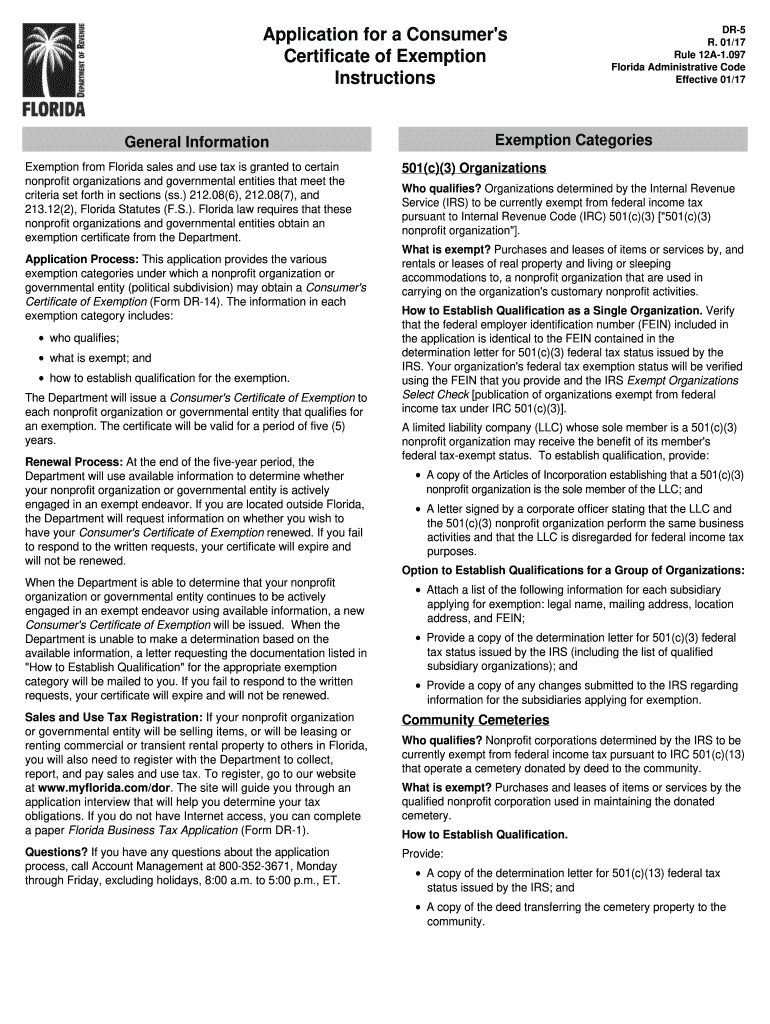

Florida Tax Exempt Form

What is a consumer certificate of exemption?

A consumer certificate of exemption is a document that allows buyers to purchase goods or services without paying sales tax. This certificate is typically used by businesses that resell items or by organizations that are exempt from sales tax under specific regulations. It serves as proof that the purchaser is entitled to an exemption based on their status or the nature of the transaction. Understanding the requirements and legal implications of using this certificate is essential for both buyers and sellers to ensure compliance with state tax laws.

Steps to complete the consumer certificate of exemption

Filling out a consumer certificate of exemption involves several key steps to ensure accuracy and compliance. Here are the essential steps:

- Gather necessary information, including the buyer's name, address, and tax identification number.

- Identify the specific exemption reason, such as resale or non-profit status, and ensure it aligns with state regulations.

- Complete all required fields on the certificate, ensuring that the information is accurate and up-to-date.

- Sign and date the certificate to validate it, as many states require a signature for it to be considered legally binding.

- Provide the completed certificate to the seller, who will retain it for their records.

Legal use of the consumer certificate of exemption

The legal use of a consumer certificate of exemption is governed by state laws, which outline who qualifies for tax exemptions and under what circumstances. It is crucial for purchasers to understand their eligibility and the specific criteria established by their state. Misuse of the certificate, such as using it for personal purchases or failing to provide accurate information, can result in penalties, including fines or back taxes owed. Sellers must also verify the legitimacy of the certificate to protect themselves from potential liability.

Required documents for obtaining a consumer certificate of exemption

To obtain a consumer certificate of exemption, individuals or businesses may need to provide specific documentation. Commonly required documents include:

- A valid tax identification number or employer identification number (EIN).

- Proof of eligibility for the exemption, such as a resale certificate or nonprofit status documentation.

- Completed application forms as required by the state tax authority.

It is advisable to check with the local tax authority for any additional requirements that may apply.

Penalties for non-compliance with the consumer certificate of exemption

Failing to comply with the regulations surrounding the consumer certificate of exemption can lead to serious consequences. Penalties may include:

- Fines imposed on the purchaser for improper use of the certificate.

- Liability for unpaid sales tax on exempted purchases.

- Legal action taken by state tax authorities for repeated violations.

Both buyers and sellers should ensure they understand their responsibilities to avoid these penalties.

Eligibility criteria for a consumer certificate of exemption

Eligibility for a consumer certificate of exemption varies by state, but common criteria include:

- Businesses that purchase items for resale.

- Nonprofit organizations that meet specific qualifications.

- Government entities that are exempt from sales tax.

It is essential to review state-specific guidelines to determine eligibility and ensure compliance with all requirements.

Quick guide on how to complete consumers certificate of exemption form for ohio

Effortlessly Prepare Florida Tax Exempt Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without interruptions. Manage Florida Tax Exempt Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign Florida Tax Exempt Form with Ease

- Acquire Florida Tax Exempt Form and click on Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Florida Tax Exempt Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

Create this form in 5 minutes!

How to create an eSignature for the consumers certificate of exemption form for ohio

How to create an eSignature for the Consumers Certificate Of Exemption Form For Ohio online

How to create an eSignature for the Consumers Certificate Of Exemption Form For Ohio in Google Chrome

How to create an eSignature for signing the Consumers Certificate Of Exemption Form For Ohio in Gmail

How to make an electronic signature for the Consumers Certificate Of Exemption Form For Ohio from your smart phone

How to make an eSignature for the Consumers Certificate Of Exemption Form For Ohio on iOS

How to make an eSignature for the Consumers Certificate Of Exemption Form For Ohio on Android OS

People also ask

-

What is the Florida Tax Exempt Form and who needs it?

The Florida Tax Exempt Form is a document used by individuals and businesses to claim exemption from sales tax on certain purchases. Organizations such as non-profits, government entities, and certain educational institutions may need this form to avoid paying sales tax on eligible items. Understanding how to properly utilize the Florida Tax Exempt Form can help organizations save money and comply with tax regulations.

-

How can airSlate SignNow help with the Florida Tax Exempt Form?

airSlate SignNow provides a streamlined platform for creating, signing, and managing the Florida Tax Exempt Form electronically. By using our service, you can easily send the form for eSignature, track its status, and ensure compliance without the hassle of paperwork. This not only saves time but also reduces the risk of errors associated with manual processing.

-

Is there a cost associated with using airSlate SignNow for the Florida Tax Exempt Form?

Yes, there is a subscription fee for using airSlate SignNow, which offers various pricing plans depending on your needs. Our plans are designed to be cost-effective for businesses of all sizes, allowing you to utilize features specifically for handling documents like the Florida Tax Exempt Form without breaking the bank. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Florida Tax Exempt Form?

airSlate SignNow includes a variety of features that enhance the management of the Florida Tax Exempt Form, such as templates, customizable workflows, and real-time tracking. You can create reusable templates for the form, automate the signing process, and securely store completed documents for easy access. These features make it simpler to manage tax-exempt transactions efficiently.

-

Can I integrate airSlate SignNow with other software for the Florida Tax Exempt Form?

Absolutely! airSlate SignNow offers seamless integrations with popular software like CRM systems, accounting tools, and cloud storage services. This means you can easily connect your existing tools to manage the Florida Tax Exempt Form alongside other business processes, creating a more efficient workflow and reducing data entry errors.

-

How does airSlate SignNow ensure the security of the Florida Tax Exempt Form?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents like the Florida Tax Exempt Form. We utilize advanced encryption methods, secure cloud storage, and compliance with industry standards to protect your data. This means you can confidently manage your tax-exempt documents knowing they are secure and protected.

-

What support does airSlate SignNow provide for using the Florida Tax Exempt Form?

airSlate SignNow offers comprehensive support for users needing assistance with the Florida Tax Exempt Form. Our customer service team is available via chat, email, or phone to help you with any questions or challenges you may face. Additionally, we provide resources like tutorials and FAQs to guide you through the process of using the form effectively.

Get more for Florida Tax Exempt Form

- Internship monthly time log smumn form

- Transcript enrollment verification request form saint paul school

- St thomas education centre application form

- Salem state university transcript form

- Affidavit form for sam houston state 2009

- Application for readmission samuel merritt university samuelmerritt form

- Workforce confidentiality agreement form samuel merritt university samuelmerritt

- Undergraduate change of major or minor form san francisco sfsu

Find out other Florida Tax Exempt Form

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney