Form Irs 941 Fill Online 2018

What is the Form IRS 941 Fill Online

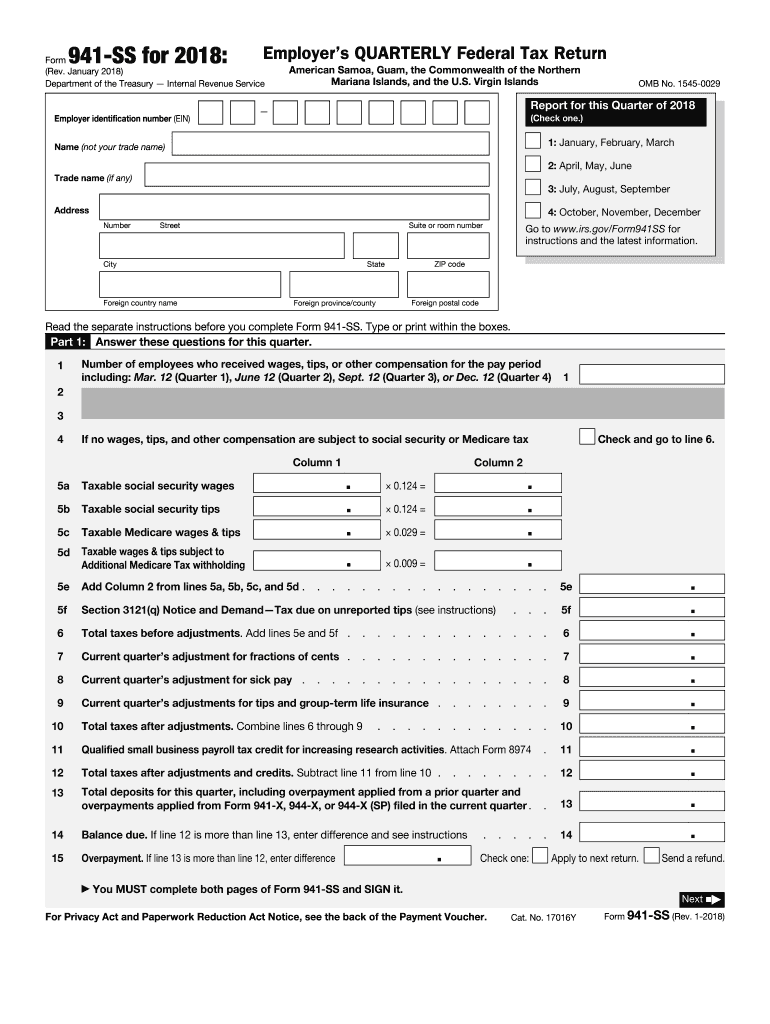

The Form IRS 941 is a quarterly tax return used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employees' paychecks. This form is essential for businesses to accurately report and pay their federal payroll taxes. The IRS requires this form to be filed four times a year, and it includes information on the number of employees, wages paid, and taxes withheld. Filling out the form online streamlines the process, allowing for easier submission and record-keeping.

Steps to Complete the Form IRS 941 Fill Online

Completing the Form IRS 941 online involves several key steps:

- Gather necessary information, including your Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Access the online form through a secure platform that supports IRS forms.

- Fill in the required fields, ensuring all information is accurate and up-to-date.

- Review the form for any errors or omissions before submission.

- Submit the completed form electronically to the IRS.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines when filing Form IRS 941. The form is due on the last day of the month following the end of each quarter. The deadlines are as follows:

- First quarter (January to March): Due by April 30

- Second quarter (April to June): Due by July 31

- Third quarter (July to September): Due by October 31

- Fourth quarter (October to December): Due by January 31 of the following year

Form Submission Methods (Online / Mail / In-Person)

Form IRS 941 can be submitted through various methods, providing flexibility for employers:

- Online: Many businesses opt to file electronically through authorized e-file providers, which can simplify the process and ensure timely submission.

- Mail: Employers can also print the completed form and send it via postal mail to the appropriate IRS address, depending on their location.

- In-Person: Although less common, some employers may choose to deliver their forms directly to local IRS offices.

Penalties for Non-Compliance

Failure to file Form IRS 941 on time or inaccuracies in the submitted information can result in penalties. The IRS imposes fines for late filings, which can accumulate over time. Additionally, underreporting taxes may lead to interest charges on unpaid amounts. It is crucial for employers to ensure timely and accurate submissions to avoid these financial repercussions.

Key Elements of the Form IRS 941 Fill Online

When filling out Form IRS 941, several key elements must be included:

- Employer Identification Number (EIN): A unique number assigned to businesses for tax purposes.

- Number of Employees: Total count of employees during the quarter.

- Total Wages Paid: The sum of all wages paid to employees during the quarter.

- Taxes Withheld: Amount of federal income tax, Social Security tax, and Medicare tax withheld from employee wages.

Quick guide on how to complete form 941 ss 2018 2019

Explore the easiest method to complete and sign your Form Irs 941 Fill Online

Are you still spending time creating your official documents on paper instead of handling them online? airSlate SignNow presents a superior way to complete and sign your Form Irs 941 Fill Online and associated forms for public services. Our intelligent electronic signature platform provides you with all the tools you need to manage paperwork swiftly and in compliance with regulatory standards - comprehensive PDF editing, organizing, safeguarding, signing, and sharing features all readily available within a user-friendly interface.

Only a few steps are needed to finish filling out and signing your Form Irs 941 Fill Online:

- Insert the editable template into the editor with the Get Form button.

- Review what information you must include in your Form Irs 941 Fill Online.

- Move through the sections using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to complete the fields with your information.

- Enhance the content with Text boxes or Images available in the top toolbar.

- Emphasize what is essential or Remove information that is no longer relevant.

- Select Sign to create a legally valid electronic signature with any method you prefer.

- Add the Date next to your signature and finalize your work using the Done button.

Store your finished Form Irs 941 Fill Online in the Documents section of your profile, download it, or transfer it to your preferred cloud storage. Our platform also enables flexible file sharing. There’s no need to print your forms when you need to submit them to the relevant public office - send them via email, fax, or by requesting a USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 941 ss 2018 2019

FAQs

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

What do you put on Schedule B when filling out Form 941?

Form 941 Schedule B can be filled out in 5 steps:1. Enter business info (Name and EIN)2. Choose tax year/quarter3. Select the quarter you’re filing for4. Enter your tax liability by semi-weekly & total liability for the quarter5. Attach to Form 941 & transmit to the IRS(these instructions work best when paired with TaxBandits e-filing)

Create this form in 5 minutes!

How to create an eSignature for the form 941 ss 2018 2019

How to generate an eSignature for the Form 941 Ss 2018 2019 in the online mode

How to make an electronic signature for the Form 941 Ss 2018 2019 in Chrome

How to create an eSignature for signing the Form 941 Ss 2018 2019 in Gmail

How to generate an electronic signature for the Form 941 Ss 2018 2019 straight from your smart phone

How to generate an electronic signature for the Form 941 Ss 2018 2019 on iOS

How to generate an electronic signature for the Form 941 Ss 2018 2019 on Android OS

People also ask

-

What is the Form Irs 941 Fill Online feature in airSlate SignNow?

The Form Irs 941 Fill Online feature in airSlate SignNow allows users to complete and electronically sign their IRS Form 941 with ease. This feature streamlines the process of filing quarterly payroll taxes, ensuring accuracy and efficiency. By utilizing airSlate SignNow, businesses can manage their tax obligations directly from their devices.

-

How much does it cost to fill out the Form Irs 941 Fill Online using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs, including a cost-effective solution for filling out the Form Irs 941 Fill Online. Pricing typically starts with a monthly subscription that includes unlimited document signing and access to all features. For precise pricing details, visit our website or contact our sales team.

-

What are the benefits of using airSlate SignNow for Form Irs 941 Fill Online?

Using airSlate SignNow for Form Irs 941 Fill Online provides several benefits, including enhanced security, time-saving automation, and easy document management. The platform allows users to fill out forms quickly and securely sign them electronically, reducing the need for paper-based processes. This leads to fewer errors and faster submission to the IRS.

-

Can I integrate airSlate SignNow with other applications for filling Form Irs 941 Fill Online?

Yes, airSlate SignNow offers seamless integrations with various business applications, making it easy to fill out Form Irs 941 Fill Online directly from your preferred tools. Integrations with popular accounting and payroll software ensure that your data flows smoothly, enhancing your workflow and efficiency. Check our integrations page for specific applications.

-

Is it easy to fill out the Form Irs 941 Fill Online with airSlate SignNow?

Absolutely! airSlate SignNow is designed for user-friendliness, making it simple to fill out the Form Irs 941 Fill Online. The intuitive interface guides users through each step of the process, ensuring that you can complete and sign your forms without any technical hassles.

-

What types of documents can I eSign besides Form Irs 941 Fill Online?

In addition to Form Irs 941 Fill Online, airSlate SignNow allows users to eSign a wide range of documents, including contracts, agreements, and tax forms. This versatility makes it an ideal solution for businesses looking to streamline their document signing processes across various types of paperwork.

-

Is airSlate SignNow compliant with IRS regulations for Form Irs 941 Fill Online?

Yes, airSlate SignNow is fully compliant with IRS regulations for filling and signing Form Irs 941 Fill Online. The platform employs advanced security measures and complies with electronic signature laws, ensuring that your electronic submissions are valid and accepted by the IRS.

Get more for Form Irs 941 Fill Online

Find out other Form Irs 941 Fill Online

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT