Notice and Acknowledgement of Pay Rate and Payday under Section 195 1 of the New York State Labor Law, Notice for Hourly Rate Em Form

Understanding the LS-54 Form

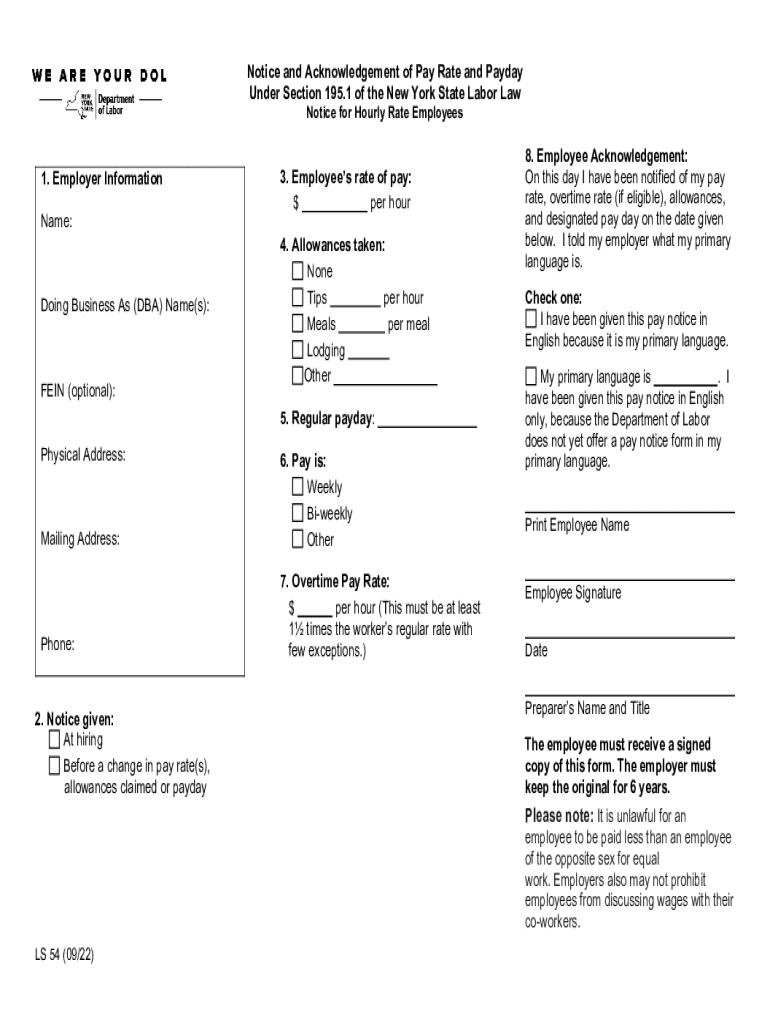

The LS-54 form, also known as the Notice and Acknowledgement of Pay Rate and Payday, is a crucial document mandated by New York State Labor Law under Section 195(1). This form serves to inform employees about their pay rates and the schedule of paydays. It is essential for employers to provide this notice to ensure compliance with state regulations and to foster transparency in employer-employee relationships.

Key Elements of the LS-54 Form

The LS-54 form includes several key elements that must be accurately filled out. These elements are:

- Employee Information: Name and address of the employee.

- Employer Information: Name and address of the employer.

- Pay Rate: The specific rate of pay for the employee.

- Pay Schedule: The frequency of paydays (weekly, bi-weekly, etc.).

- Effective Date: The date when the pay rate becomes effective.

Completing these sections accurately is vital for compliance and to avoid potential penalties.

Steps to Complete the LS-54 Form

Completing the LS-54 form involves several straightforward steps:

- Gather necessary information about the employee and employer.

- Fill in the employee's name and address in the designated fields.

- Provide the employer's name and address accurately.

- Specify the employee's pay rate and the pay schedule.

- Include the effective date of the pay rate.

- Both the employer and employee must sign and date the form to acknowledge receipt.

Following these steps ensures that the form is completed correctly and meets legal requirements.

Legal Use of the LS-54 Form

The LS-54 form is legally required under New York State Labor Law. Employers must provide this notice to employees at the time of hiring and whenever there is a change in pay rate or pay schedule. Failure to comply with this requirement can result in penalties for employers, including fines and legal action. It is important for both employers and employees to understand the legal implications associated with this form.

Obtaining the LS-54 Form

Employers can obtain the LS-54 form from the New York State Department of Labor's website or through various labor law compliance resources. The form is available in a fillable PDF format, making it easy to complete and print. Employers should ensure they have the most current version of the form to remain compliant with any updates to labor laws.

Penalties for Non-Compliance

Employers who fail to provide the LS-54 form may face significant penalties. These can include fines imposed by the New York State Department of Labor and potential legal claims from employees. It is crucial for employers to understand their obligations and ensure that all employees receive the required documentation to avoid these consequences.

Handy tips for filling out Notice And Acknowledgement Of Pay Rate And Payday Under Section 195 1 Of The New York State Labor Law, Notice For Hourly Rate Em online

Quick steps to complete and e-sign Notice And Acknowledgement Of Pay Rate And Payday Under Section 195 1 Of The New York State Labor Law, Notice For Hourly Rate Em online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms can be. Obtain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Use signNow to e-sign and share Notice And Acknowledgement Of Pay Rate And Payday Under Section 195 1 Of The New York State Labor Law, Notice For Hourly Rate Em for e-signing.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the notice and acknowledgement of pay rate and payday under section 195 1 of the new york state labor law notice for hourly rate

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ls 54 form fillable and how can it benefit my business?

The ls 54 form fillable is a digital document that allows users to complete and sign forms electronically. This feature streamlines the process of managing paperwork, saving time and reducing errors. By using the ls 54 form fillable, businesses can enhance efficiency and improve customer satisfaction.

-

Is the ls 54 form fillable available for free?

While airSlate SignNow offers a range of pricing plans, the ls 54 form fillable is included in our subscription options. We provide a cost-effective solution that fits various business needs. You can explore our pricing page to find the best plan that includes access to the ls 54 form fillable.

-

Can I customize the ls 54 form fillable for my specific needs?

Yes, the ls 54 form fillable can be easily customized to meet your specific requirements. You can add fields, change layouts, and incorporate branding elements to ensure the form aligns with your business identity. This flexibility makes the ls 54 form fillable a versatile tool for any organization.

-

What features does the ls 54 form fillable offer?

The ls 54 form fillable includes features such as electronic signatures, document tracking, and secure storage. These functionalities enhance the overall user experience and ensure that your documents are handled efficiently. With the ls 54 form fillable, you can manage your forms with ease and confidence.

-

How does the ls 54 form fillable integrate with other software?

The ls 54 form fillable seamlessly integrates with various software applications, including CRM systems and cloud storage services. This integration allows for a smooth workflow and ensures that your documents are easily accessible. By using the ls 54 form fillable, you can enhance collaboration across your organization.

-

Is the ls 54 form fillable secure for sensitive information?

Absolutely! The ls 54 form fillable is designed with security in mind, employing encryption and secure access protocols. This ensures that sensitive information remains protected throughout the signing process. Trusting the ls 54 form fillable means prioritizing the safety of your data.

-

Can I track the status of my ls 54 form fillable documents?

Yes, airSlate SignNow provides tracking capabilities for your ls 54 form fillable documents. You can easily monitor who has viewed, signed, or completed the form. This feature adds transparency to your document management process and helps you stay organized.

Get more for Notice And Acknowledgement Of Pay Rate And Payday Under Section 195 1 Of The New York State Labor Law, Notice For Hourly Rate Em

Find out other Notice And Acknowledgement Of Pay Rate And Payday Under Section 195 1 Of The New York State Labor Law, Notice For Hourly Rate Em

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document

- How Do I Electronic signature Minnesota Car Dealer Form

- Can I Electronic signature Missouri Car Dealer Document

- How Do I Electronic signature Nevada Car Dealer PDF

- How To Electronic signature South Carolina Banking Document

- Can I Electronic signature New York Car Dealer Document