Sc Trust Form

What is the South Carolina Trust?

A South Carolina trust is a legal arrangement that allows an individual, known as the grantor, to transfer assets to a trustee. The trustee manages these assets on behalf of the beneficiaries. Trusts can serve various purposes, including estate planning, asset protection, and tax management. In South Carolina, trusts are governed by state laws, which outline the rights and responsibilities of all parties involved. This legal structure can help avoid probate, ensuring a smoother transition of assets upon the grantor's passing.

Key Elements of the South Carolina Trust

Understanding the key elements of a South Carolina trust is essential for effective management and compliance. The primary components include:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or institution responsible for managing the trust's assets according to the grantor's instructions.

- Beneficiaries: Individuals or entities that receive benefits from the trust, such as income or assets.

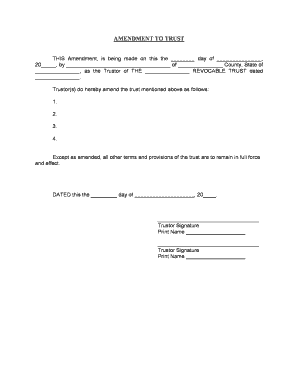

- Trust Document: A legal document that outlines the terms and conditions of the trust, including how assets should be managed and distributed.

Steps to Complete the South Carolina Trust

Creating a South Carolina trust involves several steps to ensure it is legally valid and meets the grantor's intentions. Here are the essential steps:

- Determine the type of trust: Decide whether to establish a revocable or irrevocable trust based on your needs.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

- Draft the trust document: Work with a legal professional to create a comprehensive trust document that outlines all terms.

- Transfer assets: Legally transfer ownership of the chosen assets into the trust.

- Review and update: Regularly review the trust to ensure it aligns with your current wishes and legal requirements.

Legal Use of the South Carolina Trust

To ensure the legal validity of a South Carolina trust, it must comply with state laws and regulations. This includes proper drafting of the trust document, clear identification of the grantor, trustee, and beneficiaries, and adherence to any specific requirements for certain types of trusts. Additionally, the trust must be executed with the necessary formalities, such as signatures and, in some cases, notarization. Understanding these legal requirements helps prevent disputes and ensures the trust operates as intended.

Required Documents for the South Carolina Trust

Establishing a South Carolina trust requires specific documentation to ensure its legality and functionality. The primary documents include:

- Trust Agreement: The foundational document that outlines the terms and conditions of the trust.

- Asset Transfer Documents: Legal paperwork needed to transfer ownership of assets into the trust.

- Identification: Proof of identity for the grantor, trustee, and beneficiaries, which may include driver’s licenses or Social Security numbers.

- Tax Identification Number: If the trust is irrevocable, it may require its own tax identification number for tax purposes.

State-Specific Rules for the South Carolina Trust

South Carolina has specific rules governing the establishment and management of trusts. These regulations cover aspects such as the duties of trustees, the rights of beneficiaries, and the legal requirements for trust documentation. Familiarity with state-specific rules is crucial for anyone looking to create or manage a trust in South Carolina. This ensures compliance with local laws and helps protect the interests of all parties involved.

Quick guide on how to complete sc trust

Complete Sc Trust effortlessly on any gadget

Digital document administration has gained popularity among businesses and individuals. It offers an exceptional eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, alter, and eSign your files quickly without any hold-ups. Manage Sc Trust on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The optimal method to alter and eSign Sc Trust with ease

- Obtain Sc Trust and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your files or obscure sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, monotonous form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and eSign Sc Trust and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Carolina trust and why is it important?

A South Carolina trust is a legal entity that holds assets for the benefit of designated beneficiaries. It is important because it can help manage and protect assets, provide tax benefits, and ensure your estate is distributed according to your wishes. Establishing a South Carolina trust can also simplify the probate process, making it easier for your heirs.

-

How can airSlate SignNow assist with creating a South Carolina trust?

airSlate SignNow offers an easy-to-use interface for creating, signing, and managing documents related to a South Carolina trust. Our platform enables you to customize trust documents efficiently, ensuring they meet state requirements. With robust eSignature capabilities, you can securely finalize your trust documentation anytime, anywhere.

-

What features does airSlate SignNow provide for South Carolina trust documents?

airSlate SignNow provides features such as customizable templates for South Carolina trust documents, cloud storage for secure access, and eSignature functionality. Additionally, our platform offers real-time tracking and notifications to keep you updated on the signing status. These features streamline the process, making it efficient and reliable.

-

Is airSlate SignNow cost-effective for managing a South Carolina trust?

Yes, airSlate SignNow offers a cost-effective solution for managing your South Carolina trust. Our pricing plans are designed to suit different needs, ensuring that you receive the best value without compromising on quality. With our platform, you can save time and resources while maintaining legal compliance.

-

Can I integrate airSlate SignNow with my existing tools for South Carolina trust management?

Absolutely! airSlate SignNow integrates seamlessly with various tools you might already be using, including CRM systems and document management software. These integrations facilitate a smooth workflow for managing your South Carolina trust, enhancing efficiency and collaboration within your organization.

-

What are the benefits of using airSlate SignNow for my South Carolina trust?

Using airSlate SignNow for your South Carolina trust provides several benefits, including easy document creation, secure eSigning, and comprehensive tracking. The platform enhances document accessibility and collaboration, allowing both trustees and beneficiaries to interact effectively. Additionally, our user-friendly interface simplifies the overall trust management process.

-

How secure is airSlate SignNow when handling South Carolina trust documents?

airSlate SignNow takes security seriously, employing robust encryption and compliance with industry standards to protect your South Carolina trust documents. We ensure that all data is securely stored and that access is controlled, minimizing the risk of unauthorized access. Your trust documents will be safe and secure with us.

Get more for Sc Trust

- Agreement ford motor co and bolt inc sample form

- Final rule secgovhome form

- Management and consulting agreement active marketing llc form

- Sec info morgan stanley institutional fund inc n 30d form

- Web site and cybercasting agreement form

- Free sales representative agreement findformscom

- Danny w fordhistoripedia official wikifandom form

- Products use and general services form

Find out other Sc Trust

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF