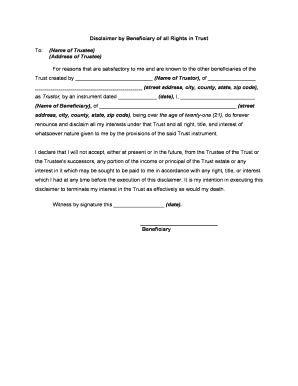

Beneficiary Trust Form

What is the beneficiary trust?

A beneficiary trust is a legal arrangement where a trustee holds assets for the benefit of designated beneficiaries. This type of trust ensures that the assets are managed and distributed according to the wishes of the trust creator, often referred to as the grantor. Beneficiary trusts can be used for various purposes, including estate planning, asset protection, and providing for minors or individuals with disabilities. Understanding the structure and purpose of a beneficiary trust is essential for anyone considering this option as part of their financial planning.

Key elements of the beneficiary trust

Several key elements define a beneficiary trust, making it distinct from other types of trusts. These include:

- Trustee: The individual or entity responsible for managing the trust assets and ensuring compliance with the trust's terms.

- Beneficiaries: The individuals or entities entitled to receive benefits from the trust, as specified by the grantor.

- Trust document: A legal document outlining the terms, conditions, and rules governing the trust, including how and when distributions are made.

- Assets: The property or funds placed into the trust, which can include real estate, investments, or cash.

These elements work together to create a framework that governs the trust's operation and ensures that the grantor's intentions are met.

Steps to complete the beneficiary trust

Completing a beneficiary trust involves several important steps to ensure its validity and effectiveness. Here’s a general outline of the process:

- Determine the purpose: Identify the specific goals for establishing the trust, such as asset protection or providing for dependents.

- Select a trustee: Choose a reliable individual or institution to manage the trust and act in the best interests of the beneficiaries.

- Draft the trust document: Work with a legal professional to create a comprehensive trust document that outlines the terms and conditions.

- Fund the trust: Transfer assets into the trust, ensuring proper title and ownership are established.

- Review and update: Regularly review the trust to ensure it aligns with changing circumstances or laws.

Following these steps can help ensure that the beneficiary trust is set up correctly and functions as intended.

Legal use of the beneficiary trust

The legal use of a beneficiary trust is governed by state laws and regulations, which can vary significantly across jurisdictions. It is essential to ensure compliance with these laws to avoid potential legal issues. Key legal considerations include:

- Trust validity: The trust must be created in accordance with state laws, including proper execution and documentation.

- Tax implications: Understanding the tax responsibilities associated with the trust, including income tax and estate tax considerations.

- Beneficiary rights: Beneficiaries have specific rights regarding information and distributions, which must be respected by the trustee.

Consulting with a legal expert can help navigate these complexities and ensure that the trust operates within the legal framework.

Examples of using the beneficiary trust

Beneficiary trusts can be employed in various scenarios, demonstrating their versatility in estate planning. Some common examples include:

- Providing for minors: A trust can ensure that funds are managed responsibly until a child reaches adulthood.

- Protecting assets from creditors: Establishing a trust can shield assets from potential claims in case of financial difficulties.

- Supporting individuals with disabilities: A special needs trust can provide for a disabled beneficiary without jeopardizing their eligibility for government benefits.

These examples illustrate how a beneficiary trust can be tailored to meet specific needs and circumstances.

Quick guide on how to complete beneficiary trust

Complete Beneficiary Trust seamlessly on any device

Digital document management has gained signNow traction among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow provides you with all the tools you need to create, adjust, and eSign your documents promptly without any hold-ups. Manage Beneficiary Trust on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to edit and eSign Beneficiary Trust effortlessly

- Find Beneficiary Trust and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize necessary sections of the documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Beneficiary Trust to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a disclaimer beneficiary and how does it work?

A disclaimer beneficiary is a person designated to receive benefits from an estate or trust, but who chooses to decline those benefits. This can help avoid tax implications or conflicts among heirs. Understanding how to implement a disclaimer beneficiary clause in your documents is essential, and airSlate SignNow provides the tools to facilitate this process seamlessly.

-

How can airSlate SignNow help in managing disclaimer beneficiary documents?

airSlate SignNow offers an efficient platform to create, manage, and eSign documents that include disclaimer beneficiary clauses. You can easily customize templates, ensuring that all necessary legal language is accurately incorporated. Our secure and user-friendly interface streamlines the document management process, guaranteeing compliance and peace of mind.

-

Is there a cost associated with using airSlate SignNow for disclaimer beneficiary documents?

Yes, airSlate SignNow provides a variety of pricing plans to suit different needs, allowing businesses to choose the level of features they require for managing disclaimer beneficiary documents. With our cost-effective solution, you gain access to unlimited eSigning, document templates, and secure cloud storage. We offer transparent pricing with no hidden fees, ensuring you receive great value.

-

What features does airSlate SignNow offer for disclaimer beneficiary management?

Our platform is equipped with features such as template creation, automated workflows, and real-time tracking for managing disclaimer beneficiary documents. You can pre-fill information, set signing order, and receive notifications when documents are executed. These tools enhance efficiency and reduce the chances of errors, making document management straightforward.

-

What are the benefits of using airSlate SignNow for estate planning involving disclaimer beneficiaries?

Using airSlate SignNow for estate planning simplifies the process of incorporating disclaimer beneficiaries into your documents. The easy-to-use interface enhances collaboration between parties, ensuring everyone is informed and involved in decision-making. Additionally, our secure platform provides peace of mind regarding the privacy and protection of sensitive information.

-

Can airSlate SignNow integrate with other software for disclaimer beneficiary documentation?

Yes, airSlate SignNow offers integrations with a variety of third-party applications to streamline the process of managing disclaimer beneficiary documentation. Popular integrations include CRM systems, cloud storage services, and project management tools. This connectivity allows for a seamless workflow, ensuring all your documents are accessible and organized.

-

How secure is airSlate SignNow when dealing with disclaimer beneficiary documents?

Security is a top priority at airSlate SignNow. We use advanced encryption and secure authentication processes to protect all documents, including those related to disclaimer beneficiaries. Our compliance with industry standards ensures that your sensitive information is safeguarded against unauthorized access.

Get more for Beneficiary Trust

- Writ of garnishment for support colorado form

- Debtor person form

- Notice of levy colorado form

- Notice of appeal colorado form

- Colorado disclosure form

- Marital legal separation and property settlement agreement where no children or no joint property or debts and divorce action 497300134 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts and divorce 497300135 form

- Marital legal separation and property settlement agreement where minor children and no joint property or debts that is 497300136 form

Find out other Beneficiary Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors