No Creditors Form

What is the No Creditors

The term "no creditors" typically refers to a declaration or affidavit that asserts an individual or entity has no outstanding debts or obligations to creditors. This declaration can be important in various legal and financial contexts, such as during bankruptcy proceedings or when applying for certain types of loans or financial assistance. The affidavit serves as a formal statement that provides assurance to interested parties that the individual or entity is not currently in debt, which can help facilitate smoother transactions and approvals.

How to use the No Creditors

Using the no creditors affidavit involves several steps to ensure that the document is properly completed and legally binding. First, gather all necessary information, including personal identification details and any relevant financial statements that support your claim of having no creditors. Next, fill out the affidavit form accurately, ensuring that all information is truthful and complete. After completing the form, sign it in the presence of a notary public, if required. This notarization adds an additional layer of authenticity to your declaration, making it more likely to be accepted by lenders or courts.

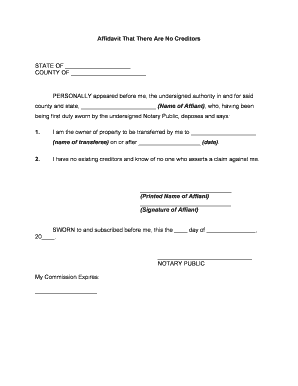

Key elements of the No Creditors

When preparing a no creditors affidavit, certain key elements must be included to ensure its validity. These elements typically consist of:

- Personal Information: Full name, address, and contact details of the individual or entity making the declaration.

- Statement of No Creditors: A clear statement asserting that there are no outstanding debts or obligations.

- Supporting Evidence: Any documentation that supports the claim, such as bank statements or credit reports.

- Signature and Notarization: The signature of the individual or authorized representative, along with a notary public's seal, if applicable.

Steps to complete the No Creditors

Completing the no creditors affidavit involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather necessary documentation, including identification and financial records.

- Obtain the official no creditors affidavit form, which may be available from legal resources or financial institutions.

- Fill out the form with accurate and truthful information.

- Review the completed form for any errors or omissions.

- Sign the affidavit in front of a notary public, if required.

- Submit the completed affidavit to the relevant parties, such as lenders or courts, as needed.

Legal use of the No Creditors

The legal use of a no creditors affidavit is significant in various financial and legal scenarios. It can be utilized when applying for loans, as lenders often require assurance that the applicant has no outstanding debts. Additionally, it may be necessary in legal proceedings, such as bankruptcy cases, to verify an individual's financial status. The affidavit serves as a formal declaration that can help protect the individual from future claims by creditors, thereby providing peace of mind during financial transactions.

Eligibility Criteria

To be eligible to file a no creditors affidavit, individuals or entities typically must meet certain criteria. These may include:

- Being free from any outstanding debts or obligations to creditors.

- Providing accurate and truthful information in the affidavit.

- Being of legal age or having an authorized representative if a minor or incapacitated.

It is crucial to ensure that all eligibility requirements are met before submitting the affidavit to avoid potential legal complications.

Quick guide on how to complete no creditors

Finalize No Creditors effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed papers, as you can find the appropriate template and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents promptly without holdups. Manage No Creditors on any system using airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and eSign No Creditors with ease

- Obtain No Creditors and click Get Form to initiate.

- Employ the features we provide to complete your template.

- Emphasize signNow sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal significance as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Edit and eSign No Creditors and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to have no creditors when using airSlate SignNow?

Having no creditors means that your business can manage its financial obligations effectively while using airSlate SignNow for document management. This solution allows you to streamline your processes without worrying about financial liabilities tied to your electronic signatures.

-

How can airSlate SignNow help me avoid dealing with creditors?

By utilizing airSlate SignNow's efficient electronic signature capabilities, businesses can ensure timely documentation and contract management, signNowly reducing the chances of accumulating debts. When your agreements are processed quickly and accurately, you maintain a better financial standing with no creditors.

-

Is airSlate SignNow a cost-effective option for businesses concerned about creditors?

Yes, airSlate SignNow offers a cost-effective solution that does not compromise on quality. By using our service, businesses can save money on printing and mailing costs, giving them more control over their finances and reducing dependency on creditors.

-

What features does airSlate SignNow provide to manage documentation with no creditors?

AirSlate SignNow features customizable templates, automated workflows, and secure eSigning which together ensure that all documents are processed efficiently. These features reduce the risk of delays and disputes that could lead to creditor involvement.

-

Can I integrate airSlate SignNow with other applications to manage my finances with no creditors?

Absolutely! AirSlate SignNow integrates seamlessly with various applications such as CRM systems and accounting software. By connecting these tools, businesses can manage their financial processes better, leading to fewer chances of needing assistance from creditors.

-

How does airSlate SignNow benefit businesses that prefer working with no creditors?

The platform provides consistent tracking and compliance features that help businesses maintain clarity and organization in their document handling. When processes are transparent and efficient, businesses can avoid financial mismanagement and keep creditors at bay.

-

What pricing plans does airSlate SignNow offer for businesses with no creditors?

airSlate SignNow offers competitive pricing plans that cater to different business needs, ensuring you only pay for what you use. This pricing structure is ideal for businesses looking to maintain financial independence while avoiding reliance on creditors.

Get more for No Creditors

- Destruction and damage if the project is destroyed or damaged for any reason form

- And specifications are hereby made a part of this contract and may contain pictures diagrams or form

- Landscaping or finish grading is to be performed at the work site by the contractor

- Except where such destruction or damage was caused by the sole negligence of the contractor or form

- Foundation windows form

- Garage door sensors form

- Its subcontractors owner shall pay contractor for any additional work done by contractor in form

- At page document number of county south form

Find out other No Creditors

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word