Business Credit Application PDF Form

What is the Business Credit Application PDF?

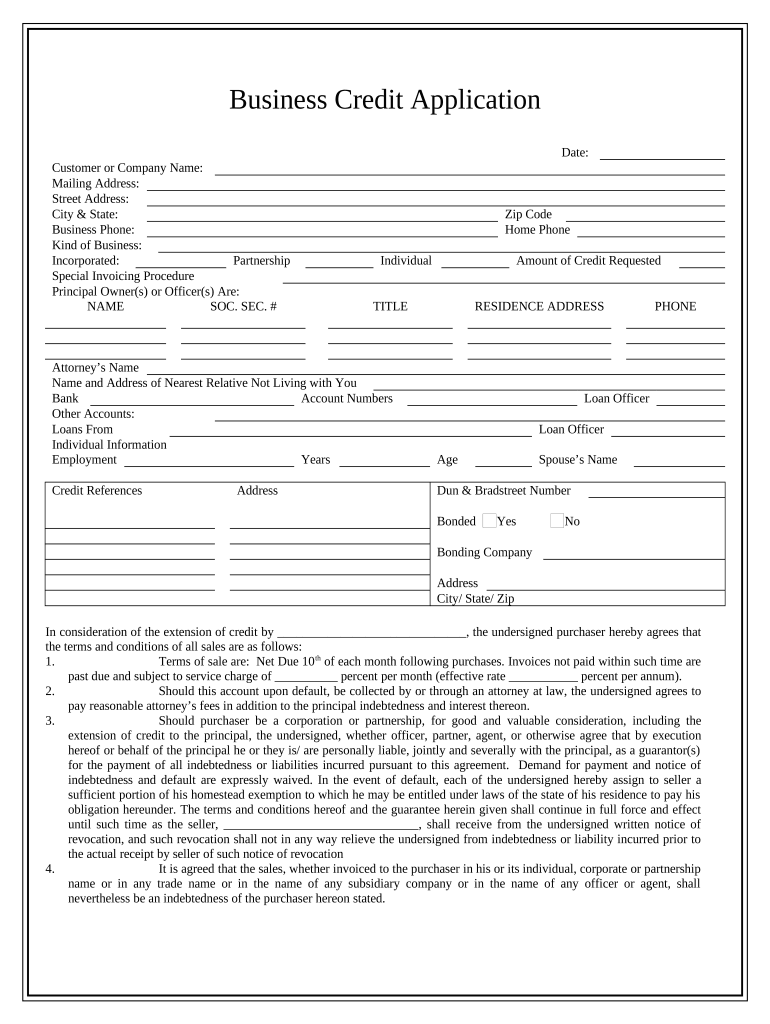

The business credit application PDF is a formal document used by businesses to request credit from suppliers, lenders, or financial institutions. This form collects essential information about the business, including its legal structure, financial status, and credit history. It serves as a vital tool for assessing the creditworthiness of the applicant, allowing creditors to make informed decisions regarding credit limits and terms.

Steps to Complete the Business Credit Application PDF

Completing the business credit application PDF involves several key steps to ensure accuracy and compliance. First, gather necessary information, including your business's legal name, address, and tax identification number. Next, provide details about your business's ownership structure, such as the names of the owners and their respective ownership percentages. After that, include financial information, such as annual revenue, existing debts, and assets. Finally, review the application for completeness and accuracy before submitting it to the creditor.

Legal Use of the Business Credit Application PDF

The business credit application PDF is legally binding when completed correctly. To ensure its validity, the document must comply with applicable laws and regulations regarding electronic signatures and data protection. Utilizing a trusted eSignature platform, like signNow, guarantees that the application meets legal standards set forth by ESIGN, UETA, and other relevant frameworks. This compliance helps protect both the applicant and the creditor during the credit evaluation process.

Key Elements of the Business Credit Application PDF

Several key elements are essential to include in the business credit application PDF. These elements typically encompass:

- Business Information: Legal name, address, and type of business entity.

- Ownership Details: Names and ownership percentages of business owners.

- Financial Information: Annual revenue, existing debts, and assets.

- Credit References: Contact information for suppliers or lenders who can provide credit history.

- Signature Section: Area for authorized individuals to sign and date the application.

How to Obtain the Business Credit Application PDF

Obtaining the business credit application PDF can be done through various channels. Many financial institutions and suppliers provide downloadable versions of the application on their websites. Additionally, businesses can create a custom application using templates available online. It is essential to ensure that the form complies with the specific requirements of the creditor to whom it will be submitted.

Form Submission Methods

The business credit application PDF can be submitted through multiple methods, depending on the preferences of the creditor. Common submission methods include:

- Online Submission: Many creditors allow applicants to upload completed forms directly through their websites.

- Email Submission: Applicants can send the completed PDF via email to the designated contact at the creditor's institution.

- Mail Submission: Some creditors may require physical copies to be mailed to their offices for processing.

- In-Person Submission: Applicants may also have the option to deliver the application in person, especially for local lenders.

Quick guide on how to complete business credit application pdf

Prepare Business Credit Application Pdf effortlessly on any device

Digital document management has gained traction among enterprises and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without interruptions. Handle Business Credit Application Pdf on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Business Credit Application Pdf with ease

- Find Business Credit Application Pdf and click on Get Form to begin.

- Use the tools we offer to fill in your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal authority as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Edit and eSign Business Credit Application Pdf while ensuring excellent communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a business credit application PDF?

A business credit application PDF is a standardized form that allows businesses to apply for credit from lenders or suppliers. This PDF format ensures that the application is easily shareable and can be completed digitally or printed for submission. Utilizing a business credit application PDF helps streamline the credit approval process.

-

How does airSlate SignNow facilitate the business credit application PDF process?

airSlate SignNow simplifies the business credit application PDF process by enabling users to upload, eSign, and send documents with minimal hassle. The platform provides templates for business credit applications, ensuring you have a professional format ready to customize. This efficiency helps reduce turnaround time for obtaining credit.

-

Are there any costs associated with using airSlate SignNow for business credit applications?

AirSlate SignNow offers various pricing plans to suit different business needs, starting with a free trial to explore its features. While using the service to handle a business credit application PDF, costs will depend on your selected plan, but it is generally considered a cost-effective solution for managing documents electronically.

-

What features are included in airSlate SignNow for managing business credit application PDFs?

Key features of airSlate SignNow include document templates, eSignature capabilities, and seamless workflow automation. These tools allow you to create, send, and receive signed business credit application PDFs efficiently, enhancing productivity and ensuring compliance. Additionally, it provides secure storage for all signed documents.

-

How can I integrate airSlate SignNow with my existing business tools for credit applications?

AirSlate SignNow integrates with numerous business tools and platforms such as CRM systems, payment processors, and cloud storage solutions. This means you can automatically manage your business credit application PDFs alongside existing workflows, improving efficiency. Check the integration section on our website for a complete list of compatible applications.

-

What are the benefits of using airSlate SignNow for business credit applications?

Using airSlate SignNow for your business credit application PDF offers signNow benefits, such as speeding up the application process and reducing paper usage. The platform allows for real-time tracking of documents, ensuring all parties are informed on their status. Additionally, secure eSigning enhances document integrity and compliance.

-

Is my data safe when using airSlate SignNow to manage business credit application PDFs?

Yes, airSlate SignNow prioritizes data security and employs advanced encryption protocols to protect your business credit application PDFs and other sensitive information. Regular security audits and compliance with industry standards ensure that your data is safe from unauthorized access. Feel reassured that your business documents are managed securely.

Get more for Business Credit Application Pdf

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out south carolina form

- Property manager agreement south carolina form

- Agreement for delayed or partial rent payments south carolina form

- Tenants maintenance repair request form south carolina

- Guaranty attachment to lease for guarantor or cosigner south carolina form

- Amendment to lease or rental agreement south carolina form

- Warning notice due to complaint from neighbors south carolina form

- Lease subordination agreement south carolina form

Find out other Business Credit Application Pdf

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free

- Electronic signature North Carolina Guaranty Agreement Online

- eSignature Connecticut Outsourcing Services Contract Computer

- eSignature New Hampshire Outsourcing Services Contract Computer

- eSignature New York Outsourcing Services Contract Simple

- Electronic signature Hawaii Revocation of Power of Attorney Computer

- How Do I Electronic signature Utah Gift Affidavit

- Electronic signature Kentucky Mechanic's Lien Free

- Electronic signature Maine Mechanic's Lien Fast

- Can I Electronic signature North Carolina Mechanic's Lien

- How To Electronic signature Oklahoma Mechanic's Lien

- Electronic signature Oregon Mechanic's Lien Computer

- Electronic signature Vermont Mechanic's Lien Simple

- How Can I Electronic signature Virginia Mechanic's Lien

- Electronic signature Washington Mechanic's Lien Myself

- Electronic signature Louisiana Demand for Extension of Payment Date Simple

- Can I Electronic signature Louisiana Notice of Rescission

- Electronic signature Oregon Demand for Extension of Payment Date Online

- Can I Electronic signature Ohio Consumer Credit Application