Non Foreign Affidavit under IRC 1445 Arizona Form

What is the Non Foreign Affidavit Under IRC 1445 Arizona

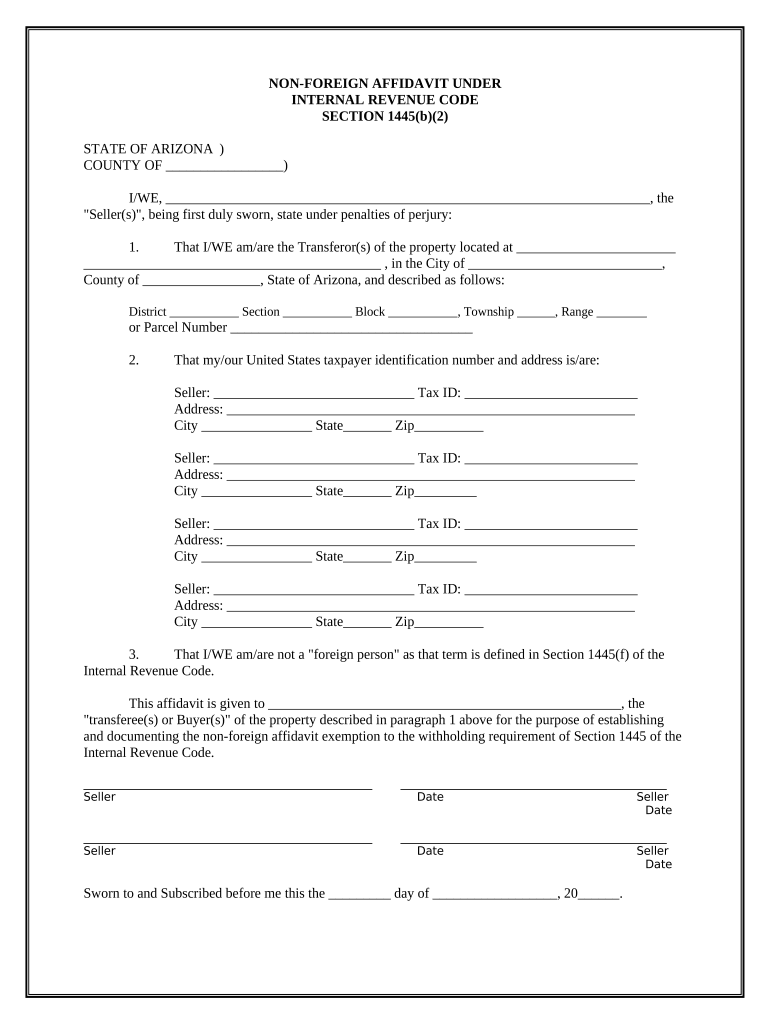

The Non Foreign Affidavit Under IRC 1445 is a legal document required in Arizona for transactions involving real estate where the seller is not a foreign person. This affidavit serves to certify that the seller is a U.S. person, thereby exempting the buyer from withholding taxes that would otherwise apply to foreign sellers. The form is essential for ensuring compliance with the Internal Revenue Code, specifically Section 1445, which mandates withholding on certain real estate transactions involving foreign entities.

Steps to Complete the Non Foreign Affidavit Under IRC 1445 Arizona

Completing the Non Foreign Affidavit involves several key steps:

- Gather necessary information, including the seller's name, address, and taxpayer identification number.

- Provide details about the property being sold, including its address and legal description.

- Sign and date the affidavit in the presence of a notary public to ensure its legal validity.

- Submit the completed affidavit to the buyer, who will retain it for their records and for compliance purposes.

Legal Use of the Non Foreign Affidavit Under IRC 1445 Arizona

The legal use of the Non Foreign Affidavit is crucial for both buyers and sellers in real estate transactions. By completing this affidavit, sellers affirm their status as U.S. persons, which protects buyers from potential tax liabilities associated with foreign sellers. This document must be executed properly to be considered valid in the eyes of the IRS and state authorities, ensuring that all parties comply with tax regulations.

Key Elements of the Non Foreign Affidavit Under IRC 1445 Arizona

Key elements of the Non Foreign Affidavit include:

- The seller's full legal name and address.

- The seller's taxpayer identification number (TIN).

- A statement confirming the seller's status as a U.S. person.

- The property address and legal description.

- The seller's signature and date, along with a notary's acknowledgment.

How to Obtain the Non Foreign Affidavit Under IRC 1445 Arizona

The Non Foreign Affidavit can typically be obtained from a real estate attorney, title company, or online legal document services. It is important to ensure that the version used complies with Arizona state laws and the IRS requirements. Many title companies also provide this form as part of their closing documentation for real estate transactions.

Filing Deadlines / Important Dates

While the Non Foreign Affidavit itself does not have a specific filing deadline, it must be completed and submitted at the time of closing a real estate transaction. Buyers should ensure they receive the affidavit from the seller before finalizing the purchase to avoid any potential tax withholding issues. It is advisable to consult with a tax professional for any specific timelines related to individual transactions.

Quick guide on how to complete non foreign affidavit under irc 1445 arizona

Accomplish Non Foreign Affidavit Under IRC 1445 Arizona effortlessly on any gadget

Digital document administration has become increasingly favored by companies and individuals. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without any holdups. Manage Non Foreign Affidavit Under IRC 1445 Arizona on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric task today.

The easiest way to alter and eSign Non Foreign Affidavit Under IRC 1445 Arizona without stress

- Obtain Non Foreign Affidavit Under IRC 1445 Arizona and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or redact sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Modify and eSign Non Foreign Affidavit Under IRC 1445 Arizona and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Non Foreign Affidavit Under IRC 1445 Arizona?

A Non Foreign Affidavit Under IRC 1445 Arizona is a document that certifies the seller's status as a non-foreign person, which can help avoid withholding tax during real estate transactions. By using this affidavit, sellers can streamline their processes and ensure compliance with federal regulations while benefiting from tax exemptions.

-

How can airSlate SignNow assist with Non Foreign Affidavit Under IRC 1445 Arizona?

airSlate SignNow offers an easy-to-use platform that allows users to create, edit, and eSign Non Foreign Affidavit Under IRC 1445 Arizona documents efficiently. Our tools simplify the documentation process, ensuring that all necessary information is included and correctly formatted to meet legal requirements.

-

What are the pricing plans for using airSlate SignNow for Non Foreign Affidavit Under IRC 1445 Arizona?

airSlate SignNow offers flexible pricing plans to accommodate different business needs, including affordable options for small businesses. Users can choose a monthly or annual subscription that best fits their requirements, ensuring access to features specifically designed for handling documents like the Non Foreign Affidavit Under IRC 1445 Arizona.

-

Are there any integrations available to streamline the process of signing Non Foreign Affidavit Under IRC 1445 Arizona?

Yes, airSlate SignNow integrates seamlessly with various applications such as CRM systems, cloud storage, and productivity tools. This allows users to easily manage their Non Foreign Affidavit Under IRC 1445 Arizona documents alongside their other workflows, enhancing efficiency and collaboration.

-

What features does airSlate SignNow offer for managing Non Foreign Affidavit Under IRC 1445 Arizona?

airSlate SignNow provides features such as customizable templates, in-app chat support, and advanced tracking capabilities specifically tailored for documents like the Non Foreign Affidavit Under IRC 1445 Arizona. These tools ensure that users can efficiently create, send, and track their affidavits with ease.

-

Can multiple users collaborate on a Non Foreign Affidavit Under IRC 1445 Arizona using airSlate SignNow?

Absolutely! airSlate SignNow allows multiple users to collaborate on the same Non Foreign Affidavit Under IRC 1445 Arizona document in real-time. This shared access promotes teamwork and helps ensure that all necessary parties can review and sign the affidavit promptly.

-

Is there a mobile app available for signing Non Foreign Affidavit Under IRC 1445 Arizona?

Yes, airSlate SignNow provides a mobile app that enables users to sign and manage Non Foreign Affidavit Under IRC 1445 Arizona documents on-the-go. This mobile accessibility allows for greater flexibility and convenience, making it easy to complete important transactions anytime, anywhere.

Get more for Non Foreign Affidavit Under IRC 1445 Arizona

- Nm will form

- Legal last will and testament form for married person with adult and minor children from prior marriage new mexico

- Legal last will and testament form for married person with adult and minor children new mexico

- Mutual wills package with last wills and testaments for married couple with adult and minor children new mexico form

- Nm widow form

- Legal last will and testament form for widow or widower with minor children new mexico

- Legal last will form for a widow or widower with no children new mexico

- Legal last will and testament form for a widow or widower with adult and minor children new mexico

Find out other Non Foreign Affidavit Under IRC 1445 Arizona

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed