Notice Regarding Payment Form

What is the Notice Regarding Payment

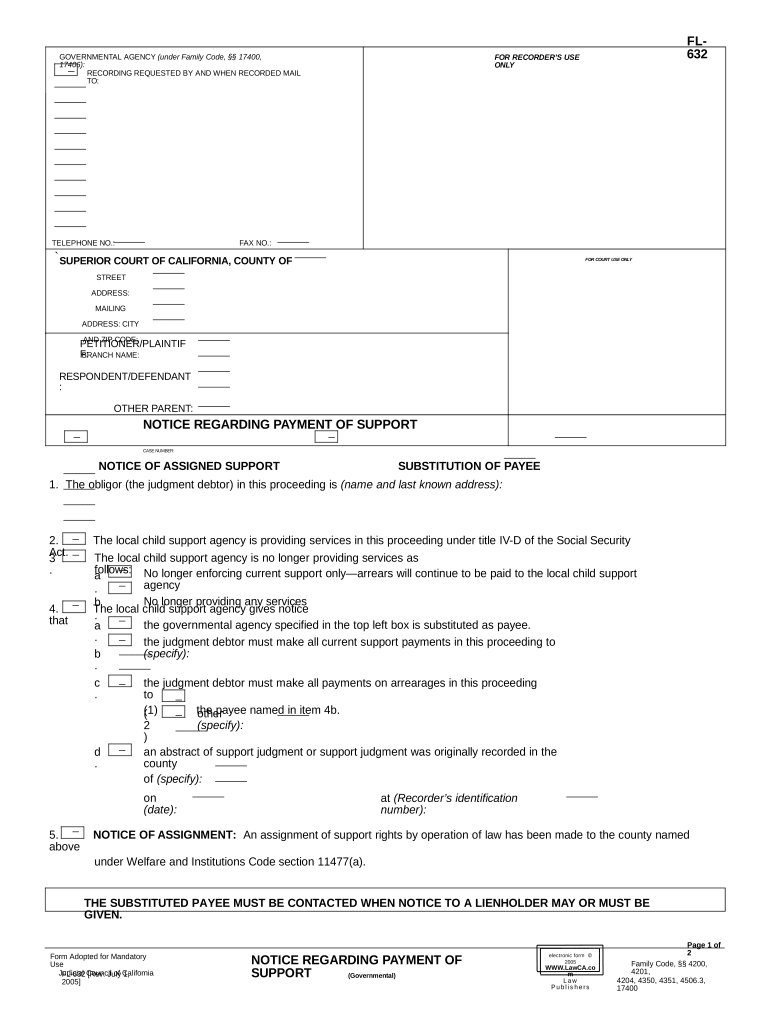

The Notice Regarding Payment is an essential document used in various governmental processes in California. It serves as a formal notification to individuals or businesses regarding payment obligations or issues related to government services. This notice can encompass a range of topics, including tax payments, fines, or fees owed to state agencies. Understanding the specifics of this notice is crucial for compliance and to avoid potential penalties.

How to use the Notice Regarding Payment

Using the Notice Regarding Payment involves several steps to ensure proper handling and compliance. Recipients should carefully read the notice to understand the payment details, including the amount due, payment methods, and deadlines. It is important to follow the instructions provided in the notice to avoid misunderstandings. If there are any questions or disputes regarding the payment, contacting the issuing agency promptly can help resolve issues efficiently.

Key elements of the Notice Regarding Payment

The key elements of the Notice Regarding Payment include the following:

- Recipient Information: Details about the individual or business receiving the notice.

- Payment Amount: The total amount due, including any applicable fees or penalties.

- Due Date: The deadline by which the payment must be made to avoid further action.

- Payment Instructions: Clear guidelines on how to submit the payment, including acceptable methods.

- Contact Information: Details for the issuing agency for any inquiries or disputes.

Steps to complete the Notice Regarding Payment

Completing the Notice Regarding Payment involves a systematic approach to ensure accuracy and compliance. Follow these steps:

- Review the notice thoroughly to understand the payment details.

