CIT 1 *246080200* NEW MEXICO CORPORATE INCOME Form

What is the 2024 CIT 1 New Mexico Corporate Income?

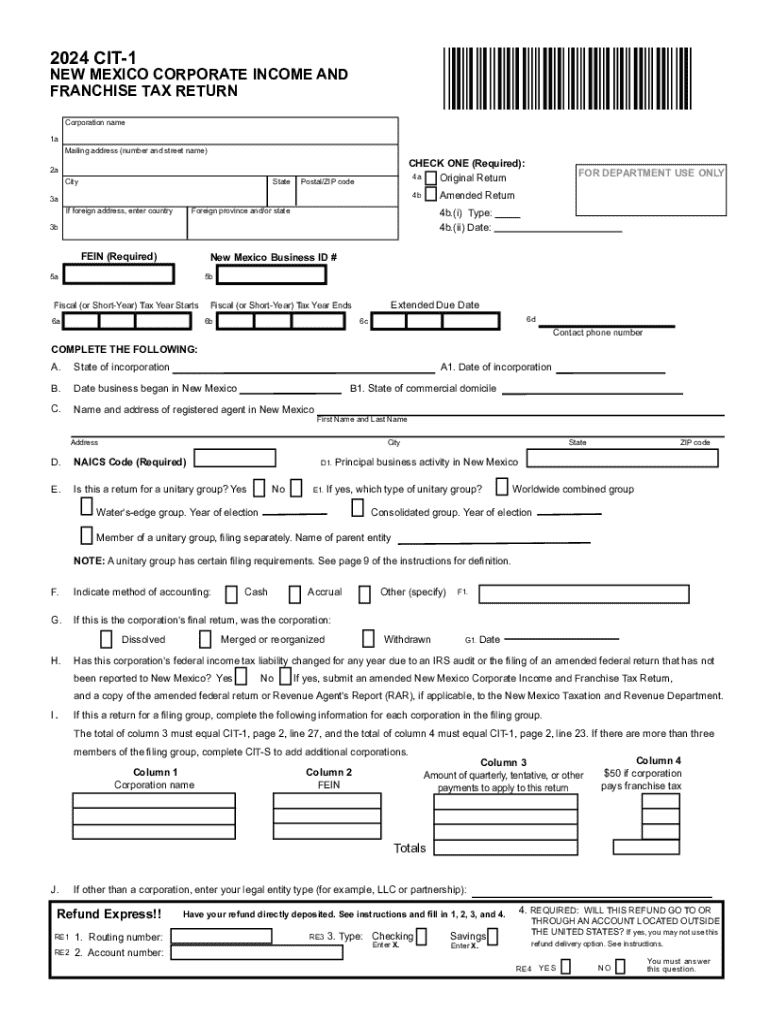

The 2024 CIT 1 form is the New Mexico Corporate Income Tax Return, which is required for corporations operating within the state. This form is essential for reporting the corporation's income, deductions, and tax liability to the New Mexico Taxation and Revenue Department. Corporations must complete this form annually to comply with state tax laws and regulations.

Steps to Complete the 2024 CIT 1 New Mexico Corporate Income

Completing the 2024 CIT 1 involves several key steps:

- Gather all necessary financial documents, including income statements, balance sheets, and prior tax returns.

- Calculate the total income earned by the corporation during the tax year.

- Identify and apply any allowable deductions to determine the taxable income.

- Use the tax rates applicable for the current year to calculate the total tax owed.

- Complete the CIT 1 form accurately, ensuring all sections are filled out correctly.

- Review the completed form for accuracy and compliance with New Mexico tax regulations.

Filing Deadlines / Important Dates

The filing deadline for the 2024 CIT 1 form is typically the 15th day of the fourth month following the end of the corporation’s tax year. For corporations operating on a calendar year, this means the form is due by April 15, 2025. It is crucial to be aware of these deadlines to avoid penalties and interest on unpaid taxes.

Form Submission Methods

The 2024 CIT 1 form can be submitted in various ways to ensure convenience for corporations:

- Online: Corporations can file electronically through the New Mexico Taxation and Revenue Department's online portal.

- Mail: The completed form can be printed and mailed to the appropriate tax office.

- In-Person: Corporations may also choose to submit the form in person at designated tax offices.

Required Documents

To complete the 2024 CIT 1, corporations must have the following documents ready:

- Financial statements, including income and balance sheets.

- Records of all income sources and expenses.

- Prior year tax returns for reference.

- Any supporting documentation for deductions claimed.

Penalties for Non-Compliance

Failure to file the 2024 CIT 1 form on time can result in significant penalties. Corporations may face late filing fees, interest on unpaid taxes, and potential audits by the New Mexico Taxation and Revenue Department. It is important for corporations to adhere to all filing requirements to avoid these consequences.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cit 1 246080200 new mexico corporate income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2024 cit 1 and how does it benefit my business?

The 2024 cit 1 is an innovative solution designed to streamline document signing and management. By utilizing airSlate SignNow, businesses can enhance their workflow efficiency, reduce turnaround times, and improve overall productivity. This tool is particularly beneficial for organizations looking to modernize their document processes.

-

How much does the 2024 cit 1 cost?

The pricing for the 2024 cit 1 varies based on the plan you choose. airSlate SignNow offers flexible pricing options to accommodate businesses of all sizes, ensuring that you get the best value for your investment. You can explore our pricing page for detailed information on the available plans.

-

What features are included in the 2024 cit 1?

The 2024 cit 1 includes a range of powerful features such as customizable templates, real-time tracking, and secure cloud storage. These features are designed to simplify the eSigning process and enhance collaboration among team members. With airSlate SignNow, you can manage all your document needs in one place.

-

Can the 2024 cit 1 integrate with other software?

Yes, the 2024 cit 1 seamlessly integrates with various software applications, including CRM systems, project management tools, and cloud storage services. This integration capability allows businesses to create a cohesive workflow, making document management more efficient. airSlate SignNow supports numerous integrations to fit your existing tech stack.

-

Is the 2024 cit 1 secure for sensitive documents?

Absolutely, the 2024 cit 1 prioritizes security with advanced encryption and compliance with industry standards. airSlate SignNow ensures that your sensitive documents are protected throughout the signing process. You can trust that your data is safe and secure while using our platform.

-

How does the 2024 cit 1 improve team collaboration?

The 2024 cit 1 enhances team collaboration by allowing multiple users to work on documents simultaneously. With features like comments and notifications, team members can communicate effectively and stay updated on document status. This collaborative approach leads to faster decision-making and improved project outcomes.

-

What types of documents can I manage with the 2024 cit 1?

With the 2024 cit 1, you can manage a wide variety of documents, including contracts, agreements, and forms. airSlate SignNow supports various file formats, making it easy to upload and send any document for eSigning. This versatility ensures that you can handle all your document needs efficiently.

Get more for CIT 1 *246080200* NEW MEXICO CORPORATE INCOME

Find out other CIT 1 *246080200* NEW MEXICO CORPORATE INCOME

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter