Ca Homestead Form

What is the CA Homestead?

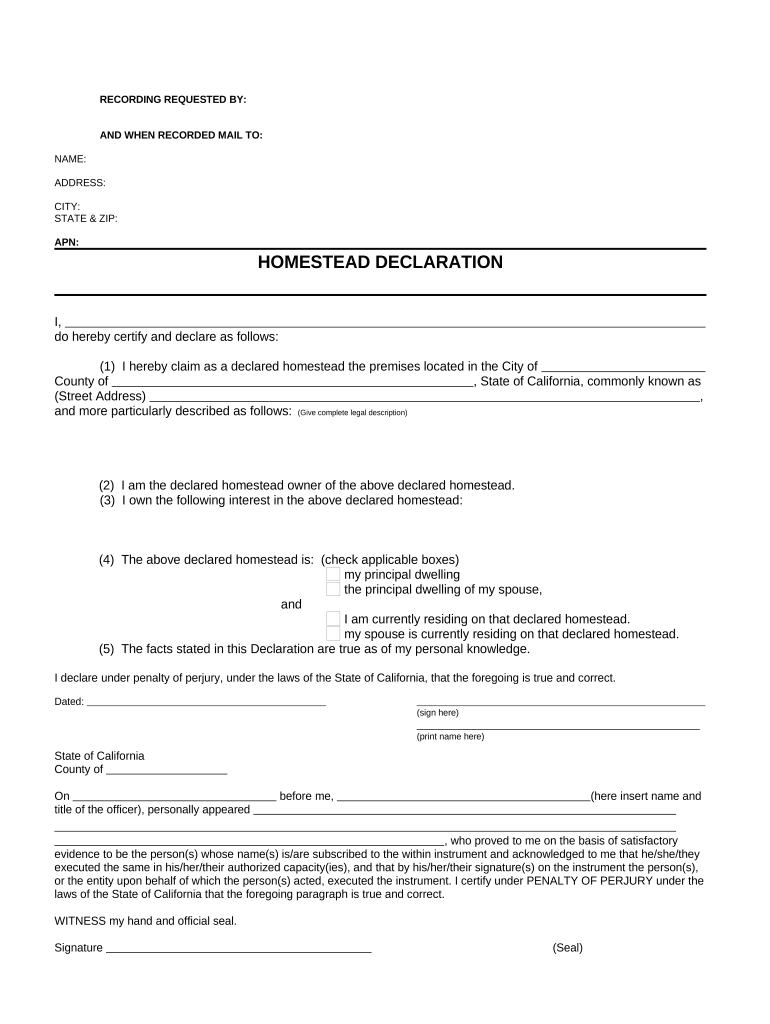

The CA Homestead refers to a legal provision that protects a homeowner's primary residence from creditors and certain legal actions. This protection is particularly important for individuals facing financial difficulties, as it allows them to maintain a secure living environment. The homestead exemption can vary by state, but in California, it provides specific protections under state law. Homeowners must file a declaration of homestead to qualify for these benefits, which can help shield a portion of their home equity from being seized to satisfy debts.

How to Obtain the CA Homestead

To obtain the CA Homestead exemption, homeowners must follow a straightforward process. First, they need to complete a homestead declaration form, which can typically be found on the county assessor's website or at local government offices. Once the form is filled out, it must be filed with the appropriate county office, often the county recorder. It is essential to ensure that the property is designated as the primary residence, as this is a key eligibility criterion. Homeowners should also be aware of any filing deadlines to ensure they receive the exemption for the current tax year.

Steps to Complete the CA Homestead

Completing the CA Homestead exemption involves several clear steps:

- Determine Eligibility: Ensure that the property is your primary residence and that you meet the necessary criteria.

- Obtain the Form: Download or request the homestead declaration form from your county's official website or office.

- Fill Out the Form: Provide accurate information, including your name, property address, and any other required details.

- File the Form: Submit the completed form to your county recorder's office, either in person or by mail.

- Keep Records: Retain a copy of the filed form for your personal records, as this will be important for future reference.

Legal Use of the CA Homestead

The legal use of the CA Homestead is primarily to protect homeowners from losing their primary residence due to financial hardships. This protection is crucial during bankruptcy proceedings or when facing creditor claims. By filing for the homestead exemption, homeowners can safeguard a portion of their home equity, which varies based on the property's value and the current laws. It is important to understand that the homestead exemption does not eliminate debts but rather provides a legal shield for the homeowner's primary residence.

Key Elements of the CA Homestead

Several key elements define the CA Homestead exemption:

- Primary Residence: The property must be the homeowner's principal place of residence.

- Filing Requirement: Homeowners must file a declaration to receive the exemption.

- Equity Protection: The exemption protects a specified amount of equity in the home from creditors.

- Legal Framework: The exemption is governed by California state law, which outlines the specific protections and eligibility requirements.

Eligibility Criteria

To qualify for the CA Homestead exemption, homeowners must meet specific eligibility criteria, including:

- The property must be owned and occupied as the primary residence.

- Homeowners must file the declaration of homestead in the appropriate county.

- There may be limits on the amount of equity that can be protected, which can vary based on the homeowner's age and disability status.

Quick guide on how to complete ca homestead

Complete Ca Homestead effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and eSign your documents swiftly and without holdups. Handle Ca Homestead on any platform with airSlate SignNow Android or iOS applications and enhance any document-centered process today.

The easiest way to edit and eSign Ca Homestead seamlessly

- Locate Ca Homestead and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, laborious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in a few clicks from any device of your choice. Edit and eSign Ca Homestead and guarantee excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA homestead and how does it work?

A CA homestead is a legal designation that protects a portion of your home's value from creditors. This protection can be vital for homeowners in California who want to safeguard their assets. By filing a homestead declaration, you ensure that your primary residence is recognized legally, which can help you retain your home in times of financial distress.

-

How can airSlate SignNow help with CA homestead documents?

airSlate SignNow offers a streamlined solution for electronically signing and managing CA homestead documents. You can easily create, send, and eSign forms related to your homestead declaration. The platform ensures compliance and provides a secure way to manage sensitive documents, all while saving you time and effort.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including options for personal users and teams. The plans are cost-effective and provide access to all essential features needed for managing CA homestead documents. With flexible pricing, you can choose a plan that best fits your volume of usage and desired functionalities.

-

Are there any features specifically beneficial for CA homestead filing?

Yes, airSlate SignNow includes features like customizable templates and automated workflows that are particularly useful for CA homestead filing. These features help you generate necessary documents quickly and accurately. Additionally, the ability to track document status ensures that you are always aware of where your homestead filings stand.

-

Can I integrate airSlate SignNow with other tools I use for CA homestead management?

Absolutely! airSlate SignNow integrates seamlessly with various tools that you might already use for managing CA homestead filings, such as CRM systems and cloud storage solutions. These integrations enhance your workflow efficiency by allowing you to connect all your applications in one place.

-

What benefits does airSlate SignNow provide for business owners dealing with CA homestead?

For business owners, airSlate SignNow simplifies the process of managing CA homestead declarations while ensuring compliance and security. By using this platform, you can minimize paperwork, enhance collaboration with team members, and expedite the signing process. This efficiency not only saves time but also helps protect your business interests.

-

Is airSlate SignNow secure for handling sensitive CA homestead information?

Yes, airSlate SignNow prioritizes the security of your documents, which is crucial when dealing with sensitive CA homestead information. The platform uses advanced encryption protocols and complies with industry standards to ensure your data is safe. With features like two-factor authentication, you can have confidence that your documents are protected against unauthorized access.

Get more for Ca Homestead

Find out other Ca Homestead

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement