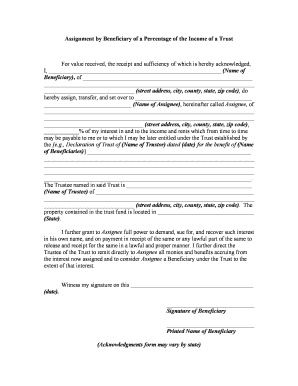

Beneficiary Income Form

Understanding Beneficiary Income

Beneficiary income refers to the financial benefits received by a beneficiary from a trust or estate. This income can include distributions from various types of trusts, such as irrevocable trusts or living trusts. The amount and frequency of these distributions may vary based on the terms set forth in the trust document. Beneficiaries typically receive income generated from the trust's assets, which can include dividends, interest, or rental income.

Steps to Complete the Beneficiary Income Form

Completing the beneficiary income form involves several key steps to ensure accuracy and compliance with legal requirements. First, gather all necessary documentation, including the trust agreement and any previous tax returns. Next, accurately fill out the form by providing personal information, details about the trust, and the specific income amounts received. It is crucial to review the form for completeness and correctness before submission. Lastly, ensure that the form is signed and dated appropriately to validate the submission.

Legal Use of Beneficiary Income

The legal use of beneficiary income is governed by the terms of the trust and applicable state laws. Beneficiaries must understand their rights and obligations regarding the income received. This includes reporting the income for tax purposes, as it may be subject to income tax. Additionally, beneficiaries should be aware of any restrictions on how the income can be used, as specified in the trust document. Consulting with a legal professional can provide clarity on these obligations.

Required Documents for Beneficiary Income

When completing a beneficiary income form, certain documents are essential for accurate reporting. These typically include:

- The trust agreement outlining the terms of distribution.

- Documentation of income received, such as bank statements or distribution notices.

- Previous tax returns, if applicable, to provide a comprehensive financial picture.

Having these documents on hand will facilitate a smoother completion process and ensure compliance with legal requirements.

IRS Guidelines for Beneficiary Income

The Internal Revenue Service (IRS) provides specific guidelines regarding the taxation of beneficiary income. Beneficiaries must report any income received from trusts on their tax returns. The IRS requires that beneficiaries receive a Schedule K-1 form from the trust, detailing the income distributed. Understanding these guidelines is crucial for accurate tax reporting and avoiding potential penalties.

Examples of Using Beneficiary Income

Beneficiary income can be utilized in various ways, depending on the beneficiary's needs and the terms of the trust. Common examples include:

- Using the income to cover living expenses, such as housing or education costs.

- Investing the income for future growth, such as purchasing stocks or bonds.

- Saving the income for retirement or other long-term financial goals.

Each beneficiary's situation is unique, and the use of income should align with personal financial strategies and the trust's stipulations.

Quick guide on how to complete beneficiary income

Finish Beneficiary Income effortlessly on any gadget

Web-based document management has gained traction among businesses and individuals. It presents an ideal eco-friendly substitute to traditional printed and signed documents, enabling you to find the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents swiftly without holdups. Manage Beneficiary Income on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and electronically sign Beneficiary Income with ease

- Find Beneficiary Income and click on Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Put an end to lost or misfiled documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Beneficiary Income and ensure outstanding communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary percentage trust?

A beneficiary percentage trust is a legal arrangement where assets are distributed among beneficiaries based on predetermined percentage allocations. This ensures that each beneficiary receives their entitled share, which can simplify estate planning and safeguard the wishes of the grantor.

-

How does airSlate SignNow support beneficiary percentage trusts?

airSlate SignNow streamlines the document signing process necessary for setting up a beneficiary percentage trust. With our electronic signature capabilities, you can easily send, sign, and manage trust documents, ensuring compliance and reducing the time spent on administrative tasks.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans that accommodate businesses of all sizes looking to manage beneficiary percentage trusts efficiently. Our affordable tiers give you access to essential features, including document templates and eSigning capabilities, without breaking the bank.

-

Can I customize templates for beneficiary percentage trust documents?

Yes, airSlate SignNow allows you to create and customize templates specifically for beneficiary percentage trust documents. This means you can tailor the language and format to meet your unique needs and ensure that all necessary clauses are included.

-

What benefits does airSlate SignNow provide for managing beneficiary percentage trusts?

With airSlate SignNow, managing beneficiary percentage trusts becomes intuitive and efficient. Our platform provides secure storage, easy access to documents, and tracking capabilities, so you can always stay updated on the status of your trust agreements.

-

Does airSlate SignNow integrate with other software for managing trusts?

Absolutely! airSlate SignNow offers integrations with various popular software solutions that can help manage beneficiary percentage trusts more effectively. These integrations can streamline your workflow by connecting your eSigning process with your existing document management systems.

-

Is electronic signing valid for beneficiary percentage trust documents?

Yes, electronic signing through airSlate SignNow is legally valid and recognized for beneficiary percentage trust documents. By using our platform, you can ensure that all electronic signatures comply with industry standards and regulations.

Get more for Beneficiary Income

- Arkansas real estate home sales package with offer to purchase contract of sale disclosure statements and more for residential form

- Georgia documents form

- Letter landlord tenant form

- Emancipation form

- New jersey real estate home sales package with offer to purchase contract of sale disclosure statements and more for form

- Secured promissory note form

- Malpractice form

- Texas pllc form

Find out other Beneficiary Income

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT