SignNow secure for NY mechanics handling sensitive information?

Absolutely. airSlate SignNow prioritizes security, utilizing advanced encryption and secure cloud storage to protect sensitive information. This ensures that the documents of NY mechanics, including contracts and customer data, are safe from unauthorized access or bsignNowes. You can eSign with confidence knowing your data is secure.

-

How can NY mechanics get started with airSlate SignNow?

Getting started with airSlate SignNow is simple for NY mechanics. You can sign up for a free trial to explore the platform's features and benefits. Once you're ready, onboarding is quick and user-friendly, allowing you to start sending and eSigning documents within minutes.

-

What types of documents can NY mechanics eSign using airSlate SignNow?

NY mechanics can eSign a variety of documents using airSlate SignNow, including service agreements, invoices, and repair authorizations. The platform's versatility allows mechanics to manage documents efficiently for different aspects of their business. This flexibility enhances the overall client experience by speeding up processes.

Get more for Itemized Statement

- How to fill out bankruptcy schedule c the property you claim form

- Add the amounts of all form

- Schedule d creditors holding secured claims superseded form

- Form leases pdffiller

- Fillable online caeb uscourts schedule i current income of form

- 1 67 sample master mailing list requirements pursuant to form

- Statement of financial affairs for individuals filing for form

- United nations framework convention on climate unfccc form

Find out other Itemized Statement

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple

- Electronic signature Florida Amendment to an LLC Operating Agreement Safe

- How Can I eSignature South Carolina Exchange of Shares Agreement

- Electronic signature Michigan Amendment to an LLC Operating Agreement Computer

- Can I Electronic signature North Carolina Amendment to an LLC Operating Agreement

- Electronic signature South Carolina Amendment to an LLC Operating Agreement Safe

- Can I Electronic signature Delaware Stock Certificate

- Electronic signature Massachusetts Stock Certificate Simple