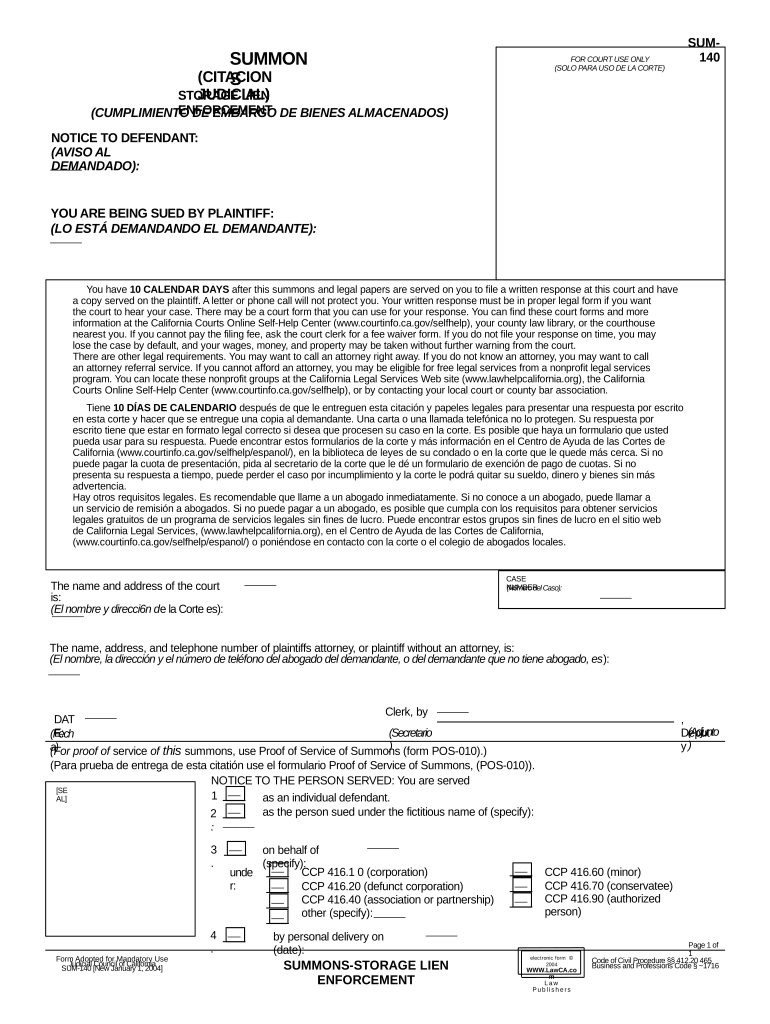

SUM 140 Form

What is the SUM 140

The SUM 140 form is a specific document used primarily for tax purposes in the United States. It serves as a declaration of income and deductions, allowing taxpayers to report their financial information accurately. This form is essential for individuals and businesses to ensure compliance with federal tax regulations. Understanding the purpose of the SUM 140 is crucial for effective tax management and avoiding potential penalties.

How to obtain the SUM 140

Obtaining the SUM 140 form is a straightforward process. Taxpayers can access it through the official IRS website or request a physical copy from a local IRS office. Additionally, many tax preparation software programs offer the SUM 140 as part of their filing options. It is important to ensure that you are using the most current version of the form to comply with the latest tax regulations.

Steps to complete the SUM 140

Completing the SUM 140 form involves several key steps. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, fill out the form accurately, ensuring that all information is complete and correct. Pay close attention to the sections regarding income sources and eligible deductions. Once completed, review the form for any errors before submitting it to the appropriate tax authority.

Legal use of the SUM 140

The SUM 140 form is legally binding when completed and submitted according to IRS regulations. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to legal consequences. Utilizing a reliable electronic signature solution can enhance the form's legitimacy, ensuring compliance with eSignature laws such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the SUM 140 form are critical to avoid penalties. Generally, the form must be submitted by April fifteenth of each year for individual taxpayers. However, extensions may be available under certain circumstances. It is advisable to mark important dates on your calendar to ensure timely submission and compliance with IRS requirements.

Required Documents

To complete the SUM 140 form, several documents are typically required. These may include W-2 forms from employers, 1099 forms for freelance or contract work, and receipts for deductible expenses. Collecting these documents in advance can streamline the completion process and help ensure accuracy in reporting income and deductions.

Penalties for Non-Compliance

Failure to file the SUM 140 form on time or providing inaccurate information can result in significant penalties. The IRS may impose fines, interest on unpaid taxes, and even legal action in severe cases. Understanding the importance of compliance with the SUM 140 form can help taxpayers avoid these negative consequences and maintain good standing with tax authorities.

Quick guide on how to complete sum 140

Prepare SUM 140 easily on any device

Web-based document management has become increasingly favored by businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides you with all the essential tools to create, modify, and eSign your documents promptly without delays. Manage SUM 140 on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused workflow today.

How to adjust and eSign SUM 140 effortlessly

- Obtain SUM 140 and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or mislaid files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Modify and eSign SUM 140 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is SUM 140 and how does it relate to airSlate SignNow?

SUM 140 is a key feature within airSlate SignNow that enhances document management and signing efficiency. It streamlines the eSignature process, making it easier for businesses to manage contracts and agreements digitally, ultimately saving time and resources.

-

How much does airSlate SignNow cost with SUM 140 features?

The pricing for airSlate SignNow varies depending on the plan selected and includes options that utilize the SUM 140 functionality. Businesses can choose from different subscription tiers, ensuring they only pay for the features that best meet their document signing needs.

-

What are the main benefits of using SUM 140 in airSlate SignNow?

Using SUM 140 in airSlate SignNow signNowly boosts efficiency in document signing. It enables users to create templates, track signatures, and ensure compliance seamlessly, all of which contribute to faster turnaround times and reduced administrative burdens.

-

Can SUM 140 be integrated with other software?

Yes, SUM 140 seamlessly integrates with various third-party applications and software, enhancing productivity. Whether you use CRM platforms or cloud storage services, airSlate SignNow can connect with them to streamline your document workflows.

-

Is there a free trial available for airSlate SignNow featuring SUM 140?

Yes, airSlate SignNow offers a free trial that includes access to SUM 140 features. This allows prospective customers to experience its capabilities without any financial commitment, making it easier to evaluate its fit for their business.

-

How does SUM 140 ensure document security in airSlate SignNow?

SUM 140 incorporates robust security measures, including encryption and secure access controls, to protect sensitive documents. airSlate SignNow ensures that all eSigned documents are stored securely, compliant with legal standards, and accessible only to authorized users.

-

What types of documents can be signed using SUM 140?

With SUM 140 in airSlate SignNow, users can sign a wide variety of documents, including contracts, agreements, and forms. The platform supports different file formats, making it versatile for any business needs.

Get more for SUM 140

Find out other SUM 140

- eSign South Dakota Legal Letter Of Intent Free

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure