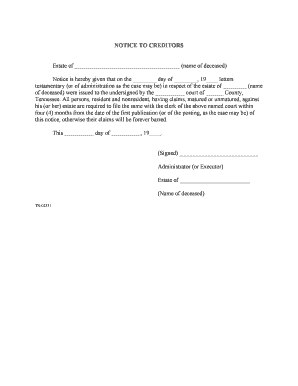

Tennessee Notice to Creditors of Estate Form

What is the Tennessee Notice To Creditors Of Estate

The Tennessee Notice To Creditors Of Estate is a legal document that serves to inform creditors of a deceased person's estate about the probate process. This notice is essential for ensuring that all debts and claims against the estate are properly addressed. It outlines the necessary steps for creditors to file their claims within a specified timeframe, which is typically four months from the date of the notice. By providing this notice, the executor or administrator of the estate fulfills their legal obligation to notify all interested parties about the estate's administration.

How to use the Tennessee Notice To Creditors Of Estate

To utilize the Tennessee Notice To Creditors Of Estate, the executor or administrator must first complete the form accurately. This involves providing essential details such as the decedent's name, date of death, and the name and contact information of the executor. Once the form is filled out, it must be published in a local newspaper and sent to known creditors. This ensures that all potential claimants are aware of the estate proceedings and can take appropriate action regarding their claims.

Steps to complete the Tennessee Notice To Creditors Of Estate

Completing the Tennessee Notice To Creditors Of Estate involves several key steps:

- Gather necessary information about the decedent, including their full name and date of death.

- Identify all known creditors and their contact details.

- Fill out the notice form, ensuring all required information is included.

- Publish the notice in a local newspaper for a specified duration, usually once a week for four consecutive weeks.

- Send copies of the notice to known creditors via certified mail.

- Keep records of publication and mailing as proof of compliance.

Key elements of the Tennessee Notice To Creditors Of Estate

The key elements of the Tennessee Notice To Creditors Of Estate include:

- Decedent's Information: Full name and date of death.

- Executor's Information: Name and contact details of the executor or administrator.

- Claim Filing Deadline: The timeframe within which creditors must file their claims, typically four months.

- Publication Details: Information on where and when the notice will be published.

Legal use of the Tennessee Notice To Creditors Of Estate

The legal use of the Tennessee Notice To Creditors Of Estate is crucial in the probate process. This notice serves to protect the rights of both the estate and the creditors. By formally notifying creditors, the executor ensures that all claims are addressed within the legal timeframe, preventing future disputes. Failure to provide this notice may result in claims being barred, which could lead to legal complications for the estate and its beneficiaries.

Filing Deadlines / Important Dates

Filing deadlines for the Tennessee Notice To Creditors Of Estate are critical to the probate process. The notice must be published within a reasonable time after the appointment of the executor. Creditors typically have four months from the date of the first publication to submit their claims. It is essential for the executor to adhere to these timelines to ensure compliance with Tennessee probate laws and to protect the estate from potential legal issues.

Quick guide on how to complete tennessee notice to creditors of estate

Complete Tennessee Notice To Creditors Of Estate effortlessly on any device

Managing documents online has become prevalent among companies and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, as you can locate the right template and securely save it online. airSlate SignNow provides you with all the features necessary to create, modify, and eSign your documents swiftly without delays. Handle Tennessee Notice To Creditors Of Estate on any platform with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and eSign Tennessee Notice To Creditors Of Estate with ease

- Locate Tennessee Notice To Creditors Of Estate and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your alterations.

- Select how you would like to share your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device you prefer. Alter and eSign Tennessee Notice To Creditors Of Estate and guarantee outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Tennessee Notice To Creditors Of Estate?

A Tennessee Notice To Creditors Of Estate is a legal document that notifies creditors of a deceased person's estate about the need to submit claims for payment. This notice helps ensure that all debts are settled before the estate is distributed to beneficiaries, making it a crucial part of estate administration in Tennessee.

-

How can airSlate SignNow assist with the Tennessee Notice To Creditors Of Estate?

airSlate SignNow provides an efficient platform to create, send, and eSign your Tennessee Notice To Creditors Of Estate. With its user-friendly interface, you can streamline the process of notifying creditors, ensuring that all necessary documentation is easily accessible and properly executed.

-

What features does airSlate SignNow offer for estate management?

airSlate SignNow offers a variety of features for estate management, including customizable document templates, secure eSigning, and an intuitive document tracking system. These tools facilitate the timely and accurate filing of a Tennessee Notice To Creditors Of Estate, helping executors manage their responsibilities more effectively.

-

Is there a cost associated with using airSlate SignNow for the Tennessee Notice To Creditors Of Estate?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be cost-effective for individuals and businesses alike. The pricing plans are flexible and can accommodate various needs, ensuring you can efficiently manage your Tennessee Notice To Creditors Of Estate without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing estates?

Absolutely! airSlate SignNow integrates seamlessly with a range of tools and software, enhancing your ability to manage documents related to a Tennessee Notice To Creditors Of Estate. By connecting with your existing systems, you can create a streamlined workflow that maximizes efficiency.

-

What are the benefits of using airSlate SignNow for the Tennessee Notice To Creditors Of Estate?

Using airSlate SignNow for the Tennessee Notice To Creditors Of Estate delivers numerous benefits, including faster document processing, reduced paperwork errors, and enhanced security. These features not only save you time but also provide peace of mind knowing your legal documents are in compliance with Tennessee regulations.

-

How long does it take to prepare a Tennessee Notice To Creditors Of Estate using airSlate SignNow?

Preparing a Tennessee Notice To Creditors Of Estate with airSlate SignNow is quick and efficient, often taking just a few minutes. With ready-made templates and straightforward eSigning processes, you can have your notice ready to send in no time.

Get more for Tennessee Notice To Creditors Of Estate

- Doe et al v reed washington secretary of state et al form

- Court forms surrender of weapons forms washington state courts

- Hearing type codes valid case types washington state courts form

- Weapons that i own or have in my possession or control and any concealed pistol form

- Surrender weapons and concealed pistol washington state courts form

- Note if you previously surrendered your firearms other dangerous weapons and concealed form

- Domestic violence protection order process washington state courts form

- Court forms vulnerable adult protection washington state courts

Find out other Tennessee Notice To Creditors Of Estate

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document