- Gather any required documents that may be needed for payment processing.

- Choose the appropriate payment method as outlined in the notice.

- Complete the payment by following the provided instructions.

- Keep a copy of the payment confirmation for your records.

Legal use of the Notice Regarding Payment

The legal use of the Notice Regarding Payment is governed by state regulations and laws. It is important to ensure that the notice is issued in compliance with California's legal standards. This includes adherence to proper notification procedures and timelines. Failure to comply with the notice can result in penalties or legal action, making it crucial for recipients to understand their obligations and rights.

Who Issues the Form

The Notice Regarding Payment is typically issued by various governmental agencies within California, such as the Department of Revenue, local tax authorities, or other regulatory bodies. Each agency has its own procedures for issuing notices, and the specific agency responsible will be indicated on the notice itself. Understanding which agency issued the notice can help recipients address their inquiries or disputes more effectively.

Quick guide on how to complete notice regarding payment

Complete Notice Regarding Payment effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed papers, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, alter, and eSign your documents swiftly without any delays. Handle Notice Regarding Payment on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Notice Regarding Payment with ease

- Find Notice Regarding Payment and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then select the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow manages all your document-related needs in just a few clicks from any device you prefer. Modify and eSign Notice Regarding Payment and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the CA payment governmental feature in airSlate SignNow?

The CA payment governmental feature in airSlate SignNow allows users to securely collect payments for government-related services via e-signature. This feature ensures compliance with local regulations while simplifying the payment process for both businesses and governmental entities.

-

How does airSlate SignNow assist with CA payment governmental processes?

airSlate SignNow streamlines CA payment governmental processes by providing a user-friendly platform for document signing and payment collection. The integration of e-signatures with payment processing helps reduce paperwork and enhances efficiency for governmental transactions.

-

What are the pricing options for using airSlate SignNow for CA payment governmental purposes?

airSlate SignNow offers various pricing plans tailored to meet the needs of businesses and governmental agencies engaged in CA payment governmental transactions. These plans are structured to provide flexibility and value, ensuring organizations can select a solution that aligns with their budget and requirements.

-

Can airSlate SignNow integrate with other platforms for CA payment governmental operations?

Yes, airSlate SignNow can seamlessly integrate with various third-party platforms to facilitate CA payment governmental operations. This integration enhances workflow automation and provides a comprehensive solution for managing documents and payments efficiently.

-

What benefits does airSlate SignNow provide for CA payment governmental transactions?

Using airSlate SignNow for CA payment governmental transactions offers multiple benefits, including increased efficiency, enhanced security, and improved compliance. Organizations can easily track document status and payment processes, ensuring a smoother operation.

-

Is airSlate SignNow compliant with CA payment governmental regulations?

Absolutely! airSlate SignNow is designed to comply with CA payment governmental regulations, providing a secure environment for document signing and payment collection. This compliance helps reduce the risk of legal issues while maintaining the integrity of governmental transactions.

-

How does e-signature enhance the CA payment governmental experience?

E-signatures within airSlate SignNow enhance the CA payment governmental experience by providing a fast, secure, and legally binding method for document signing. This eliminates delays associated with traditional paper methods and improves overall user satisfaction.

Get more for Notice Regarding Payment

- Dui 497429566 form

- Washington rights 497429567 form

- Judgment and sentence for driving under the influence physical control duis washington form

- Conditional waiver and release of claim of lien upon final payment washington form

- Cost bill form

- Wa judgment form

- Letter tenant notice 497429573 form

- Wa supplemental statement form

Find out other Notice Regarding Payment

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement

- How To Electronic signature Wisconsin Agreement

- Electronic signature Tennessee Agreement contract template Mobile

- How To Electronic signature Florida Basic rental agreement or residential lease

- Electronic signature California Business partnership agreement Myself

- Electronic signature Wisconsin Business associate agreement Computer

- eSignature Colorado Deed of Indemnity Template Safe

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement