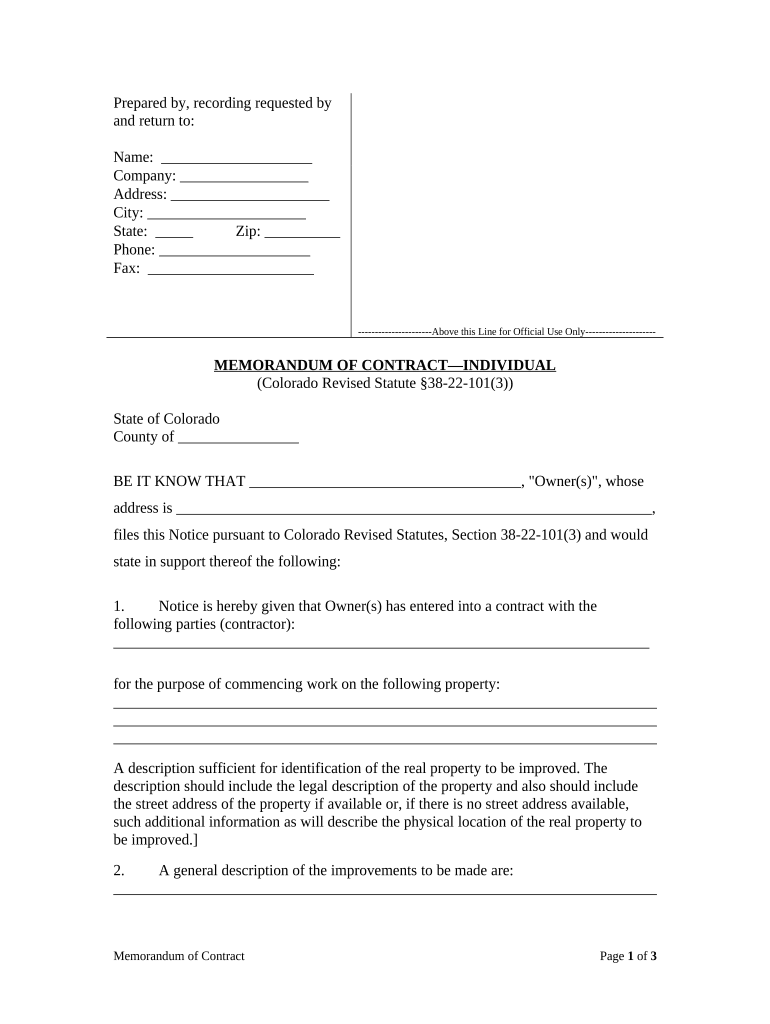

Colorado Individual Form

What is the Colorado Individual

The Colorado Individual form is a crucial document used for various personal and tax-related purposes within the state of Colorado. This form is essential for individuals to report their income, claim deductions, and fulfill their tax obligations. It serves as a means for residents to ensure compliance with state tax laws while also providing a structured way to communicate financial information to the state government.

How to use the Colorado Individual

Using the Colorado Individual form involves several steps that ensure accurate reporting of your financial information. First, gather all necessary documentation, including income statements, receipts for deductions, and any other relevant financial records. Next, fill out the form carefully, ensuring that all information is accurate and complete. After completing the form, review it for any errors before submission. It is essential to retain a copy for your records, as this may be needed for future reference or audits.

Steps to complete the Colorado Individual

Completing the Colorado Individual form requires a systematic approach. Follow these steps:

- Gather all relevant financial documents, such as W-2s, 1099s, and receipts.

- Obtain the latest version of the Colorado Individual form from the appropriate state resources.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately, including wages, interest, and other sources.

- Claim any eligible deductions or credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods.

Legal use of the Colorado Individual

The legal use of the Colorado Individual form is governed by state tax laws. It is essential to ensure that all information provided is truthful and accurate, as any discrepancies can lead to penalties or legal issues. The form must be submitted by the designated deadlines to avoid late fees or interest charges. Additionally, electronic submissions must comply with eSignature laws to ensure their validity.

