Oklahoma Order Form

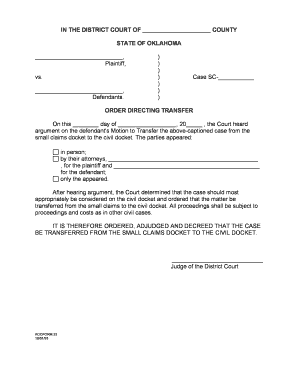

What is the Oklahoma Order Form

The Oklahoma order form is a legal document used primarily for various transactions within the state of Oklahoma. This form serves as a formal request for services or goods, ensuring that both parties involved have a clear understanding of the terms and conditions. It is important for maintaining records and can be utilized in different contexts, such as business agreements, service requests, or legal transactions. Understanding the specific purpose of the form is crucial for its effective use.

How to use the Oklahoma Order Form

Using the Oklahoma order form involves several straightforward steps to ensure that it is filled out correctly and serves its intended purpose. First, gather all necessary information, including the details of the parties involved, the items or services being requested, and any specific terms related to the transaction. Next, fill out the form accurately, ensuring that all required fields are completed. Once the form is filled out, it should be reviewed for accuracy before obtaining the necessary signatures. Finally, submit the form according to the specified instructions, whether that be online, by mail, or in person.

Steps to complete the Oklahoma Order Form

Completing the Oklahoma order form requires careful attention to detail. Follow these steps for a successful submission:

- Gather Information: Collect all relevant details, including names, addresses, and descriptions of the goods or services.

- Fill Out the Form: Enter the information into the designated fields, ensuring accuracy and clarity.

- Review: Double-check the form for any errors or omissions before finalizing it.

- Sign: Obtain the necessary signatures from all parties involved to validate the document.

- Submit: Send the completed form via the appropriate method as indicated in the instructions.

Legal use of the Oklahoma Order Form

The Oklahoma order form is legally binding when completed correctly and signed by all relevant parties. To ensure its legality, it must comply with state laws regarding contracts and agreements. This includes having clear terms, mutual consent, and the capacity of all parties to enter into the agreement. Additionally, the form must be executed in a manner that adheres to any specific legal requirements, such as notarization or witness signatures, if applicable.

Key elements of the Oklahoma Order Form

Several key elements must be included in the Oklahoma order form to ensure its effectiveness and legality. These elements typically include:

- Contact Information: Names and addresses of all parties involved.

- Description of Goods/Services: A detailed explanation of what is being ordered.

- Terms and Conditions: Clear stipulations regarding payment, delivery, and any other relevant details.

- Signatures: Required signatures from all parties to validate the agreement.

- Date: The date on which the form is completed and signed.

State-specific rules for the Oklahoma Order Form

In Oklahoma, specific rules govern the use of the order form to ensure compliance with state laws. These rules may include requirements for the format of the document, necessary disclosures, and any specific language that must be included. It is essential for users to familiarize themselves with these state-specific regulations to avoid potential legal issues. Consulting with a legal professional can provide clarity on any nuances that may apply to the Oklahoma order form.

Quick guide on how to complete oklahoma order form

Effortlessly Prepare Oklahoma Order Form on Any Device

Managing documents online has gained signNow traction among both enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Oklahoma Order Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Oklahoma Order Form with Ease

- Obtain Oklahoma Order Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select how you prefer to deliver your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Edit and eSign Oklahoma Order Form and guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oklahoma order form?

An Oklahoma order form is a specific document designed for businesses operating in Oklahoma to streamline the process of taking orders from customers. airSlate SignNow enables users to create customizable Oklahoma order forms that enhance efficiency and accuracy in order management.

-

How does airSlate SignNow help with creating an Oklahoma order form?

airSlate SignNow offers user-friendly templates and customizable features that allow you to create an effective Oklahoma order form quickly. With drag-and-drop functionality, you can easily add fields specific to your business needs, ensuring a smooth experience for your customers.

-

Is there a cost associated with using the Oklahoma order form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans depending on the features you need for your Oklahoma order form. Each plan is designed to be cost-effective while providing the necessary tools to manage your orders efficiently.

-

Can I integrate my Oklahoma order form with other applications?

Absolutely! airSlate SignNow allows for seamless integration with various applications such as CRM software and payment gateways, enhancing your Oklahoma order form's functionality. This integration helps to automate your workflow, making order management signNowly easier.

-

What features does the Oklahoma order form include?

The Oklahoma order form created with airSlate SignNow includes essential features such as eSignature capabilities, customizable fields, and automated notifications. These features not only simplify the order-taking process but also ensure all transactions are secure and legally binding.

-

How can an Oklahoma order form benefit my business?

Utilizing an Oklahoma order form through airSlate SignNow can boost your business efficiency by reducing manual entry errors and speeding up the order process. It allows for better tracking of orders and improves customer satisfaction through quick responses and streamlined communication.

-

Is the Oklahoma order form mobile-friendly?

Yes, airSlate SignNow's Oklahoma order form is fully optimized for mobile devices. This means that customers can place orders and sign documents directly from their smartphones or tablets, providing convenience and flexibility in today's fast-paced environment.

Get more for Oklahoma Order Form

- Employers and child care establishing services through the form

- 2019 supreme court of texas decisions texas case law form

- Comes now the plaintiff and would show as follows to wit form

- Superior court of the state of delaware leonard form

- Comes now the plaintiff by and through its attorney of record 490235213 form

- I an adult resident of county form

- I an adult resident citizen of form

- Name chief form

Find out other Oklahoma Order Form

- Can I Electronic signature New York Car Dealer Document

- How To Electronic signature North Carolina Car Dealer Word

- How Do I Electronic signature North Carolina Car Dealer Document

- Can I Electronic signature Ohio Car Dealer PPT

- How Can I Electronic signature Texas Banking Form

- How Do I Electronic signature Pennsylvania Car Dealer Document

- How To Electronic signature South Carolina Car Dealer Document

- Can I Electronic signature South Carolina Car Dealer Document

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF