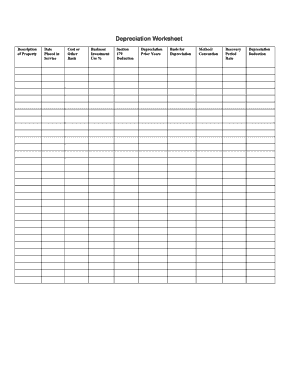

Depreciation Worksheet Form

What is the Depreciation Worksheet

The depreciation worksheet is a financial tool used to calculate the depreciation of assets over time. It helps businesses and individuals track the decrease in value of their assets, which is essential for accurate accounting and tax reporting. This worksheet typically includes sections for asset details, acquisition costs, useful life estimates, and depreciation methods. By organizing this information, users can assess their assets' value and ensure compliance with IRS regulations.

How to use the Depreciation Worksheet

To effectively use the depreciation worksheet, begin by gathering all relevant information about your assets. This includes the purchase date, cost, and expected lifespan. Next, select the appropriate depreciation method, such as straight-line or declining balance. Enter the data into the worksheet, ensuring that each section is filled out accurately. Regularly update the worksheet to reflect any changes, such as asset disposals or new acquisitions, to maintain accurate records for financial reporting and tax purposes.

Steps to complete the Depreciation Worksheet

Completing the depreciation worksheet involves several key steps:

- Identify the assets you wish to depreciate.

- Gather necessary information, including acquisition costs and useful life.

- Select a depreciation method that aligns with your accounting practices.

- Fill in the worksheet with the collected data, ensuring accuracy.

- Calculate the annual depreciation expense based on your chosen method.

- Review the completed worksheet for any discrepancies before finalizing.

Legal use of the Depreciation Worksheet

The legal use of the depreciation worksheet is crucial for compliance with IRS regulations. Accurate depreciation calculations can impact tax liabilities and financial statements. To ensure legal validity, the worksheet must adhere to the guidelines set forth by the IRS, including proper documentation of asset purchases and depreciation methods. Using a reliable electronic solution can also enhance the legal standing of the completed worksheet by providing a secure and verifiable record of the information entered.

IRS Guidelines

The IRS provides specific guidelines for using depreciation worksheets, which include instructions on acceptable depreciation methods and record-keeping requirements. It is essential to follow these guidelines to avoid penalties and ensure accurate tax reporting. The IRS outlines various depreciation methods, such as Modified Accelerated Cost Recovery System (MACRS), and stipulates the documentation needed to support depreciation claims. Familiarizing yourself with these guidelines can help streamline the process and ensure compliance.

Required Documents

To complete the depreciation worksheet, certain documents are necessary. These typically include:

- Purchase invoices or receipts for the assets.

- Documentation of the asset's useful life and depreciation method.

- Previous tax returns if applicable, to reference prior depreciation claims.

- Financial statements that may include asset valuations.

Having these documents readily available will facilitate an accurate and efficient completion of the depreciation worksheet.

Examples of using the Depreciation Worksheet

Examples of using the depreciation worksheet can illustrate its practical application. For instance, a small business may use the worksheet to calculate the depreciation of office equipment purchased for $5,000 with a useful life of five years. By applying the straight-line method, the business would record an annual depreciation expense of $1,000. Similarly, a rental property owner might use the worksheet to track the depreciation of their property, which can significantly impact their taxable income. These examples highlight the versatility and importance of the depreciation worksheet in various financial scenarios.

Quick guide on how to complete depreciation worksheet 481374480

Prepare Depreciation Worksheet effortlessly on any device

Digital document management has become increasingly popular with businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, as you can access the right form and securely store it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without any holdups. Manage Depreciation Worksheet on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The simplest way to modify and electronically sign Depreciation Worksheet without hassle

- Locate Depreciation Worksheet and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Depreciation Worksheet and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a depreciation worksheet and how can airSlate SignNow help?

A depreciation worksheet is a tool that helps businesses track asset depreciation over time. airSlate SignNow provides an easy-to-use platform for creating and managing your depreciation worksheets, ensuring that you have accurate financial records and documentation for tax purposes.

-

How does airSlate SignNow ensure the security of my depreciation worksheet?

Security is a priority for airSlate SignNow. We employ industry-standard encryption and secure access protocols to protect your depreciation worksheet and sensitive data, ensuring that only authorized users can make changes or view documents.

-

Can I integrate existing accounting software with airSlate SignNow to work on my depreciation worksheet?

Yes, airSlate SignNow offers integrations with various accounting software solutions, allowing you to easily import data needed for your depreciation worksheet. This feature streamlines your workflow and minimizes manual data entry, saving you time and reducing errors.

-

What are the pricing options for using airSlate SignNow for my depreciation worksheet?

airSlate SignNow provides flexible pricing plans to accommodate businesses of all sizes. Whether you need basic features or advanced tools for managing your depreciation worksheet, there’s a plan that fits your needs, and you can start with a free trial to find the best match.

-

Can I share my depreciation worksheet with colleagues using airSlate SignNow?

Absolutely! airSlate SignNow makes it easy to share your depreciation worksheet with colleagues for collaboration. You can invite team members to review, edit, or eSign documents, ensuring everyone stays on the same page regarding asset management.

-

What features does airSlate SignNow offer for managing a depreciation worksheet?

airSlate SignNow offers a variety of features tailored to managing your depreciation worksheet, such as customizable templates, automated workflows, and eSignature capabilities. These features help streamline the process of monitoring your assets while maintaining compliance with tax regulations.

-

Is there customer support available for using airSlate SignNow with my depreciation worksheet?

Yes, airSlate SignNow provides comprehensive customer support to assist you with any questions or issues related to your depreciation worksheet. Our support team is available via chat, email, or phone to ensure you have the help you need for a smooth experience.

Get more for Depreciation Worksheet

- State of new jersey agriculture retention and development program form

- Real estate forms get printable rental forms online

- Control number nj evic pkg form

- Uniform summary support order 490200147

- Rule 4 3 divisions venue transfer of actions nj courts form

- Form of order order of protection

- 54 2g form

- Temporary support order new jersey family practice justia form

Find out other Depreciation Worksheet

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself