California Trust Form

What is the California Trust Form

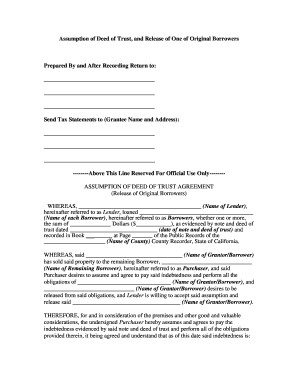

The California Trust Form is a legal document used to establish a trust in the state of California. It outlines the terms and conditions under which the trust operates, detailing the responsibilities of the trustee and the rights of the beneficiaries. This form is essential for individuals looking to manage their assets effectively, ensuring that their wishes are honored after their passing. A properly executed California Trust Form can help avoid probate, providing a smoother transition of assets to heirs.

How to use the California Trust Form

Using the California Trust Form involves several key steps. First, individuals must gather all necessary information regarding their assets and beneficiaries. Next, the form should be filled out accurately, ensuring that all details are complete and correct. Once completed, the form must be signed by the trustor and notarized to ensure its legal validity. It is advisable to keep copies of the signed form in a safe place and to inform the trustee of its location. This ensures that the trust can be executed according to the trustor's wishes.

Steps to complete the California Trust Form

Completing the California Trust Form requires careful attention to detail. Follow these steps for successful completion:

- Gather all relevant information about assets, beneficiaries, and the trustee.

- Fill out the form, ensuring all sections are completed accurately.

- Review the form for any errors or omissions.

- Sign the form in the presence of a notary public to validate the document.

- Distribute copies to all relevant parties, including the trustee and beneficiaries.

Legal use of the California Trust Form

The California Trust Form is legally binding when executed according to state laws. To ensure its legal use, it must comply with California's specific requirements for trusts. This includes proper notarization and adherence to the state's regulations regarding trust management. Additionally, the form must clearly outline the terms of the trust, including the identification of the trustee and beneficiaries, to avoid disputes in the future. Understanding these legal requirements is crucial for the trust to be enforceable.

Key elements of the California Trust Form

Several key elements must be included in the California Trust Form to ensure its effectiveness:

- Trustor's Information: The name and contact details of the individual creating the trust.

- Trustee Designation: Identification of the person or entity responsible for managing the trust.

- Beneficiaries: Names and details of individuals or organizations that will benefit from the trust.

- Assets Included: A detailed list of assets that will be placed in the trust.

- Terms of Distribution: Clear instructions on how and when the assets will be distributed to beneficiaries.

State-specific rules for the California Trust Form

California has specific rules governing the creation and management of trusts. These rules dictate how the California Trust Form must be completed and executed. For instance, the trustor must be of legal age and sound mind when creating the trust. Additionally, California law requires that the trust be in writing and signed by the trustor. Understanding these state-specific regulations is essential to ensure that the trust is valid and enforceable.

Quick guide on how to complete california trust form

Complete California Trust Form effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without interruptions. Manage California Trust Form on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to edit and eSign California Trust Form with ease

- Locate California Trust Form and click Get Form to initiate.

- Employ the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign California Trust Form and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the California One Form and how does it work with airSlate SignNow?

The California One Form is a streamlined document designed for ease of use in various business transactions. With airSlate SignNow, you can easily create, send, and eSign the California One Form, ensuring that all parties can complete the necessary documents quickly and efficiently.

-

What are the benefits of using airSlate SignNow for the California One Form?

Using airSlate SignNow for the California One Form offers numerous benefits, including reduced turnaround time for documents, enhanced security features, and easy access from any device. It simplifies the signing process, allowing businesses to focus on their core activities while ensuring compliance and effectiveness.

-

Is airSlate SignNow compatible with the California One Form's requirements?

Yes, airSlate SignNow is fully compatible with the California One Form and adheres to all legal requirements. This ensures that your electronically signed documents are valid and recognized by California authorities, offering peace of mind for all users.

-

What pricing plans are available for using airSlate SignNow with the California One Form?

airSlate SignNow offers various pricing plans to suit the needs of different businesses, including a free trial. Each plan includes features that support the California One Form, allowing you to choose one that fits your budget while providing necessary functionalities.

-

Can I integrate airSlate SignNow with other tools when using the California One Form?

Absolutely! airSlate SignNow offers seamless integrations with many popular applications to enhance your workflow. This means you can easily connect the California One Form with your existing tools, improving productivity and collaboration within your organization.

-

How secure is airSlate SignNow when handling the California One Form?

airSlate SignNow takes security seriously, implementing advanced encryption and compliance measures to protect your documents. When you use the California One Form with airSlate SignNow, you can rest assured that your information is safeguarded against unauthorized access.

-

What features make airSlate SignNow the best choice for the California One Form?

With features like customizable templates, real-time tracking, and automated reminders, airSlate SignNow is designed to simplify the process of handling the California One Form. These tools make it easy to manage document workflows while ensuring that every signature is collected promptly.

Get more for California Trust Form

- Tennessee statewide multimodal freight plan tngov form

- Bridge financing warrant form

- Sabre a preliminary proxy statement providing form

- Articles of incorporation procter ampampamp gamble co findlaw form

- Waiver of notice templatelegalnature form

- At the offices of the corporation insert address on 19 pursuant form

- 1800704 wisconsin legislature form

- A131 the form in which documents must be submitted 06072015

Find out other California Trust Form

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure