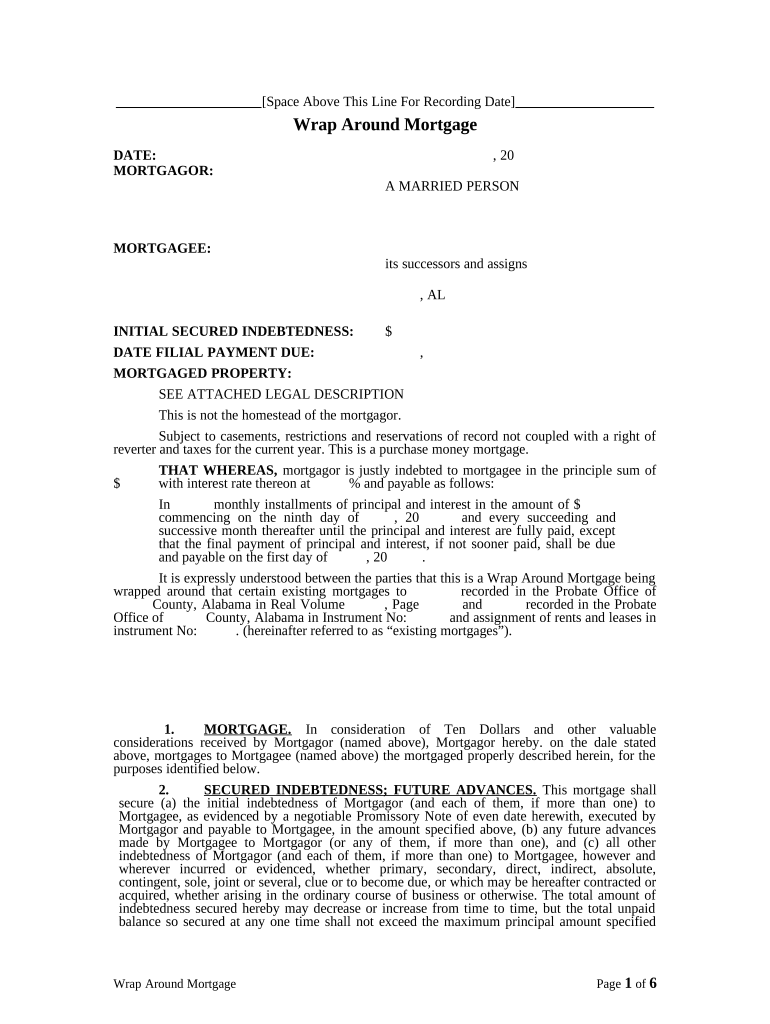

Wrap around Mortgage Alabama Form

What is the Wrap Around Mortgage Alabama

A wrap around mortgage is a type of financing arrangement where a new mortgage is created that "wraps around" an existing mortgage. This allows the borrower to take advantage of the existing loan's terms while obtaining additional funds. In Alabama, this arrangement is particularly useful for buyers who may not qualify for traditional financing or for sellers looking to facilitate a sale without paying off their current mortgage. The new lender makes payments to the original lender while the borrower pays the new lender, creating a single payment structure.

How to use the Wrap Around Mortgage Alabama

Using a wrap around mortgage in Alabama involves several steps. First, the buyer and seller must agree on the terms of the wrap around agreement, including the interest rate and payment schedule. Next, the buyer should conduct due diligence on the existing mortgage to ensure it is in good standing. Once the terms are settled, a formal agreement should be drafted, outlining the obligations of both parties. It is advisable to have a legal professional review the document to ensure compliance with Alabama laws. Finally, the buyer makes payments to the seller, who then continues to pay the original mortgage lender.

Steps to complete the Wrap Around Mortgage Alabama

Completing a wrap around mortgage in Alabama requires careful attention to detail. Here are the essential steps:

- Negotiate terms between the buyer and seller, including interest rates and repayment schedules.

- Review the existing mortgage to confirm its status and any potential liabilities.

- Draft a wrap around mortgage agreement, ensuring it includes all necessary legal provisions.

- Have the agreement reviewed by a qualified attorney to ensure it meets Alabama legal requirements.

- Execute the agreement, ensuring both parties sign and retain copies for their records.

- Begin the payment process, with the buyer making payments to the seller.

Legal use of the Wrap Around Mortgage Alabama

The legal use of a wrap around mortgage in Alabama is governed by state laws and regulations. It is essential that both parties understand their rights and obligations under the agreement. The wrap around mortgage must be properly documented to be enforceable in court. Additionally, it is important to ensure that the existing mortgage does not contain a due-on-sale clause, which could trigger the full repayment of the loan upon transfer of the property. Consulting with a legal expert can help navigate these complexities and ensure compliance with applicable laws.

Key elements of the Wrap Around Mortgage Alabama

Several key elements define a wrap around mortgage in Alabama:

- Existing Mortgage: The original loan that the wrap around mortgage is based on.

- New Loan Terms: The interest rate and payment schedule agreed upon by the buyer and seller.

- Legal Agreement: A formal contract that outlines the responsibilities of both parties.

- Payment Structure: The method by which the buyer pays the seller, who in turn pays the original lender.

State-specific rules for the Wrap Around Mortgage Alabama

In Alabama, specific rules apply to wrap around mortgages. These include disclosure requirements to ensure that both parties are fully informed about the terms of the agreement. Additionally, Alabama law may require that the wrap around mortgage be recorded with the county to provide public notice of the arrangement. It is crucial to adhere to these regulations to avoid potential legal issues in the future. Engaging a local attorney can help ensure that all state-specific requirements are met.

Quick guide on how to complete wrap around mortgage alabama

Complete Wrap Around Mortgage Alabama effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents quickly without any hindrances. Handle Wrap Around Mortgage Alabama on any device with airSlate SignNow's Android or iOS apps and simplify any document-related process today.

The easiest way to modify and eSign Wrap Around Mortgage Alabama without difficulty

- Obtain Wrap Around Mortgage Alabama and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your alterations.

- Select your preferred method for submitting your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require reprinting new document copies. airSlate SignNow meets your needs in document management with just a few clicks from any device of your choice. Edit and eSign Wrap Around Mortgage Alabama and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wrap Around Mortgage in Alabama?

A Wrap Around Mortgage in Alabama is a type of financing that allows a seller to finance a property purchase while maintaining their existing mortgage. This arrangement allows the buyer to make payments directly to the seller, who then continues to make payments on their existing loan. It can be a beneficial option for buyers with less access to traditional financing.

-

How do I qualify for a Wrap Around Mortgage in Alabama?

To qualify for a Wrap Around Mortgage in Alabama, buyers typically need to demonstrate their ability to make monthly payments, even if they don’t have perfect credit scores. Documentation such as income verification and credit history will be reviewed. Consulting with a knowledgeable lender familiar with wrap-around mortgages can help streamline the process.

-

What are the benefits of a Wrap Around Mortgage in Alabama?

The benefits of a Wrap Around Mortgage in Alabama include lower upfront costs and the ability to bypass traditional financing institutions. This financing option can also be quicker and less complex than conventional loans, plus it may offer flexible terms that can be negotiated directly between the buyer and seller.

-

What are the potential risks associated with a Wrap Around Mortgage in Alabama?

The potential risks of a Wrap Around Mortgage in Alabama include the possibility of the seller defaulting on their existing loan, which can put the buyer at risk of losing their investment. Additionally, if the mortgage is not properly structured, buyers might face complications during resale. It’s essential to consult with a legal professional to mitigate these risks.

-

Are Wrap Around Mortgages common in Alabama?

Wrap Around Mortgages are not the most common financing option in Alabama, but they can be valuable for certain buyers and sellers. They are often used in creative financing strategies, particularly when traditional mortgage options fall short. Understanding how they work can help interested parties make informed decisions.

-

How does a Wrap Around Mortgage differ from a traditional mortgage in Alabama?

A Wrap Around Mortgage differs from a traditional mortgage in that it involves a seller financing the home loan while still servicing their existing mortgage. This means the buyer makes payments to the seller, who in turn pays their mortgage. Traditional mortgages involve dealing directly with lending institutions and typically require stricter qualification criteria.

-

Can I use airSlate SignNow to facilitate a Wrap Around Mortgage agreement in Alabama?

Yes, you can use airSlate SignNow to facilitate a Wrap Around Mortgage agreement in Alabama. Our platform provides a secure and efficient way to sign and manage all necessary documentation while ensuring both parties are protected. Additionally, it simplifies the process, making it easier for buyers and sellers to handle their agreements.

Get more for Wrap Around Mortgage Alabama

- Massachusetts violation form

- Massachusetts letter rent form

- Letter tenant notice rent 497309686 form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase massachusetts form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant massachusetts form

- Insurer notification of termination for workers compensation massachusetts form

- Massachusetts tenant form

- Letter tenant landlord 497309691 form

Find out other Wrap Around Mortgage Alabama

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF

- How Can I Electronic signature New Mexico Finance & Tax Accounting Word

- How Do I Electronic signature New York Education Form

- How To Electronic signature North Carolina Education Form

- How Can I Electronic signature Arizona Healthcare / Medical Form

- How Can I Electronic signature Arizona Healthcare / Medical Presentation

- How To Electronic signature Oklahoma Finance & Tax Accounting PDF

- How Can I Electronic signature Oregon Finance & Tax Accounting PDF

- How To Electronic signature Indiana Healthcare / Medical PDF

- How Do I Electronic signature Maryland Healthcare / Medical Presentation

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF