Deed Grantor Grantee Form

What is the Deed Grantor Grantee

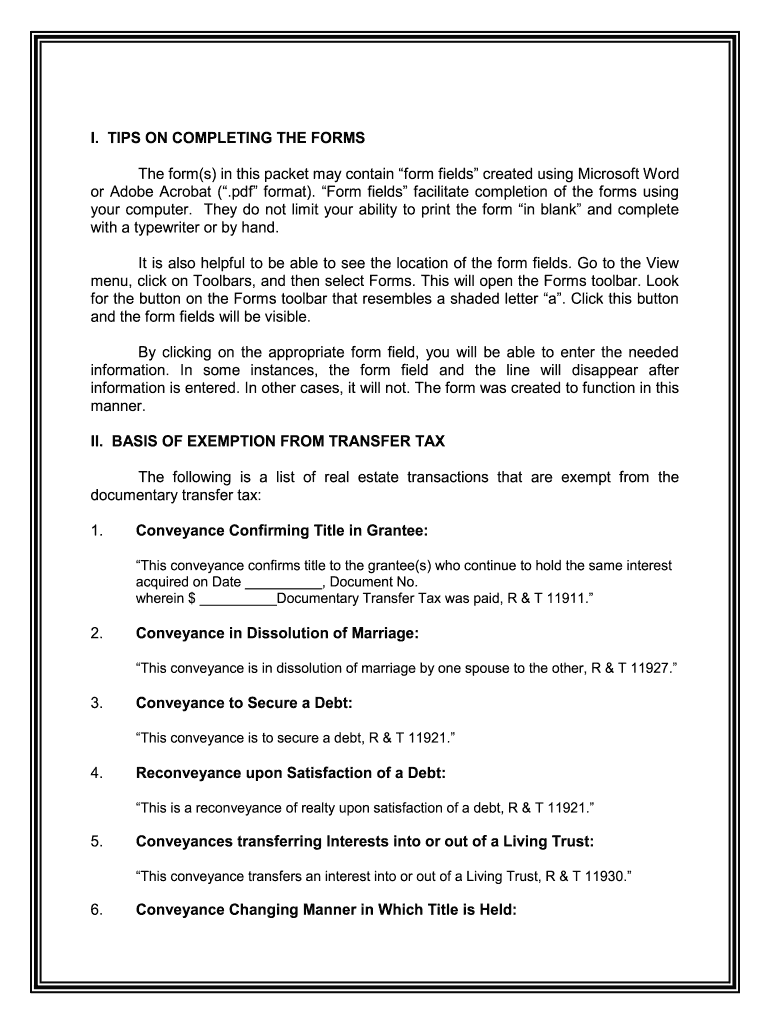

The deed grantor grantee is a legal document that facilitates the transfer of property ownership from one party (the grantor) to another (the grantee). This form outlines the specifics of the transaction, including the names and addresses of both parties, a description of the property, and any conditions or restrictions related to the transfer. Understanding this document is essential for anyone involved in real estate transactions, as it serves as the foundation for establishing legal ownership.

How to use the Deed Grantor Grantee

Using the deed grantor grantee involves several steps to ensure the document is correctly filled out and executed. First, both parties must agree on the terms of the property transfer. Next, the grantor needs to complete the form by providing accurate information about themselves and the grantee, along with details about the property being transferred. Once completed, the document must be signed by the grantor, and in many cases, it should be notarized to enhance its legal standing. Finally, the completed form should be filed with the appropriate local government office to officially record the transfer.

Steps to complete the Deed Grantor Grantee

Completing the deed grantor grantee involves a systematic approach to ensure accuracy and legality. Follow these steps:

- Gather necessary information, including the full names and addresses of the grantor and grantee.

- Provide a detailed description of the property, including its legal description and any relevant parcel numbers.

- Specify any conditions of the transfer, such as easements or restrictions.

- Sign the document in the presence of a notary public, if required by state law.

- Submit the completed form to the local recording office to finalize the transfer.

Key elements of the Deed Grantor Grantee

Several key elements must be included in the deed grantor grantee to ensure its validity:

- Grantor and Grantee Information: Full names and addresses of both parties.

- Property Description: A complete legal description of the property being transferred.

- Consideration: The amount paid for the property, if applicable.

- Signatures: Signatures of the grantor and any required witnesses or notaries.

- Date: The date when the deed is executed.

Legal use of the Deed Grantor Grantee

The deed grantor grantee is legally binding once executed and recorded. It serves as proof of ownership and is crucial in protecting the rights of both the grantor and grantee. To ensure its legal use, it must comply with state-specific regulations, which may dictate how the document should be formatted, signed, and filed. Failure to adhere to these regulations can result in disputes or challenges to the validity of the property transfer.

State-specific rules for the Deed Grantor Grantee

Each state in the U.S. has its own regulations governing the use of the deed grantor grantee. These rules can affect various aspects, such as the required information, notarization requirements, and filing procedures. It is essential for both grantors and grantees to familiarize themselves with their state's specific laws to ensure compliance and avoid potential legal issues. Consulting with a real estate attorney or local government office can provide clarity on these requirements.

Quick guide on how to complete deed grantor grantee 481376831

Accomplish Deed Grantor Grantee effortlessly on any gadget

Digital document administration has become increasingly favored among enterprises and individuals. It offers an ideal environmentally-friendly substitute to conventional printed and signed documents, as you can easily find the appropriate template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Deed Grantor Grantee on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to alter and electronically sign Deed Grantor Grantee without hassle

- Obtain Deed Grantor Grantee and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes just moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or through an invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Deed Grantor Grantee and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of a deed grantor grantee in the signing process?

In the signing process, a deed grantor grantee typically refers to the parties involved in a transaction. The grantor is the party transferring the property, while the grantee is the recipient. Understanding this distinction is crucial for proper documentation and ensures a smooth eSignature experience with airSlate SignNow.

-

How can airSlate SignNow assist in the documentation of deed grantor grantee transactions?

airSlate SignNow streamlines the process of creating and managing documents for deed grantor grantee transactions. Our platform enables users to customize templates, ensuring all necessary fields are included for both parties. This reduces errors and expedites the signing process.

-

What features does airSlate SignNow offer for handling deed grantor grantee agreements?

AirSlate SignNow provides features such as customizable templates, automated workflows, and real-time tracking of document status. These tools can simplify the execution of deeds, making it easier for grantors and grantees to manage their agreements efficiently.

-

Is airSlate SignNow cost-effective for managing deed grantor grantee documents?

Yes, airSlate SignNow offers cost-effective pricing plans tailored to several business needs, including those involving deed grantor grantee documents. With no hidden fees and a user-friendly interface, our platform makes it accessible for businesses of all sizes to utilize eSignatures.

-

Does airSlate SignNow integrate with other tools for deed grantor grantee documentation?

Absolutely! airSlate SignNow seamlessly integrates with popular tools and software that can aid in the documentation of deed grantor grantee transactions. These integrations enhance workflow efficiency and ensure you have all the resources needed to manage your eSignature processes effectively.

-

What are the benefits of using airSlate SignNow for deed grantor grantee processes?

The benefits of using airSlate SignNow for deed grantor grantee processes include improved efficiency, enhanced security, and reduced turnaround times. By utilizing our platform, both grantors and grantees can confidently execute their transactions while ensuring compliance with legal standards.

-

How secure is airSlate SignNow for managing sensitive deed grantor grantee agreements?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive deed grantor grantee agreements. Our platform uses advanced encryption methods and complies with industry standards to protect your documents and data throughout the signing process.

Get more for Deed Grantor Grantee

- Confidentiality agreement shrm form

- To departing employee dear mr smith since you have form

- 5856 congressional record house april 17 social security form

- How to manage your contact list in excel template form

- In regards to changing the nameaddress of a party form

- Ucc financing statement ucc1 nebraska secretary of state form

- Hereby release indemnify and hold harmless and forever form

- Lmss liability and release waiver smartwaiver form

Find out other Deed Grantor Grantee

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form

- Can I eSign Hawaii Legal Document

- How To eSign Hawaii Legal Document

- Help Me With eSign Hawaii Legal Document

- How To eSign Illinois Legal Form

- How Do I eSign Nebraska Life Sciences Word

- How Can I eSign Nebraska Life Sciences Word

- Help Me With eSign North Carolina Life Sciences PDF