Collateral Form

What is the collateral form?

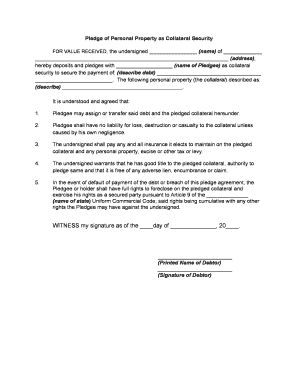

The collateral form is a legal document used to secure a loan or other financial obligation with personal property. This form outlines the specific assets that will serve as collateral, ensuring that the lender has a claim to these assets in case of default. Commonly used in various financial transactions, the collateral form is essential for both lenders and borrowers to clearly define the terms of the agreement and protect their interests.

Key elements of the collateral form

Understanding the key elements of the collateral form is crucial for its effective use. The primary components include:

- Identification of Parties: Clearly states the names and contact information of both the borrower and lender.

- Description of Collateral: Provides a detailed description of the personal property being pledged, including any identifying information such as serial numbers or titles.

- Loan Amount: Specifies the amount of money being borrowed and how it relates to the value of the collateral.

- Terms of Agreement: Outlines the repayment terms, interest rates, and any conditions that must be met.

- Signatures: Requires signatures from both parties to validate the agreement legally.

Steps to complete the collateral form

Completing the collateral form involves several important steps to ensure accuracy and legality:

- Gather Information: Collect all necessary details about the collateral, including descriptions and valuations.

- Fill Out the Form: Enter the required information in the form, ensuring clarity and completeness.

- Review the Terms: Carefully read through the terms of the agreement to ensure mutual understanding.

- Obtain Signatures: Have both parties sign the document, confirming their acceptance of the terms.

- Store the Document Safely: Keep a copy of the signed form in a secure location for future reference.

Legal use of the collateral form

The legal use of the collateral form is governed by various laws and regulations that ensure its enforceability. It must comply with state-specific laws regarding secured transactions, which may vary. Additionally, the form should meet the requirements set forth by the Uniform Commercial Code (UCC) in the United States, which provides a framework for the creation and enforcement of security interests in personal property. Proper execution of the form, including obtaining necessary signatures and providing accurate descriptions, is essential for it to be legally binding.

How to use the collateral form

Using the collateral form effectively requires an understanding of its purpose and how it fits into the broader financial transaction. When a borrower seeks a loan, they may offer personal property as collateral to secure the loan. The lender will then review the collateral form to assess the value and risk associated with the loan. Once both parties agree on the terms and complete the form, it serves as a legal document that protects the lender's interests while providing the borrower access to necessary funds.

Examples of using the collateral form

There are various scenarios where the collateral form is utilized. Some common examples include:

- Secured Loans: Individuals may use personal property, such as vehicles or real estate, to secure a loan from a bank.

- Business Financing: Small businesses often use equipment or inventory as collateral when seeking financing from lenders.

- Personal Loans: Borrowers may pledge valuable items like jewelry or art to secure personal loans.

Quick guide on how to complete collateral form

Handle Collateral Form effortlessly on any gadget

Digital document management has gained traction among enterprises and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow furnishes you with all the resources necessary to create, alter, and electronically sign your documents rapidly without delays. Manage Collateral Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and electronically sign Collateral Form effortlessly

- Find Collateral Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate worries about lost or mislaid files, tedious form searching, or errors that require printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device you prefer. Alter and electronically sign Collateral Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is personal property collateral in the context of document signing?

Personal property collateral refers to assets like vehicles, equipment, or inventory that can be used to secure a financial obligation. In the context of document signing, airSlate SignNow enables users to easily manage and eSign agreements related to personal property collateral, ensuring a secure and legally binding process.

-

How can airSlate SignNow help with managing personal property collateral agreements?

airSlate SignNow simplifies the management of personal property collateral agreements by providing a user-friendly platform for sending, signing, and storing documents. With features like templates and automated workflows, businesses can efficiently handle their collateral-related paperwork without the hassle of traditional methods.

-

What features does airSlate SignNow offer for personal property collateral transactions?

AirSlate SignNow offers features specifically beneficial for personal property collateral transactions, such as legally binding eSigning, document templates, and comprehensive audit trails. These tools ensure that all collateral agreements are executed smoothly and securely, aiding in proper documentation and compliance.

-

Is airSlate SignNow a cost-effective solution for personal property collateral management?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing personal property collateral. Our pricing plans cater to various business sizes, providing powerful eSigning capabilities and document management at competitive rates, ultimately reducing operational costs.

-

Can airSlate SignNow integrate with other systems for personal property collateral management?

Absolutely! airSlate SignNow integrates seamlessly with popular business applications, streamlining the management processes for personal property collateral. Whether it's CRM systems or document storage platforms, our integrations enhance efficiency and centralize your document handling.

-

What benefits does airSlate SignNow provide for businesses dealing with personal property collateral?

The primary benefits of using airSlate SignNow for personal property collateral include increased efficiency, reduced administrative overhead, and improved compliance. By digitizing the signing process, businesses can quickly finalize agreements, reduce paperwork, and ensure all transactions are securely documented.

-

How secure is airSlate SignNow for handling personal property collateral documents?

Security is a top priority at airSlate SignNow. We employ industry-leading encryption protocols and security measures to protect all documents related to personal property collateral transactions. All signed documents are stored safely, ensuring peace of mind for users managing sensitive agreements.

Get more for Collateral Form

Find out other Collateral Form

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later