Key elements of the Colorado Individual

Several key elements define the Colorado Individual form. These include:

- Personal identification information, such as name and Social Security number.

- Income reporting sections for various sources of income.

- Deduction and credit claims that can reduce taxable income.

- Signature line for verification of the information provided.

- Instructions for submission and deadlines to ensure compliance.

Eligibility Criteria

Eligibility to file the Colorado Individual form generally includes being a resident of Colorado and having income that is subject to state taxation. Individuals must also meet specific income thresholds and filing requirements as outlined by the Colorado Department of Revenue. It is important to review these criteria annually, as they may change based on state regulations.

Quick guide on how to complete colorado individual

Complete Colorado Individual effortlessly on any device

Managing documents online has gained popularity among companies and individuals alike. It offers a superb eco-friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Handle Colorado Individual on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to edit and eSign Colorado Individual seamlessly

- Locate Colorado Individual and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Bid farewell to lost or mislaid documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your requirements in document management with just a few clicks from your preferred device. Edit and eSign Colorado Individual and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow for colorado individuals?

airSlate SignNow is an intuitive eSignature platform designed for colorado individuals that enables you to send, sign, and manage documents electronically. It streamlines the document workflow, ensuring you can focus on what matters most. Whether you’re a freelancer or running a small business, airSlate SignNow offers a user-friendly solution for your signing needs.

-

How much does airSlate SignNow cost for colorado individuals?

For colorado individuals, airSlate SignNow offers flexible pricing plans that cater to various needs and budgets. Whether you need a single user plan or a team solution, you can select from monthly or annual subscriptions. It’s a cost-effective solution that ensures you receive the features you need without breaking the bank.

-

What features does airSlate SignNow offer to colorado individuals?

airSlate SignNow provides a suite of features for colorado individuals, including unlimited eSignatures, template creation, and document tracking. Additionally, users can customize workflows and automate repetitive tasks to enhance their efficiency. These features are designed to meet the specific needs of individuals handling their own documentation.

-

Are there benefits to using airSlate SignNow for colorado individuals?

Yes, the benefits of using airSlate SignNow for colorado individuals are numerous. It allows for faster document turnaround, enhances security through encryption, and reduces paper waste. Plus, its cloud-based nature means you can access your documents anytime, anywhere, making it highly convenient.

-

Can colorado individuals integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow seamlessly integrates with various applications that colorado individuals often use, such as Google Drive, Dropbox, and Microsoft Office. This integration helps streamline your workflow by allowing you to send and manage documents directly from your favorite platforms.

-

Is airSlate SignNow compliant with legal standards for colorado individuals?

Yes, airSlate SignNow meets all legal compliance standards, including the ESIGN Act and UETA, making it a suitable choice for colorado individuals. With this compliance, you can ensure that your electronic signatures are legally binding and secure. It gives you peace of mind while managing important documents.

-

How user-friendly is airSlate SignNow for colorado individuals?

airSlate SignNow is designed with user experience in mind, making it extremely user-friendly for colorado individuals. The intuitive interface allows even novice users to quickly get accustomed to sending and signing documents. With helpful tutorials and customer support, assistance is always available when needed.

Get more for Colorado Individual

Find out other Colorado Individual

- How Do I eSignature Arkansas Medical Records Release

- How Do I eSignature Iowa Medical Records Release

- Electronic signature Texas Internship Contract Safe

- Electronic signature North Carolina Day Care Contract Later

- Electronic signature Tennessee Medical Power of Attorney Template Simple

- Electronic signature California Medical Services Proposal Mobile

- How To Electronic signature West Virginia Pharmacy Services Agreement

- How Can I eSignature Kentucky Co-Branding Agreement

- How Can I Electronic signature Alabama Declaration of Trust Template

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple