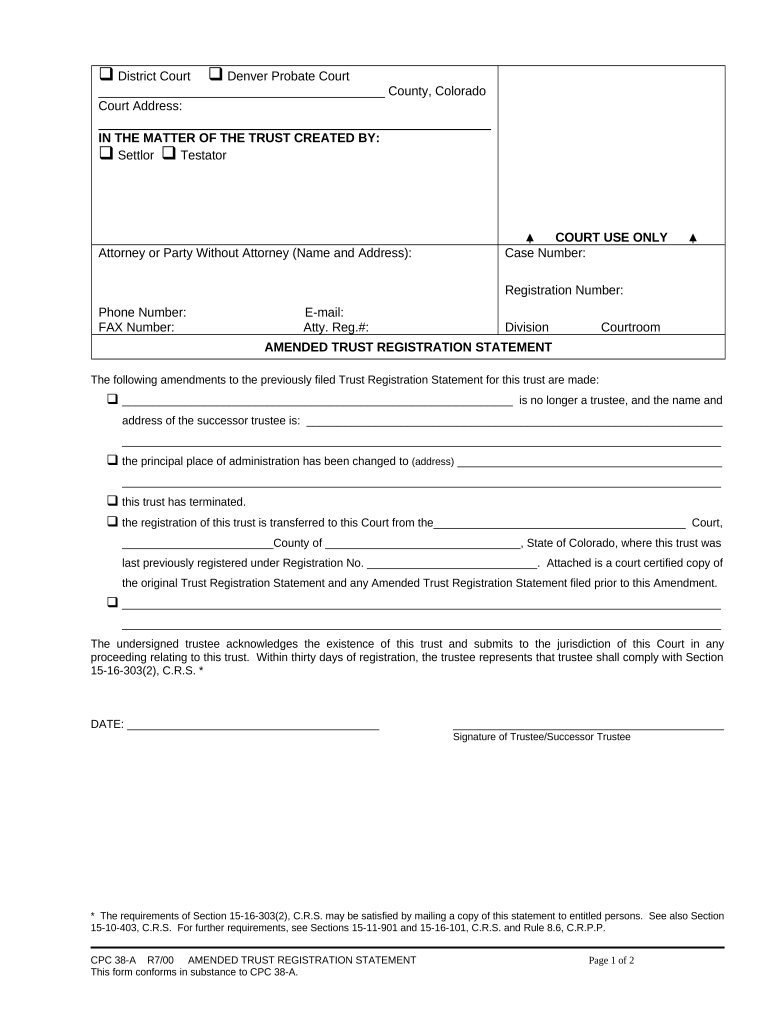

Colorado Amended Form

What is the Colorado Amended

The Colorado amended form is a crucial document used for making changes to previously filed tax returns in the state of Colorado. This form allows taxpayers to correct errors, update information, or claim additional deductions or credits that were not included in the original submission. It is essential for ensuring that your tax records are accurate and up to date, which can help prevent issues with the Colorado Department of Revenue.

How to use the Colorado Amended

Using the Colorado amended form involves a few straightforward steps. First, you need to obtain the correct version of the form, which is typically available through the Colorado Department of Revenue's website or other official channels. Next, fill out the form with the necessary corrections, ensuring that you provide accurate information. Finally, submit the completed form according to the specified submission methods, which may include online filing, mailing, or in-person submission.

Steps to complete the Colorado Amended

Completing the Colorado amended form requires careful attention to detail. Here are the essential steps:

- Gather your original tax return and any supporting documents.

- Obtain the Colorado amended form from the official website.

- Fill out the form, clearly indicating the changes you are making.

- Attach any required documentation that supports your amendments.

- Review the form for accuracy before submission.

- Submit the form via your chosen method, ensuring you keep a copy for your records.

Legal use of the Colorado Amended

The legal use of the Colorado amended form is governed by state tax laws. It is important to ensure that any amendments made are in compliance with these laws to avoid penalties or issues with the tax authorities. The form must be filed within the designated time frame, typically within three years of the original filing date or within two years of paying the tax, whichever is later. This ensures that taxpayers can correct their records legally and maintain compliance with state regulations.

Filing Deadlines / Important Dates

Filing deadlines for the Colorado amended form are critical to ensure compliance. Generally, taxpayers must file the amended form within three years of the original filing date. If you are claiming a refund, the deadline is typically two years from the date you paid the tax. It is advisable to check the Colorado Department of Revenue’s website for any updates or changes to these deadlines, as they can vary based on specific circumstances or legislative changes.

Required Documents

When filling out the Colorado amended form, certain documents are required to support your amendments. These may include:

- Your original tax return.

- Any new or corrected W-2 forms.

- Supporting documentation for additional deductions or credits.

- Any correspondence from the Colorado Department of Revenue regarding your original return.

Having these documents ready will help streamline the process and ensure that your amended return is processed efficiently.

Quick guide on how to complete colorado amended

Prepare Colorado Amended seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and safely store them online. airSlate SignNow equips you with all the resources you require to create, edit, and electronically sign your documents quickly without delays. Manage Colorado Amended on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric task today.

The easiest way to edit and eSign Colorado Amended effortlessly

- Find Colorado Amended and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or conceal sensitive details with tools specifically provided by airSlate SignNow.

- Create your signature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the information and then click the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Colorado Amended while ensuring outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado amended document?

A Colorado amended document is a legal form that is revised to reflect changes made to a previously filed document. It is crucial for maintaining accurate records with state authorities. Using airSlate SignNow, you can effortlessly create and eSign Colorado amended documents to ensure compliance.

-

How does airSlate SignNow help with Colorado amended documents?

airSlate SignNow provides a streamlined platform for creating, sending, and eSigning Colorado amended documents. Our user-friendly interface allows for quick edits and ensures that your amendments are legally binding. You can easily track the status of your documents for added peace of mind.

-

What is the cost of using airSlate SignNow for Colorado amended documents?

airSlate SignNow offers competitive pricing for its services, including the handling of Colorado amended documents. You can choose from various plans that fit your business needs. Investing in airSlate SignNow is cost-effective, especially considering the time saved in document management.

-

Can I integrate airSlate SignNow with other software for handling Colorado amended documents?

Yes, airSlate SignNow integrates seamlessly with various popular software platforms. This integration allows you to enhance your workflow when dealing with Colorado amended documents and ensures that important data can be easily shared across different applications. Consider our API options for tailored solutions.

-

What features does airSlate SignNow provide for editing Colorado amended documents?

AirSlate SignNow includes robust editing features tailored for managing Colorado amended documents. Users can make changes in real-time, add text fields, dates, and signers with ease. Additionally, our platform ensures security and compliance with legal standards for document amendments.

-

How secure is airSlate SignNow for sending Colorado amended documents?

Security is a top priority for airSlate SignNow. Our platform utilizes advanced encryption methods to protect your Colorado amended documents during transmission and storage. You can confidently send sensitive legal documents without compromising their integrity.

-

What benefits does eSigning Colorado amended documents offer?

eSigning Colorado amended documents with airSlate SignNow speeds up the entire process and reduces paper waste. You can sign from anywhere at any time, which incredibly increases your operational efficiency. Moreover, electronic signatures are legally recognized, ensuring that your amendments are valid.

Get more for Colorado Amended

- Utah ucc3 financing statement amendment addendum utah form

- Utah code form

- Utah code 497427843 form

- Utah state courts form

- Utah hac form

- Small claims forms

- Legal last will and testament form for single person with no children utah

- Legal last will and testament form for a single person with minor children utah

Find out other Colorado Amended

- eSign Hawaii Expense Statement Fast

- eSign Minnesota Share Donation Agreement Simple

- Can I eSign Hawaii Collateral Debenture

- eSign Hawaii Business Credit Application Mobile

- Help Me With eSign California Credit Memo

- eSign Hawaii Credit Memo Online

- Help Me With eSign Hawaii Credit Memo

- How Can I eSign Hawaii Credit Memo

- eSign Utah Outsourcing Services Contract Computer

- How Do I eSign Maryland Interview Non-Disclosure (NDA)

- Help Me With eSign North Dakota Leave of Absence Agreement

- How To eSign Hawaii Acknowledgement of Resignation

- How Can I eSign New Jersey Resignation Letter

- How Do I eSign Ohio Resignation Letter

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter