Oklahoma Trust Form

What is the Oklahoma Trust

The Oklahoma Trust is a legal arrangement that allows individuals to manage and distribute their assets according to specific wishes. This type of trust can help avoid probate, ensuring that assets are transferred directly to beneficiaries without court intervention. An Oklahoma living trust is particularly beneficial for estate planning, providing flexibility in how assets are handled during the grantor's lifetime and after their passing.

How to use the Oklahoma Trust

Using an Oklahoma Trust involves several steps, including establishing the trust, transferring assets into it, and designating beneficiaries. The trust document outlines how the assets will be managed and distributed. It is essential to consult with a legal professional to ensure that the trust complies with state laws and meets the grantor's objectives.

Steps to complete the Oklahoma Trust

Completing an Oklahoma Trust typically involves the following steps:

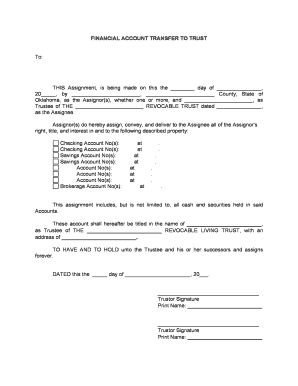

- Determine the type of trust needed, such as a revocable or irrevocable trust.

- Draft the trust document, specifying the terms, beneficiaries, and trustee.

- Transfer assets into the trust, which may include real estate, bank accounts, and investments.

- Sign the trust document in accordance with Oklahoma state laws, often in the presence of a notary.

- Review and update the trust regularly to reflect any changes in circumstances or wishes.

Legal use of the Oklahoma Trust

The legal use of an Oklahoma Trust is governed by state laws, which dictate how trusts are created, managed, and dissolved. Trusts must adhere to specific requirements to be recognized as valid, including proper documentation and execution. Understanding these legal parameters is crucial for ensuring that the trust serves its intended purpose and provides the desired benefits.

Key elements of the Oklahoma Trust

Key elements of an Oklahoma Trust include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust assets and ensuring compliance with the trust document.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death or according to the terms of the trust.

- Trust document: The legal document that outlines the terms, conditions, and management of the trust.

State-specific rules for the Oklahoma Trust

Oklahoma has specific rules governing trusts, including requirements for documentation, execution, and modification. For example, trusts must be in writing and signed by the grantor. Additionally, Oklahoma law provides guidelines on how trusts can be revoked or amended, ensuring that individuals have the flexibility to adapt their estate plans as needed.

Quick guide on how to complete oklahoma trust

Accomplish Oklahoma Trust effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents since you can locate the appropriate form and safely archive it online. airSlate SignNow provides you with all the tools you require to create, edit, and eSign your documents swiftly without unnecessary delays. Handle Oklahoma Trust on any device with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Oklahoma Trust with ease

- Obtain Oklahoma Trust and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or an invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you prefer. Modify and eSign Oklahoma Trust and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Oklahoma trust and how does it work?

An Oklahoma trust is a legal arrangement that allows you to hold and manage assets for the benefit of your beneficiaries. It can be revocable or irrevocable, enabling more control over how assets are distributed. By utilizing an Oklahoma trust, you can reduce probate costs and ensure your wishes are honored.

-

How does airSlate SignNow help with Oklahoma trusts?

airSlate SignNow streamlines the process of creating and signing documents related to Oklahoma trusts. Our easy-to-use interface allows you to quickly send, sign, and manage trust documents electronically. This not only saves time but also enhances the security and compliance of your trust documents.

-

What are the pricing options for using airSlate SignNow for Oklahoma trust documents?

airSlate SignNow offers competitive pricing plans to cater to various business needs, including those involving Oklahoma trust documents. With flexible subscription options, users can select plans that suit their budget while gaining access to essential features for document management. Take advantage of our free trial to explore how we can help with your Oklahoma trust.

-

Can I customize my trust documents using airSlate SignNow?

Yes, airSlate SignNow allows you to customize your trust documents to meet the specific requirements of your Oklahoma trust. You can easily add fields, logos, and text to create documents that reflect your needs. Customization signNowly simplifies the process of preparing trust-related paperwork.

-

Is airSlate SignNow secure for managing Oklahoma trust documents?

Absolutely! airSlate SignNow prioritizes the security of your documents, including Oklahoma trust agreements. We implement industry-standard encryption and compliance measures to protect your sensitive information throughout the document lifecycle.

-

What integrations does airSlate SignNow offer for managing Oklahoma trusts?

airSlate SignNow integrates seamlessly with various popular applications, enhancing your ability to manage Oklahoma trusts effectively. Whether you use CRMs, cloud storage solutions, or productivity tools, our integrations can help streamline your workflow and keep all your trust-related information organized.

-

What benefits can I expect from using airSlate SignNow for Oklahoma trust management?

Using airSlate SignNow for managing your Oklahoma trust provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies document management tasks, allowing you to focus on your financial planning. Experience the convenience of electronic signatures without sacrificing compliance.

Get more for Oklahoma Trust

- Master lease agreement energize connecticut form

- Ex 1017 4 ex10 17htm master lease master form

- Master frame agreement for services between city of form

- Electronic procurement virginia department of general form

- 11 form equipment maintenance agreement with a

- Agent iso agreement this agreement world payment form

- Cp contract sample 3 1 13 virginia air distributors form

- 14 form telecommunications service agreement

Find out other Oklahoma Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors