Form U 6, Rev , Public Service Company Tax Return 2025-2026

What is the Form U-6, Rev, Public Service Company Tax Return

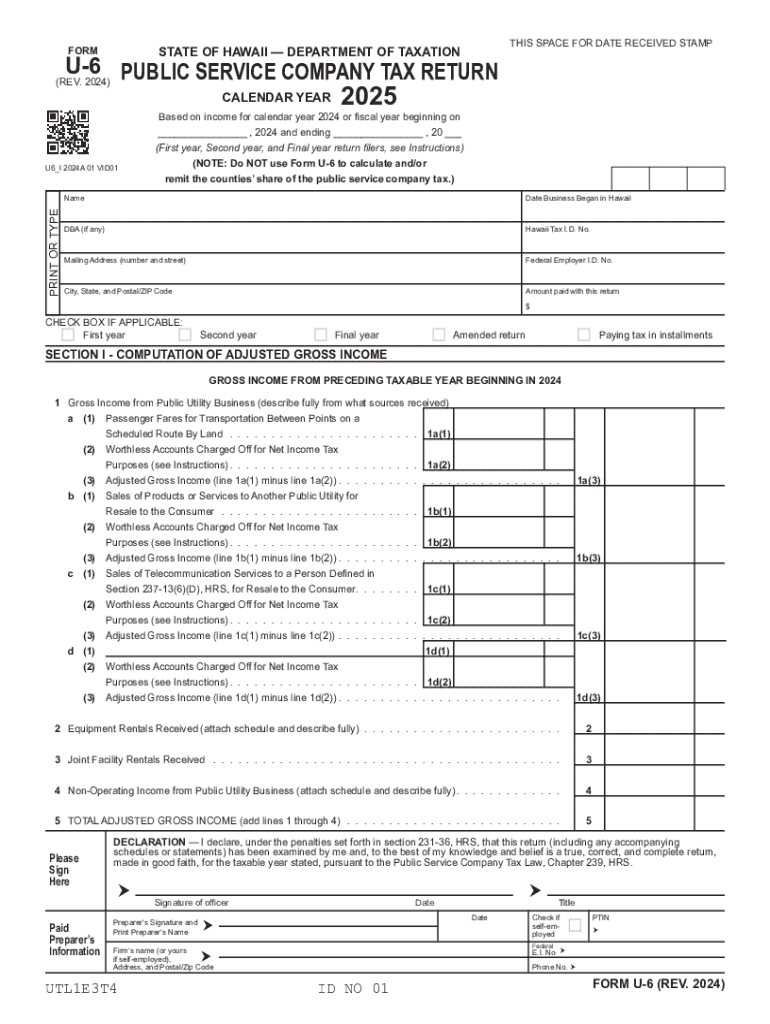

The Form U-6, Rev, is a tax return specifically designed for public service companies operating in Hawaii. This form is essential for reporting income and expenses related to the provision of public services, such as utilities and transportation. It ensures that companies comply with state tax regulations and contribute appropriately to state revenue. The form captures vital financial information, allowing the state to assess the tax liability of these companies effectively.

How to use the Form U-6, Rev, Public Service Company Tax Return

Using the Form U-6, Rev, involves several steps to ensure accurate completion and submission. Companies must gather all relevant financial data, including income statements and expense reports. The form requires detailed entries regarding revenue generated from public services, operational costs, and any applicable deductions. Once completed, the form must be submitted to the appropriate state tax authority by the designated deadline to avoid penalties.

Steps to complete the Form U-6, Rev, Public Service Company Tax Return

Completing the Form U-6, Rev, involves a systematic approach:

- Gather Financial Records: Collect all necessary documents, including income statements, expense reports, and previous tax returns.

- Fill Out the Form: Enter the required information accurately, ensuring all figures are correct and match your financial records.

- Review for Accuracy: Double-check all entries for errors or omissions to avoid complications during processing.

- Submit the Form: File the completed form by the deadline, either online or via mail, depending on your preference.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the Form U-6, Rev. Typically, the return must be filed annually, with specific due dates set by the state of Hawaii. Companies should mark their calendars to ensure timely submission, as late filings may incur penalties and interest on unpaid taxes. Staying informed about these dates helps maintain compliance and avoid unnecessary financial burdens.

Penalties for Non-Compliance

Failure to comply with the requirements of the Form U-6, Rev, can result in significant penalties for public service companies. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is essential for companies to understand the implications of non-compliance and to take proactive measures to file accurately and on time. Ensuring adherence to tax obligations protects the company’s financial standing and reputation.

Required Documents

When preparing to complete the Form U-6, Rev, several documents are necessary to support the information provided. These include:

- Financial statements, including balance sheets and income statements.

- Expense documentation, such as invoices and receipts related to public service operations.

- Previous tax returns for reference and consistency.

- Any additional documentation required by the state to substantiate claims made on the form.

Create this form in 5 minutes or less

Find and fill out the correct form u 6 rev public service company tax return

Create this form in 5 minutes!

How to create an eSignature for the form u 6 rev public service company tax return

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the hawaii u6 tax and how does it affect my business?

The hawaii u6 tax refers to a specific tax regulation in Hawaii that impacts businesses operating within the state. Understanding this tax is crucial for compliance and financial planning. By utilizing airSlate SignNow, you can streamline your document management processes related to tax filings, ensuring you stay compliant with hawaii u6 tax requirements.

-

How can airSlate SignNow help with hawaii u6 tax documentation?

airSlate SignNow provides an efficient platform for creating, sending, and eSigning documents related to hawaii u6 tax. Our solution simplifies the process of managing tax documents, allowing you to focus on your business. With our user-friendly interface, you can ensure that all necessary paperwork is completed accurately and on time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. Our plans are designed to provide cost-effective solutions while ensuring you have the tools needed to manage hawaii u6 tax documents efficiently. Visit our pricing page to find the plan that best fits your needs.

-

Does airSlate SignNow integrate with other software for hawaii u6 tax management?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software, making it easier to manage hawaii u6 tax documentation. These integrations allow for smooth data transfer and enhanced workflow efficiency. By connecting your existing tools with airSlate SignNow, you can streamline your tax processes.

-

What features does airSlate SignNow offer for managing hawaii u6 tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing hawaii u6 tax documents. These features help ensure that your documents are completed accurately and securely. Additionally, our platform allows for easy collaboration among team members.

-

Is airSlate SignNow suitable for small businesses dealing with hawaii u6 tax?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for small businesses managing hawaii u6 tax documentation. Our platform is user-friendly and provides all the necessary tools to help small businesses stay compliant without overwhelming costs. You can easily manage your tax documents with our intuitive interface.

-

How secure is airSlate SignNow for handling hawaii u6 tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your hawaii u6 tax documents. You can trust that your sensitive information is safe while using our platform, allowing you to focus on your business without worrying about data bsignNowes.

Get more for Form U 6, Rev , Public Service Company Tax Return

Find out other Form U 6, Rev , Public Service Company Tax Return

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors